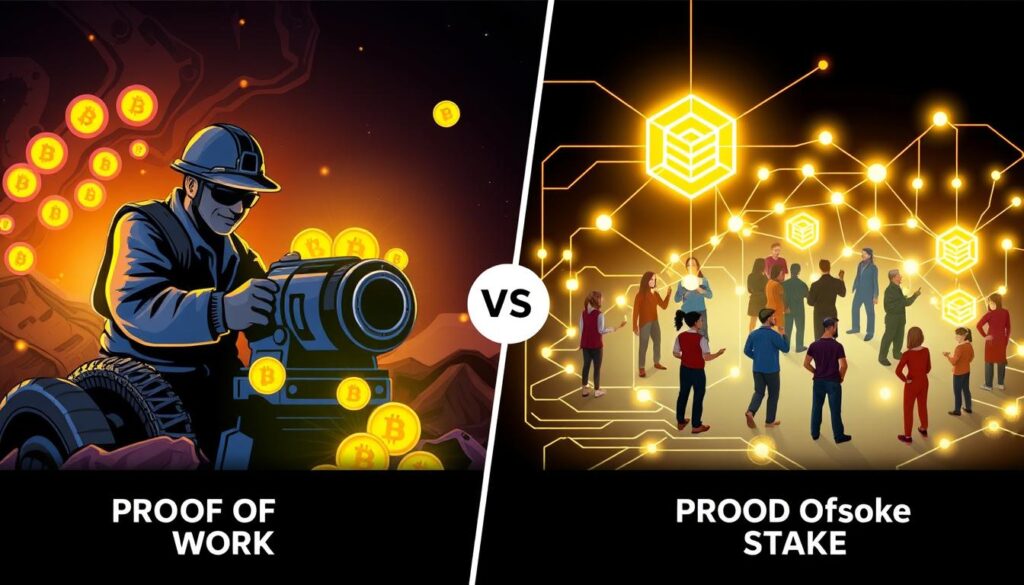

When it comes to blockchain consensus mechanisms, two systems stand out: Proof of Work (PoW) and Proof of Stake (PoS). These mechanisms are crucial for cryptocurrency validation, as they choose who gets to update a blockchain. PoW involves competition, while PoS uses a lottery-like system. Understanding the differences between these two systems is essential for anyone interested in blockchain technology and cryptocurrency validation.

Blockchain consensus mechanisms like PoW and PoS play a vital role in maintaining the integrity of a blockchain network. They help prevent fraud and ensure that all transactions are valid and secure. In the context of cryptocurrency validation, these mechanisms are essential for building trust and confidence in the network. By understanding how PoW and PoS work, we can better appreciate the importance of blockchain consensus mechanisms in the world of cryptocurrency.

Table of Contents

Introduction to Blockchain Consensus

Blockchain technology relies on consensus mechanisms to validate transactions and maintain the integrity of the network. PoW and PoS are two of the most popular consensus mechanisms used in blockchain technology. By understanding how these mechanisms work, we can better appreciate the importance of blockchain consensus mechanisms in the world of cryptocurrency validation.

Key Takeaways

- Proof of Work (PoW) and Proof of Stake (PoS) are two different consensus mechanisms used in blockchain technology.

- PoW involves competition, while PoS uses a lottery-like system to choose who gets to update a blockchain.

- Blockchain consensus mechanisms are crucial for cryptocurrency validation and maintaining the integrity of a blockchain network.

- PoW and PoS have their own sets of advantages and disadvantages, and understanding these differences is essential for anyone interested in blockchain technology.

- Both PoW and PoS will likely coexist within the cryptocurrency space in the long term, each with their own strengths and weaknesses.

- Blockchain consensus mechanisms like PoW and PoS play a vital role in preventing fraud and ensuring that all transactions are valid and secure.

What is Blockchain Consensus?

Cryptocurrencies rely on a decentralized ledger to record transactions, ensuring the integrity of the network. Blockchain security is maintained through a consensus mechanism, which enables agreement among network participants without a central authority. This mechanism is crucial for transaction validation, as it prevents fraudulent activities and ensures that all nodes on the network have the same version of the blockchain.

The evolution of consensus mechanisms has led to the development of various systems, including Proof of Work (PoW) and Proof of Stake (PoS). PoW is considered more secure but consumes more energy, while PoS is seen as more scalable and environmentally friendly. Examples of PoS cryptocurrencies include Ethereum 2.0, Solana, and Cardano, which use less energy and offer faster transaction speeds.

The importance of consensus in blockchain networks cannot be overstated, as it ensures the security and integrity of the network. With the increasing adoption of cryptocurrencies, the need for efficient and secure consensus mechanisms has become more pressing. As the technology continues to evolve, we can expect to see further innovations in consensus mechanisms, leading to more secure, scalable, and sustainable blockchain networks.

| Consensus Mechanism | Energy Consumption | Transaction Speed |

|---|---|---|

| Proof of Work (PoW) | High | Slow |

| Proof of Stake (PoS) | Low | Fast |

Understanding Proof of Work (PoW)

Proof of Work is a consensus mechanism that relies on mining to validate transactions and create new blocks. This process involves solving complex cryptographic puzzles that require significant computational power. The miner who solves the puzzle first gets to add a new block of transactions to the blockchain and is rewarded with a certain number of coins.

The mining process is a competition among miners to solve the cryptographic puzzles and validate transactions. This competition is crucial for network security, as it makes it difficult for a single entity to control the network. The computational power required to solve the puzzles is significant, which is why miners often use specialized hardware to increase their chances of solving the puzzle first.

The energy-intensive nature of mining has led to concerns about the environmental impact of Proof of Work. However, the security benefits of this mechanism have made it a popular choice for many cryptocurrencies, including Bitcoin. As the cryptocurrency space continues to evolve, it will be interesting to see how the mining process and computational power required to solve cryptographic puzzles will adapt to changing demands and concerns.

Some key aspects of Proof of Work include:

- Miners compete to solve complex cryptographic puzzles

- The miner who solves the puzzle first gets to add a new block of transactions to the blockchain

- The computational power required to solve the puzzles is significant

- The mining process is energy-intensive and has environmental implications

Exploring Proof of Stake (PoS)

Proof of Stake (PoS) is a consensus mechanism that relies on validators staking their cryptocurrency as collateral to propose and validate blocks. This approach aims to reduce energy consumption and improve scalability compared to Proof of Work (PoW). To become a validator, users must stake a certain amount of cryptocurrency, which is then locked in a special account.

Staking Requirements

The staking requirements for PoS vary depending on the blockchain platform. For example, Ethereum requires staking 32 Ethereum to participate in the Proof of Stake system. This contributes significantly to Sybil attack prevention, which is a type of attack where a single entity gains control of over 51% of a blockchain network.

Validator Selection Process

The validator selection process in PoS is random, which promotes fairness and prevents any single entity from dominating the network. Validators are chosen by chance, and the probability of being chosen is proportional to the amount of cryptocurrency staked.

Rewards and Penalties

Validators in PoS are rewarded with cryptocurrency for proposing and validating blocks. However, they can also be penalized for malicious behavior, such as proposing invalid blocks. This incentivizes honest behavior and ensures the security and integrity of the blockchain network.

Here is a comparison of the energy consumption of different blockchain platforms:

| Blockchain Platform | Energy Consumption |

|---|---|

| Bitcoin (PoW) | 100 Terawatts per hour (TWh) annually |

| Ethereum (PoS) | Reduced by up to 99% after transitioning to PoS |

Proof of Work vs Proof of Stake: Core Differences

When it comes to blockchain efficiency, two consensus mechanisms stand out: Proof of Work (PoW) and Proof of Stake (PoS). Both have their strengths and weaknesses, particularly in terms of energy consumption and network security. PoW, used by cryptocurrencies like Bitcoin, requires significant computational power to validate transactions, resulting in high energy consumption. In contrast, PoS, used by cryptocurrencies like Ethereum, relies on validators “staking” their own cryptocurrency to validate transactions, reducing energy consumption and increasing blockchain efficiency.

In terms of cryptocurrency sustainability, PoS is generally considered more environmentally friendly due to its lower energy requirements. Additionally, PoS systems often have built-in incentives for validators to act honestly, enhancing network security. For example, a validator who attempts to manipulate the network may lose their stake, providing a strong deterrent against malicious behavior.

- Energy consumption: PoW consumes significantly more energy than PoS

- Network security: PoS has built-in incentives for validators to act honestly, enhancing network security

- Blockchain efficiency: PoS is generally more efficient than PoW due to its lower energy requirements

Ultimately, the choice between PoW and PoS depends on the specific needs and goals of a cryptocurrency or blockchain network. By understanding the core differences between these two consensus mechanisms, developers and users can make informed decisions about which one is best for their use case, promoting cryptocurrency sustainability and network security.

Environmental Impact Analysis

The environmental impact of blockchain consensus mechanisms is a significant concern. Energy efficiency is a crucial factor in determining the sustainability of these mechanisms. The transition to more energy-efficient mechanisms is essential to reduce the carbon footprint of blockchain networks.

A sustainable blockchain is one that minimizes its environmental impact while maintaining its security and functionality. The use of energy-efficient consensus mechanisms, such as Proof of Stake (PoS), is a step towards achieving this goal. PoS reduces energy consumption significantly compared to Proof of Work (PoW), making it a more sustainable option.

The benefits of a sustainable blockchain are numerous. It reduces the carbon footprint of the network, making it more environmentally friendly. Additionally, it promotes energy efficiency, which is essential for the long-term sustainability of the network. As the blockchain industry continues to grow, the importance of sustainable blockchain solutions will only continue to increase.

Economic Implications of Both Systems

The economic aspects of Proof of Work (PoW) and Proof of Stake (PoS) systems are crucial to understanding their viability. In terms of cryptocurrency economics, the initial investment required for each system differs significantly. For PoW, miners must invest in expensive processing equipment and incur hefty energy charges to power the machines attempting to solve complex computations. On the other hand, PoS requires users to own a certain amount of coins or tokens to become a validator, which can be a more affordable option.

When it comes to blockchain investment, the ongoing operational costs of PoW systems are substantially higher due to the high energy consumption. In contrast, PoS systems have lower physical costs as participants must deposit tokens as collateral rather than invest in physical mining rigs. This makes PoS a more attractive option for those looking to minimize their mining profitability costs.

The potential returns on investment for both systems also vary. PoW systems offer mining rewards, but the high energy costs can eat into profits. PoS systems, on the other hand, offer staking yields, which can be a more stable source of income. Ultimately, the choice between PoW and PoS depends on individual investment goals and risk tolerance.

Key Considerations

- Initial investment requirements

- Ongoing operational costs

- Potential returns on investment

By understanding the economic implications of both systems, investors can make informed decisions about their blockchain investment strategies and maximize their mining profitability. As the cryptocurrency economics landscape continues to evolve, it’s essential to stay up-to-date on the latest developments and trends in the industry.

Network Security Considerations

When it comes to network security, both Proof of Work (PoW) and Proof of Stake (PoS) consensus mechanisms have their own set of vulnerabilities. One of the most significant threats to network integrity is a 51% attack, where an entity controls more than 50% of the miners in a PoW network or owns 51% of the staked cryptocurrency in a PoS network. This can allow the entity to alter the blockchain, compromising the security of the network.

A notable example of blockchain vulnerabilities is the risk of centralization in PoS networks. For instance, early adopters and large stakeholders can influence protocol updates, potentially leading to a concentration of power. To mitigate this risk, some networks, such as Cardano, have introduced systems that allow smaller holders to pool their stakes and share rewards, reducing the risk of centralization.

Some key considerations for network security include:

- Energy consumption: PoW networks, such as Bitcoin, consume large amounts of energy, which can make them more vulnerable to attacks.

- Staking requirements: PoS networks, such as Ethereum, require users to stake a minimum amount of cryptocurrency to verify transactions, which can lead to centralization.

- Network participation: Both PoW and PoS networks require a high level of network participation to maintain security and integrity.

In conclusion, network security is a critical consideration for both PoW and PoS consensus mechanisms. By understanding the potential vulnerabilities and taking steps to mitigate them, we can ensure the integrity and security of blockchain networks.

| Consensus Mechanism | Vulnerabilities | Mitigation Strategies |

|---|---|---|

| Proof of Work (PoW) | 51% attack, energy consumption | Increasing network participation, using renewable energy sources |

| Proof of Stake (PoS) | Centralization, staking requirements | Implementing systems for smaller holders to pool stakes, reducing staking requirements |

Scalability and Performance Metrics

When it comes to blockchain technology, scalability and performance are crucial factors to consider. Two key metrics to evaluate are blockchain throughput and transaction latency. Blockchain throughput refers to the number of transactions that can be processed per second, while transaction latency refers to the time it takes for a transaction to be confirmed on the blockchain.

In terms of blockchain throughput, Proof of Work (PoW) and Proof of Stake (PoS) have different performance characteristics. For example, the Bitcoin network, which uses PoW, takes about 10 minutes on average to create a new block, resulting in a relatively low blockchain throughput. On the other hand, the Ethereum network, which is transitioning to PoS, can process transactions much faster, with a block creation time of around 12 seconds.

Transaction Speed Comparison

A comparison of transaction speeds between PoW and PoS reveals significant differences. PoS allows for faster transaction processing, which can help reduce network congestion. However, PoW has its own strengths, such as providing a high level of security and decentralization.

Network Capacity

Network capacity is another important factor to consider when evaluating the scalability of a blockchain network. As the number of users and transactions increases, the network must be able to handle the increased load without becoming congested. Solutions such as sharding and off-chain transactions can help improve network capacity and reduce congestion.

Future Scaling Solutions

To address the scalability challenges facing blockchain networks, researchers and developers are exploring new solutions. For example, the Lightning Network is being developed to improve the scalability of the Bitcoin network, while Ethereum’s transition to PoS is expected to improve its blockchain throughput and reduce transaction latency. By addressing these scalability challenges, blockchain technology can continue to evolve and improve, supporting a wide range of applications and use cases.

| Blockchain Network | Block Creation Time | Blockchain Throughput |

|---|---|---|

| Bitcoin (PoW) | 10 minutes | Low |

| Ethereum (PoS) | 12 seconds | High |

Real-World Applications and Adoption

Cryptocurrency use cases are becoming increasingly diverse, with various industries exploring the potential of blockchain implementation. One notable example is the use of blockchain in supply chain management, where it can increase transparency and efficiency. Institutional adoption is also on the rise, with traditional financial institutions and corporations engaging with blockchain technology to improve their operations.

Some notable cryptocurrencies, such as Bitcoin and Ethereum, are leading the way in terms of blockchain implementation. Bitcoin, for instance, uses a proof-of-work consensus mechanism, while Ethereum is transitioning to a proof-of-stake mechanism. This shift is expected to reduce energy consumption and increase the scalability of the network. As a result, cryptocurrency use cases are expanding, and institutional adoption is becoming more widespread.

The benefits of blockchain implementation are numerous, including increased security, transparency, and efficiency. As more industries explore the potential of blockchain, we can expect to see a significant increase in cryptocurrency use cases and institutional adoption. Some examples of cryptocurrency use cases include:

- Decentralized finance (DeFi) applications

- Supply chain management

- Voting systems

In conclusion, the real-world applications and adoption of cryptocurrency use cases and blockchain implementation are growing rapidly. As institutional adoption increases, we can expect to see a significant expansion of cryptocurrency use cases and a greater impact on various industries.

| Cryptocurrency | Consensus Mechanism | Energy Consumption |

|---|---|---|

| Bitcoin | Proof-of-Work | High |

| Ethereum | Proof-of-Stake | Low |

The Future of Consensus Mechanisms

The future of consensus mechanisms in blockchain technology is rapidly evolving, driven by the need for more energy-efficient and scalable solutions. As the blockchain innovation continues to advance, new consensus alternatives are emerging to address the limitations of traditional proof-of-work (PoW) and proof-of-stake (PoS) mechanisms.

One of the key trends in the cryptocurrency evolution is the development of hybrid consensus mechanisms that combine the benefits of PoW and PoS. These mechanisms aim to provide a more secure, scalable, and energy-efficient way to validate transactions and achieve consensus on the blockchain.

Some of the emerging consensus alternatives include proof-of-authority (PoA), delegated proof-of-stake (DPoS), and proof-of-capacity (PoC). These mechanisms are being explored by various blockchain projects, and their potential to improve the efficiency and security of blockchain networks is significant.

The following table summarizes some of the key features of these emerging consensus mechanisms:

| Consensus Mechanism | Description |

|---|---|

| Proof-of-Authority (PoA) | Reputation-based model for transaction validation |

| Delegated Proof-of-Stake (DPoS) | Faster and more scalable than PoW or PoS |

| Proof-of-Capacity (PoC) | Uses hard drive space to validate transactions |

As the blockchain industry continues to evolve, it is likely that we will see further innovation in consensus mechanisms, driving the development of more efficient, secure, and scalable blockchain networks.

Impact on Cryptocurrency Investment

The choice between proof of work and proof of stake consensus mechanisms can significantly impact cryptocurrency investment decisions. A thorough crypto market analysis is essential to understand the underlying consensus mechanism and its effects on a cryptocurrency’s value, market perception, and long-term viability. Investors must consider the different investment strategies for proof of work and proof of stake coins, including mining investments versus staking.

Traditional investors are also approaching blockchain technology stocks with interest, including investments in companies developing proof of work or proof of stake solutions. The shift from Ethereum 1.0’s proof of work model to proof of stake is projected to reduce energy consumption by 99%, making it a more environmentally friendly option. However, the SEC’s regulatory stance on proof of stake tokens could impact their adoption and value.

Some key considerations for investors include:

- Energy consumption: Proof of work mechanisms face intense scrutiny due to their significant environmental impact and carbon footprint.

- Regulatory environment: The SEC’s approach to proof of stake tokens could benefit from a more nuanced understanding of the technology’s potential to address climate concerns.

- Market volatility: Both proof of work and proof of stake coins experience volatility, and neither system makes it more likely a coin will increase in value or drop to zero.

In conclusion, investors must carefully consider the impact of consensus mechanisms on cryptocurrency investment decisions, taking into account factors such as energy consumption, regulatory environment, and market volatility. By conducting thorough crypto market analysis and developing informed investment strategies, investors can make more informed decisions about blockchain technology stocks and navigate the complex cryptocurrency market.

| Consensus Mechanism | Energy Consumption | Regulatory Environment |

|---|---|---|

| Proof of Work | High | Less scrutiny |

| Proof of Stake | Low | More scrutiny |

Common Misconceptions and Myths

When it comes to blockchain and cryptocurrency, there are many blockchain myths and cryptocurrency misconceptions that can be misleading. One common myth is that proof of stake is more secure than proof of work. However, this is not necessarily true, as both consensus mechanisms have their own set of security risks. Understanding consensus mechanism facts is crucial to making informed decisions in the world of cryptocurrency.

Some critics argue that proof of stake leads to a “the rich get richer” situation, resulting in a less decentralized system. This is because validators in proof of stake systems earn token rewards proportional to their stake, granting significant control and advantage to larger stakeholders over smaller ones. On the other hand, proof of work systems have been criticized for their high energy consumption, with some arguing that it is not sustainable in the long term.

Here are some key facts to consider:

- Proof of stake blockchains tend to be less decentralized than traditional public companies.

- Validators in proof of stake systems can be considered equivalent to holding securities.

- Proof of stake tokens are functionally equivalent to equities, while proof of work tokens are compared more to commodities.

In conclusion, it is essential to separate fact from fiction when it comes to blockchain and cryptocurrency. By understanding the consensus mechanism facts and being aware of the blockchain myths and cryptocurrency misconceptions, we can make more informed decisions and navigate the world of cryptocurrency with confidence.

| Consensus Mechanism | Security Risks | Energy Consumption |

|---|---|---|

| Proof of Work | 51% attack, double spending | High |

| Proof of Stake | Nothing at stake, long-range attack | Low |

Conclusion

As we conclude our exploration of Proof of Work (PoW) and Proof of Stake (PoS) consensus mechanisms, it’s clear that the blockchain future is poised for continued cryptocurrency evolution. The comparison of consensus mechanisms has revealed the unique strengths and trade-offs of each system, with PoS emerging as a more energy-efficient alternative to the power-hungry PoW model.

The cryptocurrency community remains engaged in an ongoing debate about the ideal consensus approach. While PoW has proven its security through the success of Bitcoin, PoS offers promising improvements in scalability and environmental impact. As we’ve seen with Ethereum’s transition to PoS, the industry is actively exploring hybrid solutions that leverage the benefits of both systems.

Ultimately, the future of blockchain consensus will be shaped by technological advancements, regulatory frameworks, and the evolving needs of the decentralized ecosystem. Investors, developers, and enthusiasts must stay informed and engaged as this dynamic landscape continues to unfold. By understanding the nuances of PoW and PoS, we can make informed decisions and contribute to the blockchain future that serves the needs of a rapidly transforming cryptocurrency evolution.

FAQ

What is blockchain consensus and why is it essential for cryptocurrencies?

Blockchain consensus refers to the process of ensuring agreement among network participants on the state of the decentralized ledger without a central authority. It is crucial for cryptocurrencies to maintain the integrity and security of transactions, preventing double-spending and other attacks.

What is the Proof of Work (PoW) consensus mechanism?

Proof of Work is a consensus mechanism where miners compete to solve complex cryptographic puzzles using computational power. The first miner to solve the puzzle and validate a block of transactions is rewarded with cryptocurrency.

How does the Proof of Stake (PoS) consensus mechanism work?

In Proof of Stake, users stake their own cryptocurrency to become validators. The validator selection process is random, and validators are rewarded for maintaining the network’s integrity. PoS systems require less energy compared to PoW.

What are the key differences between Proof of Work and Proof of Stake?

The main differences include energy consumption, security features, and network participation requirements. PoW is more energy-intensive due to the mining process, while PoS is more energy-efficient. Both systems have unique approaches to ensuring network security and integrity.

What are the environmental implications of Proof of Work and Proof of Stake?

Proof of Work systems, like Bitcoin, have a significant environmental impact due to their high energy consumption. Proof of Stake, on the other hand, is generally more energy-efficient, making it a more sustainable option for blockchain networks.

How do the economic aspects of PoW and PoS systems differ?

The initial investment and ongoing operational costs vary between the two consensus mechanisms. PoW requires expensive mining equipment, while PoS only requires a cryptocurrency stake. The potential returns on investment also differ, with mining rewards in PoW and staking yields in PoS.

How do PoW and PoS systems compare in terms of security?

Both consensus mechanisms have unique security features. PoW is designed to prevent 51% attacks through high energy requirements, while PoS uses economic incentives to encourage honest behavior and deter malicious actors.

How do PoW and PoS systems compare in terms of scalability and performance?

PoW systems like Bitcoin often have lower transaction speeds and limited network capacity compared to PoS networks. However, scaling solutions are being developed for both types of consensus mechanisms to improve their performance and throughput.

How are PoW and PoS being used in real-world applications?

Major cryptocurrencies like Bitcoin and Ethereum use PoW and PoS, respectively, and both are being adopted by various industries beyond finance, including supply chain management, voting systems, and decentralized finance (DeFi).

What are the common misconceptions and myths surrounding PoW and PoS systems?

Some common misconceptions include assumptions about security vulnerabilities, concerns over centralization, and exaggerated claims about energy usage. It’s important to separate fact from fiction and get accurate information about the true capabilities and limitations of these consensus mechanisms.