As we approach the new year, it’s the perfect time to reflect on your financial goals and create a budget calendar to help you stay on track. This comprehensive guide will walk you through the key components of financial planning, essential budgeting tools, and strategies for effectively tracking your income and expenses in 2025.

Developing a personalized budget calendar can be a game-changer in your financial journey, empowering you to take control of your money, save for the future, and spend on the things that truly matter. Whether you’re a seasoned budgeter or just starting to get a handle on your finances, this guide will provide you with the insights and practical steps needed to create a budget calendar that works for your unique financial situation.

Table of Contents

Key Takeaways

- Establish clear financial goals to guide your budgeting efforts in 2025

- Utilize a variety of budgeting tools, both digital and traditional, to track your income and expenses

- Evaluate your current financial standing to identify areas for improvement

- Develop a personalized budget calendar to stay organized and on top of your finances

- Explore strategies for automating savings and managing debt to optimize your financial health

Understanding Financial Planning Basics

Effective financial planning is the cornerstone of achieving your personal financial goals and maintaining a healthy, stress-free relationship with your money. At its core, money management involves understanding your current financial standing, setting realistic objectives, and implementing a structured approach to budgeting and saving.

Key Components of Financial Management

A comprehensive financial plan should encompass the following crucial elements:

- Financial goals: Short-term, mid-term, and long-term objectives that guide your financial decisions.

- Net worth statement: An overview of your assets and liabilities to determine your overall financial health.

- Budget and cash flow planning: Tracking your income and expenses to maintain a balanced budget.

- Debt management: Developing a strategy to pay off existing debts and avoid new ones.

- Retirement planning: Ensuring you have sufficient funds for a comfortable retirement.

- Emergency fund: Building a safety net to cover unexpected expenses and maintain financial stability.

- Insurance coverage: Protecting your assets and loved ones from potential risks.

- Estate planning: Preparing for the distribution of your assets after your passing.

Why Budget Planning Matters in 2025

In the ever-changing financial landscape, budgeting importance has become more pronounced than ever. By implementing a budget calendar, you can gain greater control over your finances, reduce the risk of late payments, and increase your overall savings rate. This, in turn, can lead to a more secure financial future and a sense of empowerment over your money.

Setting the Foundation for Financial Success

Developing a solid financial plan is the first step towards achieving your long-term financial goals. By understanding the key components of money management and the importance of consistent budgeting, you can lay the groundwork for a prosperous financial future.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Getting Started with Your Budget Calendar

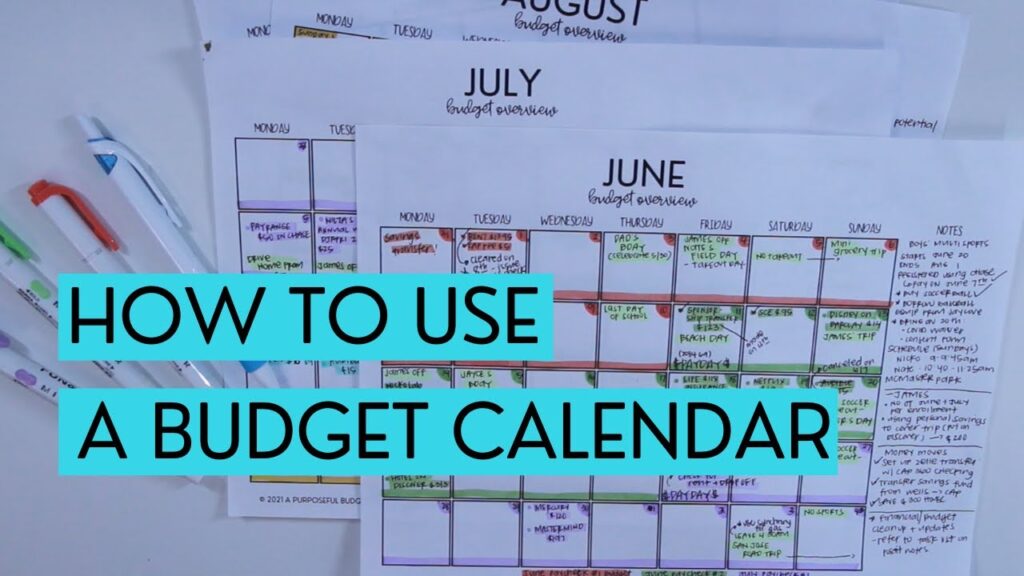

Establishing a budget calendar is a crucial first step in gaining control over your finances. It’s the foundation upon which you can build a comprehensive budget setup, track your financial assessment, and monitor your expense tracking throughout the year. By taking the time to set up your budget calendar, you’ll be well on your way to achieving financial success in 2025 and beyond.

The initial setup of your budget calendar involves several key elements:

- Review your banking records and credit card statements to get a clear picture of your current financial status. Identify both your regular and occasional expenses to ensure your budget is accurate.

- Track your expenses for at least one full month, categorizing them into fixed and variable costs. This will give you a better understanding of your spending patterns and help you identify areas for potential savings.

- Gather all your bills, subscription payments, and other recurring expenses, and note their due dates. This will help you stay organized and avoid late fees.

Visualizing your financial obligations on a calendar can be a game-changer. It allows you to see when payments are due, plan for upcoming expenses, and ensure you have sufficient funds available. By taking the time to set up your budget calendar, you’ll be well on your way to achieving financial stability and peace of mind.

“A budget calendar is the backbone of your budget and helps with staying organized. It assists in visual progress tracking and avoids overdrafts and late fees.”

Remember, the key to a successful budget calendar is consistency. Regularly reviewing and updating your calendar will help you stay on track and make informed financial decisions throughout the year. With a well-crafted budget calendar, you’ll be able to navigate your financial journey with confidence and ease.

Essential Tools for Budget Planning

Effective budget planning in 2025 requires a well-designed toolkit to track your finances with precision and efficiency. When it comes to budgeting, you have the choice between digital and physical methods, each with its own unique advantages. Let’s explore the essential tools that can help you master your personal or business budget this year.

Digital vs. Physical Budget Tracking Methods

The digital age has ushered in a wealth of budgeting apps and financial software that offer unparalleled convenience and automation. Apps like Mint, YNAB, and Goodbudget can seamlessly connect to your bank accounts, categorize expenses, and generate detailed reports with just a few taps. On the other hand, physical budget planners like the Clever Fox® Budget Planner and Erin Condren Budget Book provide a tactile experience and customizable organization, perfect for visual learners and those who prefer a more hands-on approach.

Recommended Budget Apps and Software

When it comes to budgeting apps and financial software, the market is brimming with options. Some top contenders include Scoro, Float, and Planguru for business budgeting, as well as YNAB and Mint for personal finance management. These tools often offer features like automatic expense tracking, goal setting, and real-time budget monitoring to help you stay on top of your expense trackers.

Traditional Planning Tools and Templates

If you prefer a more hands-on approach to budgeting, there are numerous traditional planning tools and templates available. The Clever Fox® Budget Planner and Erin Condren Budget Book provide comprehensive budget management with customizable sections, while Afterpay and Pay in 4 offer flexible payment options for your purchases. Additionally, free budget worksheets and spreadsheets can be found online, allowing you to create a personalized system that suits your needs.

Regardless of your preferred method, the key is to find the right balance of digital and physical tools that work best for your unique financial situation. By harnessing the power of these essential budgeting resources, you can gain control over your finances and set yourself up for financial success in 2025 and beyond.

Evaluating Your Current Financial Status

Assessing your financial standing is a crucial step in creating a comprehensive budget calendar. This process involves a thorough financial assessment, spending habits analysis, and income evaluation. By taking an honest and detailed look at your current financial situation, you can lay the groundwork for effective budgeting and achieve your long-term financial goals.

Start by calculating your monthly net income, which includes your salary, investment returns, and any other sources of revenue. Next, review your monthly expenses, categorizing them as either fixed (such as rent, mortgage, and loan payments) or variable (like utilities, groceries, and discretionary spending). Tracking your actual expenses over a three-month period can provide a reliable estimate of your average monthly costs.

Once you have a clear understanding of your income and expenses, evaluate your cash flow. A positive cash flow indicates that you have the ability to invest or save, while a negative cash flow suggests the need to cut back on expenses. Identify any spending leaks, such as over-reliance on credit cards or unnecessary purchases, and explore solutions like cash-only budgeting or delaying online impulse buys.

Regularly reviewing and adjusting your budget is essential, as changes in your personal or financial situation, such as a job transition, marriage, or having a child, can significantly impact your income and expenses. Periodic budget meetings with your spouse or family can help maintain accountability and ensure that your spending aligns with your financial goals.

By taking the time to carefully assess your current financial status, you can make informed decisions, optimize your budget, and take control of your financial future. Remember, seeking professional financial advice can be beneficial if you feel overwhelmed or need guidance in effectively managing your money.

“A budget is not just a series of numbers, but an expression of our values and priorities.” – Elizabeth Warren

Creating Your Personal Budget Calendar

Developing a personalized budget calendar is a fundamental step in achieving financial stability and reaching your monetary goals. This comprehensive tool allows you to meticulously plan and track your income, expenses, and important payment deadlines throughout the year, empowering you to take control of your financial future.

Daily, Weekly, and Monthly Planning Segments

An effective budget calendar should incorporate various planning segments to ensure all your financial obligations are accounted for. Begin by mapping out your daily expenses, such as commuting costs, groceries, and miscellaneous spending. Next, consider your weekly commitments, like rent or mortgage payments, utility bills, and recurring subscription fees. Finally, document your monthly income sources and larger, periodic expenses, such as insurance premiums, property taxes, and seasonal spending.

Important Dates and Payment Schedules

Identify and note all important financial deadlines and payment due dates within your budget calendar. This includes bill payment schedules, tax filing requirements, and any other significant money-related events. By proactively planning for these critical dates, you can avoid late fees, penalties, and unnecessary stress, ensuring your budget calendar creation, payment scheduling, and overall financial planning remain on track.

Incorporating these elements into your personalized budget calendar will provide a comprehensive overview of your financial landscape, empowering you to make informed decisions, stay accountable, and work towards your long-term financial goals.

Income Tracking Strategies

Effective budgeting starts with accurately tracking your income sources. Whether you have a steady paycheck, receive government assistance, or have additional earnings, it’s crucial to record all your financial inflows in a budget calendar. This comprehensive approach ensures you have a clear understanding of your total monthly income, which is essential for managing your expenses and reaching your financial goals.

Begin by listing all your income sources, including:

- Paychecks from your primary job or side gigs

- Government benefits, such as Social Security or disability payments

- Investment dividends or rental income

- Any other irregular or one-time earnings

Carefully note the dates these income sources are received, as well as the paycheck management and financial inflows associated with each. This will help you plan your budget accordingly and avoid any potential cash flow issues.

| Income Source | Amount | Frequency | Payment Date |

|---|---|---|---|

| Paycheck (Primary Job) | $3,500 | Bi-weekly | 1st and 15th of the month |

| Side Gig Earnings | $800 | Monthly | Last day of the month |

| Rental Income | $1,200 | Monthly | 5th of the month |

| Social Security | $1,500 | Monthly | 3rd of the month |

By accurately tracking your income sources, paycheck management, and financial inflows, you’ll be able to create a comprehensive budget calendar that sets you up for financial success in 2025 and beyond.

Expense Categories and Organization

Effective budget planning involves categorizing your expenses into fixed and variable costs, as well as prioritizing your spending based on your financial goals and needs. This structured approach to expense management can help you gain better control over your finances and identify areas where costs can be trimmed.

Fixed vs. Variable Expenses

Fixed expenses are those that remain relatively consistent from month to month, such as rent, mortgage payments, car loans, and insurance premiums. These costs are essential and non-negotiable, requiring careful planning to ensure they are covered. Variable expenses, on the other hand, fluctuate based on your spending habits and lifestyle choices, including groceries, utilities, entertainment, and discretionary purchases.

Priority-Based Spending Categories

To optimize your budget, it’s crucial to prioritize your spending categories based on your financial goals and obligations. As a general guideline, the recommended budget allocations are:

- Housing (25-35% of income)

- Transportation (10-15% of income)

- Food (10-15% of income)

- Utilities (5-10% of income)

- Insurance (10-25% of income)

- Medical & Healthcare (5-10% of income)

- Savings, Investing, & Debt Payments (10-20% of income)

- Personal Spending (5-10% of income)

- Recreation & Entertainment (5-10% of income)

- Miscellaneous (5-10% of income)

By categorizing your expenses and prioritizing your spending, you can create a more organized and effective budget, helping you achieve your financial goals and maintain financial stability.

| Expense Category | Recommended Budget Allocation |

|---|---|

| Housing | 25-35% of income |

| Transportation | 10-15% of income |

| Food | 10-15% of income |

| Utilities | 5-10% of income |

| Insurance | 10-25% of income |

| Medical & Healthcare | 5-10% of income |

| Savings, Investing, & Debt Payments | 10-20% of income |

| Personal Spending | 5-10% of income |

| Recreation & Entertainment | 5-10% of income |

| Miscellaneous | 5-10% of income |

Setting Realistic Financial Goals

Achieving financial success in 2025 starts with setting clear, measurable goals. Whether you aim to reduce debt, build your savings, or budget for a major purchase, defining your financial objectives is the first step towards long-term financial stability. When establishing your SMART goals, ensure they are Specific, Measurable, Achievable, Relevant, and Time-bound.

To get started, take a close look at your current financial situation. Review your income, expenses, and existing debt or savings. This will help you determine realistic targets and timelines for your financial goals. For example, you may set a goal to pay off $5,000 in credit card debt within the next 12 months, or to save $10,000 towards a down payment on a house by the end of 2025.

Once you have your financial objectives and SMART goals in place, incorporate them into your budget calendar. This will allow you to track your progress and make any necessary adjustments along the way. Remember, setting achievable, step-by-step goals is the key to sustained financial success.

| Financial Goal | Target Amount | Timeline |

|---|---|---|

| Pay off credit card debt | $5,000 | 12 months |

| Save for down payment on a house | $10,000 | 24 months |

| Increase emergency fund | $8,000 | 18 months |

By aligning your budget targets with your long-term financial objectives, you can ensure that your day-to-day financial decisions support your overall wealth-building strategy. Stay motivated and committed to your goals, and watch your financial future take shape.

“Setting realistic financial goals is the cornerstone of a successful budgeting strategy. It’s not about restricting your spending, but rather empowering you to make informed choices that align with your long-term prosperity.”

Emergency Fund Planning

When it comes to financial security, having an emergency savings fund is the cornerstone of a solid financial safety net. Unexpected expenses, such as medical bills, car repairs, or job loss, can quickly derail your budget and leave you vulnerable. That’s why it’s essential to prioritize building an emergency fund to cushion against life’s unexpected expenses.

Building Your Safety Net

The recommended amount for an emergency fund is typically 3-6 months’ worth of living expenses. While this may seem daunting, the key is to start small and build steadily over time. Consider setting aside a manageable amount, such as $130 per month, to gradually grow your emergency savings.

- Utilize tax refunds or bonuses to jumpstart your emergency fund

- Automate savings transfers to make the process seamless

- Explore side hustles or freelance work to boost your savings

- Trim discretionary spending to free up more funds for your emergency fund

Emergency Fund Allocation Strategies

When it comes to where to keep your emergency savings, experts recommend a dedicated savings account. This ensures your funds are easily accessible, while still earning a modest return. By separating your emergency savings from your everyday checking account, you can avoid the temptation to dip into these critical funds.

| Criteria | Ideal Emergency Fund Account |

|---|---|

| Accessibility | High |

| Liquidity | High |

| Earnings | Moderate |

| Security | High |

By prioritizing emergency fund planning, you can take control of your financial future and ensure you’re prepared for life’s unexpected events. A well-stocked emergency savings account can provide the peace of mind and stability you need to weather any financial storm.

“Having an emergency fund is like having a financial insurance policy – it’s there to protect you when life throws you a curveball.”

Debt Management and Reduction Plans

Tackling debt can be a significant financial challenge, but with the right strategies, you can take control of your financial liabilities and work towards becoming debt-free. In this section, we’ll explore various debt payoff strategies, credit management techniques, and ways to effectively manage your financial liabilities.

One of the most popular debt payoff methods is the debt snowball approach. This involves prioritizing your debts from smallest to largest balance, focusing on paying off the smallest debt first while making minimum payments on other debts. As you pay off each debt, the “snowball” effect takes place, allowing you to apply the freed-up funds towards the next debt on the list.

Another effective strategy is the debt avalanche method, which prioritizes debts based on their interest rates, starting with the highest-interest debt. This approach can save you more in interest charges over time, though it may take longer to see the first debt paid off completely.

| Debt Payoff Method | Advantages | Disadvantages |

|---|---|---|

| Debt Snowball |

|

|

| Debt Avalanche |

|

|

In addition to choosing the right debt payoff strategy, it’s crucial to track your progress and monitor your credit management. Utilize tools like debt reduction spreadsheets and credit report monitoring to stay on top of your financial situation. Remember, consistent effort and a well-structured plan are key to successfully managing and reducing your financial liabilities.

Remember, the journey to becoming debt-free may not be easy, but with the right debt payoff strategies and a commitment to credit management, you can take control of your financial liabilities and achieve financial stability.

Savings and Investment Integration

Creating a comprehensive budget calendar requires thoughtful integration of your savings and investment strategies. It’s crucial to strike a balance between short-term financial goals and long-term wealth-building objectives. By aligning these two crucial components, you can optimize your financial growth and ensure your budget remains aligned with your broader aspirations.

Short-term vs. Long-term Savings Goals

When planning your budget, differentiate between short-term savings, such as an emergency fund or a down payment on a home, and long-term savings for retirement or other significant life events. Allocate funds accordingly, ensuring that short-term needs are met while also contributing to your long-term financial security.

Investment Planning in Your Budget

Incorporate investment planning into your budget calendar to facilitate steady financial growth. Assess your risk tolerance, time horizon, and investment objectives to determine the appropriate mix of assets, such as stocks, bonds, or mutual funds. Allocate a portion of your income towards these investment vehicles, striking a balance between growth potential and risk management.

| Bank | Budgeting Features |

|---|---|

| Ally Bank | Customizable savings “buckets” and integrated budgeting tools |

| Bank of America | Interactive spending charts and categorization of expenses |

| Capital One | Automated budgeting tools that track and categorize expenses |

| Chase | Budget setting, expense tracking, and spending trend visualization |

| Current | Spending limit alerts and customizable budgeting categories |

| Huntington National Bank | Spend analysis, spending limits, and calendar-based planning |

| Regions Bank | Personalized budget creation, spending targets, and savings suggestions |

| SoFi | Integrated account data, expense tracking, and bill alerts |

| Wells Fargo | Automated expense tracking, budget creation, and savings goal monitoring |

By implementing savings strategies and investment planning into your budget calendar, you can ensure a well-rounded approach to financial growth and long-term financial stability.

Budget Calendar Maintenance Tips

Maintaining and updating your budget calendar is crucial for ensuring your financial plan remains effective throughout the year. As your circumstances change or new expenses arise, it’s important to revisit your budget calendar regularly and make necessary budget updates and financial adjustments.

Here are some tips to help you stay on top of your budget calendar maintenance:

- Schedule a quarterly spending review: Set aside time every three months to review your income, expenses, and savings goals. This will help you identify areas where you may need to make changes or reallocate funds.

- Adjust for life events: If you experience a significant life event, such as a job change, move, or new addition to your family, be sure to update your budget calendar accordingly. This will ensure your plan remains aligned with your current financial situation.

- Track unexpected expenses: Keep an eye out for any unexpected or one-time expenses that may pop up, and be sure to add them to your budget calendar. This will help you stay prepared and avoid surprise costs.

- Celebrate your progress: As you work through your budget calendar, be sure to celebrate your successes, whether it’s hitting a savings goal or paying off a debt. This will help you stay motivated and engaged with the process.

By maintaining and updating your budget calendar regularly, you’ll be able to stay on top of your finances and make informed decisions about your spending, saving, and investing. This will ultimately help you achieve your financial goals and improve your overall financial well-being.

| Feature | Description | Price |

|---|---|---|

| Auto Renewal Subscription | Sync budget data automatically | $12.99 for 6 months, $19.99 for 1 year |

| Financial Calculators | 5 tools for tips, sales tax, discounts, mortgages, and loans | Included in the app |

| Premium Features | Theme colors, ad-free, passcode lock, advanced search, and more | $2.99 per month |

By following these budget calendar maintenance tips, you can ensure your financial plan stays on track and continues to support your long-term financial goals. Remember, consistency and vigilance are key to successful budget planning and execution.

Automated Budgeting Solutions

In the digital age, managing your finances has become more streamlined than ever before. Automated budgeting solutions offer a convenient way to take control of your money, making it easier to stay on top of your spending and savings. From setting up automatic payments to leveraging digital tracking tools, these innovative technologies can revolutionize your financial planning.

Setting Up Automatic Payments

One of the key benefits of automated budgeting solutions is the ability to set up automatic bill payments. This feature ensures that your recurring expenses, such as rent, utilities, and subscriptions, are paid on time, every time. By automating these transactions, you can eliminate the risk of late fees and maintain a consistent savings habit. This not only simplifies your financial management but also helps you avoid the stress of remembering due dates.

Digital Tracking Tools

In addition to automatic payments, many automated budgeting solutions offer comprehensive digital tracking tools. These platforms allow you to monitor your income, expenses, and account balances in real-time, providing a clear picture of your financial health. With features like expense categorization, custom budgeting, and transaction history, you can gain valuable insights into your spending patterns and make informed decisions about your money.

According to a recent survey, 79% of finance professionals are dissatisfied with their current budgeting solution. However, companies that have implemented automated budgeting tools have seen significant benefits, such as Encore Electric saving 1,800 hours annually and Bethel University reducing their budgeting time from 90 hours a week to 45 hours.

By embracing automated budgeting solutions, you can streamline your financial management, reduce the risk of missed payments, and gain a deeper understanding of your spending habits. This, in turn, can lead to increased savings, reduced debt, and a more secure financial future.

| Key Benefits of Automated Budgeting Solutions | Statistics |

|---|---|

|

|

Adjusting Your Budget for Life Changes

In the ever-evolving journey of personal finance, it’s crucial to recognize that budgets are not set in stone. Life transitions, such as job changes, family additions, or major purchases, can significantly impact your financial landscape. As you navigate these pivotal moments, adapting your budget calendar becomes essential for maintaining financial flexibility and ensuring long-term budget adaptation.

When faced with life transitions, it’s essential to review and adjust your budget accordingly. This could involve recalibrating income projections, reassessing expense categories, or even establishing new financial goals. By proactively addressing these changes, you can ensure your budget remains aligned with your evolving circumstances and priorities.

- Evaluate the impact of job changes, promotions, or job loss on your income and adjust your budget accordingly.

- Anticipate the financial implications of major life events, such as marriage, childbirth, or retirement, and incorporate them into your budget planning.

- Assess the budgetary consequences of significant purchases, such as a new home, vehicle, or home renovations, and allocate funds accordingly.

Maintaining a flexible and adaptable budget is key to navigating the unpredictable nature of life. By embracing the dynamic nature of personal finance, you can ensure your budget remains a reliable tool in supporting your financial flexibility and budget adaptation throughout life transitions.

“A successful budget can help individuals identify their needs versus wants, control wasteful spending, and adapt as their financial situation changes over time.”

Remember, the true power of a budget lies in its ability to evolve alongside your life’s ebbs and flows. By regularly reviewing and adjusting your budget calendar, you can maintain a stronger grip on your financial well-being, even in the face of unexpected changes.

Common Budgeting Challenges and Solutions

Budgeting, while essential for financial well-being, can often present unique challenges. One common obstacle is unexpected expenses, such as medical bills or car repairs, which can throw off a carefully crafted budget. To overcome this, it’s crucial to build an emergency fund to cover these unforeseen costs, ensuring your budget remains on track.

Another common issue is income fluctuations, which can make it difficult to accurately predict and plan your budget. To address this, consider implementing a variable income tracking system, where you allocate a portion of your earnings to essential expenses and save the rest for more volatile income months.

Sticking to spending limits can also be a challenge for many. Impulse purchases and lifestyle creep can easily derail a budget. To combat this, set specific budget categories and limits, and use tools like cash envelopes or spending trackers to stay accountable.

- Establish an emergency fund to cover unexpected expenses

- Implement a variable income tracking system to manage income fluctuations

- Set clear budget categories and limits to avoid impulse purchases and lifestyle creep

- Utilize spending trackers and cash envelopes to stay on top of your spending

By addressing these budget obstacles and employing effective financial problem-solving strategies, you can overcome the common money management issues that often arise and maintain a healthy, sustainable budget.

Conclusion

As we conclude this comprehensive budget calendar guide, it’s important to recognize the transformative power of financial empowerment. By consistently planning, tracking, and optimizing your budget, you’re not only mastering the art of money management, but you’re also unlocking a path to greater financial freedom and success.

Whether you’re just starting your budgeting journey or refining an existing system, the insights and strategies outlined in this guide provide a solid foundation for achieving your financial goals. From setting up a personalized budget calendar to leveraging automated tools and overcoming common challenges, you now have the knowledge and resources to navigate the complexities of personal finance with confidence.

Remember, budgeting is not merely a chore, but a powerful catalyst for financial empowerment. With practice, these habits will become second nature, allowing you to focus on the things that matter most – pursuing your passions, building wealth, and creating the life you desire. Embrace the journey, celebrate your progress, and continue to refine your budget mastery for enduring money management success.

FAQ

What are the key components of financial management covered in the budget calendar guide?

The guide covers the fundamental aspects of financial planning, including setting clear money goals, evaluating current spending habits, and the importance of budgeting for greater control over finances.

Why is budget planning important in 2025?

The guide emphasizes how consistent budgeting can lead to more flexibility in spending and achieving financial objectives, making it a crucial practice for effective money management in the year 2025.

What are the initial steps in creating a budget calendar?

The guide guides readers through the initial steps of creating a budget calendar, including evaluating current financial status, reviewing banking records, and tracking expenses for a month to understand regular and occasional expenses.

What are the different budgeting methods and tools discussed in the guide?

The guide compares digital and traditional budgeting methods, highlighting popular budgeting apps, software, and physical tools like the Clever Fox® budget planners, as well as the benefits of mobile banking apps for expense tracking.

How does the guide recommend evaluating one’s current financial situation?

The guide outlines steps for assessing current financial situation, including reviewing spending habits, tallying expenses, and comparing total monthly expenses with income, emphasizing the importance of honesty and clarity in this evaluation process.

How should a personalized budget calendar be structured?

The guide provides guidance on structuring a personalized budget calendar, including daily, weekly, and monthly planning segments, and emphasizes the importance of including all income sources, regular expenses, and anticipated major costs throughout the year.

What strategies are recommended for tracking various income sources?

The guide discusses methods for effectively tracking various income sources, including regular paychecks, assistance programs, and additional income streams, emphasizing the importance of accurately recording all financial inflows for comprehensive budgeting.

How does the guide recommend categorizing and prioritizing expenses?

The guide explains how to categorize expenses into fixed and variable costs, and how to prioritize spending, covering major expense categories like housing, transportation, groceries, utilities, and discretionary spending, and emphasizing the importance of identifying areas where costs can be trimmed.

What guidance does the guide provide for setting financial goals?

The guide guides readers in setting specific, measurable financial goals, such as debt reduction, savings targets, or budgeting for major purchases, emphasizing the importance of realistic goal-setting and aligning budgeting efforts with long-term financial objectives.

How does the guide recommend building an emergency fund?

The guide discusses the importance of building an emergency fund and provides strategies for allocating money towards unexpected costs, recommending setting aside a specific amount monthly, such as 0, to build a substantial emergency fund over time.

What strategies are covered for managing and reducing debt?

The guide outlines strategies for managing and reducing debt, including credit card balances and loans, providing guidance on prioritizing debt payments within the budget and exploring options like refinancing for potential savings.

How does the guide recommend integrating savings and investment goals?

The guide discusses integrating savings and investment goals into the budget calendar, covering the difference between short-term and long-term savings objectives and providing guidance on allocating funds for various investment opportunities.

What advice is provided for maintaining and updating the budget calendar regularly?

The guide provides advice on maintaining and updating the budget calendar regularly, recommending revisiting the budget every few months to make necessary adjustments based on changing financial circumstances or goals.

What automated budgeting solutions are discussed in the guide?

The guide explores automated budgeting solutions, including setting up automatic deposits into savings accounts and using digital tools for expense tracking, highlighting the benefits of automation in maintaining consistent savings habits and reducing the risk of missed payments.

How does the guide recommend adapting the budget calendar to significant life changes?

The guide discusses strategies for adapting the budget calendar to significant life changes, such as job transitions, family additions, or major purchases, emphasizing the importance of flexibility in financial planning to accommodate evolving circumstances.

What common budgeting challenges and solutions are addressed in the guide?

The guide addresses common challenges in budgeting, such as unexpected expenses, income fluctuations, or difficulty sticking to spending limits, and provides practical solutions and tips for overcoming these obstacles to maintain effective financial management.