The MACD indicator is a popular technical analysis tool used in crypto trading to identify momentum and facilitate profitable trading strategies. With its ability to provide valuable insights into market trends and momentum, the MACD indicator has been a staple in traditional finance markets for almost fifty years. Cryptocurrency traders are now utilizing the MACD indicator to navigate the volatile crypto market and make informed trading decisions.

The MACD indicator comprises two main lines: the MACD line and the signal line, which help traders observe key trading signals, including signal line crossovers, zero line crossovers, and bullish and bearish divergences. By using the MACD indicator in conjunction with other technical indicators and risk management strategies, traders can enhance the accuracy of their trading decisions and reduce the risk of false trading indications.

Table of Contents

Key Takeaways

- The MACD indicator is a technical analysis tool used in crypto trading to identify momentum and facilitate profitable trading strategies.

- The MACD indicator comprises two main lines: the MACD line and the signal line.

- Traders use the MACD indicator to observe key trading signals, including signal line crossovers, zero line crossovers, and bullish and bearish divergences.

- The MACD indicator should be used in conjunction with other technical indicators and risk management strategies to enhance the accuracy of trading decisions.

- Cryptocurrency traders can use the MACD indicator to navigate the volatile crypto market and make informed trading decisions.

- The MACD indicator can provide valuable insights into market trends and momentum, but it is essential to use it alongside other indicators and risk management strategies.

Understanding the Basics of MACD

The MACD indicator, developed by Gerald Appel in 1979, is a powerful tool used in trend identification and as a momentum indicator. It consists of two lines: the MACD line and the signal line, which are calculated using exponential moving averages (EMAs). The MACD line is typically the difference between the 12-day and 26-day EMAs, while the signal line is a 9-day EMA of the MACD line.

The MACD components work together to provide insights into market trends. When the MACD crosses above the signal line, it indicates a bullish trend, while a cross below the signal line shows a bearish trend. The histogram, which represents the difference between the MACD line and the signal line, is used for trend analysis. By understanding these MACD components, traders can make more informed decisions about buying or selling opportunities.

As a momentum indicator, MACD helps traders identify trends and potential reversals in the market. The signal line crossover is used in combination with the MACD line to identify bullish or bearish trends. By combining MACD with other indicators, traders can enhance their trading strategies and make more accurate predictions about market movements.

What is the MACD Indicator?

The MACD indicator is a technical indicator that uses EMAs to generate the MACD line and signal line. It is commonly used in crypto trading to identify trends and potential reversals.

Components of MACD

The MACD components include the MACD line, signal line, and histogram. Each component plays a crucial role in providing insights into market trends and momentum.

Why MACD Matters in Trading

MACD matters in trading because it provides a powerful tool for trend identification and momentum analysis. By understanding the MACD components and how they work together, traders can make more informed decisions about buying and selling opportunities.

The Mathematics Behind MACD Calculations

The MACD formula is based on exponential moving averages, which are used to calculate the MACD line, signal line, and histogram. The MACD calculation involves subtracting the 26-period EMA from the 12-period EMA to generate the MACD line. This is represented by the formula: MACD = 12 Period EMA − 26 Period EMA. The signal line is a 9-period EMA of the MACD line, and the histogram is formed by subtracting the signal line from the MACD line.

The MACD indicator uses the 12 and 26-period MA’s as standard settings, and these settings are recommended to be kept consistent for accurate calculations. Understanding the MACD calculation is crucial for making informed trading decisions, as it helps investors determine the strength or weakening of bullish or bearish movements in price. The MACD formula is a key component of the indicator, and it is used to identify crossovers, divergences, and comparisons with price movements.

Here are the key components of the MACD calculation:

- MACD line: 12-period EMA – 26-period EMA

- Signal line: 9-period EMA of the MACD line

- Histogram: MACD line – signal line

The MACD calculation is a powerful tool for identifying market trends and potential trading opportunities. By understanding the mathematics behind the MACD calculations, investors can make more informed decisions and improve their trading strategies. The MACD formula is a key component of the indicator, and it is used to identify crossovers, divergences, and comparisons with price movements. The use of exponential moving averages in the MACD calculation provides a more accurate representation of market trends, and it is a key factor in the indicator’s effectiveness.

| Indicator | Calculation | Settings |

|---|---|---|

| MACD line | 12-period EMA – 26-period EMA | 12, 26 |

| Signal line | 9-period EMA of the MACD line | 9 |

| Histogram | MACD line – signal line | N/A |

Applying the MACD Indicator in Crypto Trading

To effectively use the MACD setup in crypto chart analysis, it’s essential to understand the components of the MACD indicator and how to apply them in trading decisions. The MACD indicator consists of the MACD line, signal line, and histogram, which provide insights into trend strength and potential reversals.

In crypto trading, the MACD setup is crucial for identifying trend changes and potential buy or sell signals. The MACD interpretation involves monitoring the relationship between the MACD line and signal line, as well as the histogram, to gauge the strength and direction of the trend. By using the MACD setup in crypto chart analysis, traders can make more informed decisions and improve their trading strategies.

Some key points to consider when applying the MACD indicator in crypto trading include:

- Setting up the MACD on your trading platform and adjusting the parameters to suit your trading strategy

- Reading MACD signals, such as crossovers and divergences, to identify potential trend changes

- Interpreting histogram patterns to gauge the strength and direction of the trend

By mastering the MACD setup and interpretation, traders can improve their crypto chart analysis and make more profitable trading decisions. The MACD indicator is a powerful tool for identifying trend changes and potential reversals, and its application in crypto trading can be highly effective when used in conjunction with other technical indicators and risk management strategies.

Key MACD Trading Signals

When it comes to MACD trading signals, there are several types that traders should be aware of. These signals can be used to generate buy signals and sell signals, helping traders make informed decisions. The MACD line crossing above the signal line generates a bullish signal, while the MACD line crossing below the signal line indicates a bearish signal.

Some of the key MACD trading signals include:

- Bullish crossovers, where the MACD line crosses above the signal line

- Bearish crossovers, where the MACD line crosses below the signal line

- Zero-line crossovers, where the MACD line crosses above or below the zero line

These signals can be used in conjunction with other technical indicators to enhance trading strategies. By understanding and interpreting MACD trading signals, traders can gain valuable insights into market conditions and make more informed decisions.

It’s worth noting that MACD trading signals should be used in conjunction with other forms of analysis, such as fundamental analysis and risk management techniques. By combining these approaches, traders can develop a more comprehensive understanding of the markets and make more effective trading decisions.

| Signal Type | Description |

|---|---|

| Bullish Crossover | MACD line crosses above the signal line |

| Bearish Crossover | MACD line crosses below the signal line |

| Zero-line Crossover | MACD line crosses above or below the zero line |

MACD Crossover Strategies for Cryptocurrency

When it comes to crypto trend analysis, the MACD crossover strategy is a popular choice among traders. This strategy involves looking for crossovers between the MACD line and the signal line to generate buy and sell signals. A MACD trading strategy that incorporates crossovers can be an effective way to identify trends and make informed trading decisions.

In a MACD crossover strategy, a bullish crossover occurs when the MACD line crosses above the signal line, indicating a potential buy signal. On the other hand, a bearish crossover occurs when the MACD line crosses below the signal line, indicating a potential sell signal. Some of the best performers for MACD bullish crossover in crypto trading include Pundi (NPXS), BitTorrent (BTT), and SingularityNET (AGIX), with success rates of 78.6%, 76.2%, and 75%, respectively.

For bearish crossovers, some of the top performers include Illuvium (ILV), Quicksand (QUICK), and Osmosis (OSMO), with success rates of 92.3%, 86.3%, and 83.3%, respectively. By incorporating a MACD crossover strategy into your crypto trend analysis, you can potentially improve your trading results and make more informed decisions.

Bullish Crossovers

Bullish crossovers are a key component of a MACD trading strategy. When the MACD line crosses above the signal line, it can indicate a potential buy signal. This can be a powerful tool for identifying trends and making informed trading decisions.

Bearish Crossovers

Bearish crossovers, on the other hand, occur when the MACD line crosses below the signal line. This can indicate a potential sell signal and can be an effective way to identify downtrends and make informed trading decisions.

Signal Line Crosses

Signal line crosses are another important aspect of a MACD crossover strategy. When the MACD line crosses above or below the signal line, it can generate a buy or sell signal. By incorporating signal line crosses into your MACD trading strategy, you can potentially improve your trading results and make more informed decisions.

Combining MACD with Other Technical Indicators

Traders often use the MACD indicator in conjunction with other technical indicators to enhance their trading strategy optimization. By combining MACD with other indicators, traders can gain a more comprehensive understanding of market trends and make more informed decisions. Technical analysis plays a crucial role in this process, as it allows traders to identify patterns and trends that may not be immediately apparent.

One key benefit of combining different indicators is that it can help to filter out false signals and provide more reliable buy and sell signals. For example, combining MACD with the Relative Strength Index (RSI) can help to identify overbought and oversold conditions, while also providing a more nuanced understanding of market momentum. This approach to indicator combination can be particularly effective in the context of cryptocurrency trading, where markets can be highly volatile and unpredictable.

Some common indicators that are used in combination with MACD include:

- RSI

- Stochastic

- Moving Averages

- Bollinger Bands

These indicators can be used to provide a more comprehensive understanding of market trends and to identify potential buy and sell signals. By using a combination of indicators, traders can develop a more robust trading strategy that is better equipped to handle the complexities of the cryptocurrency market. This approach totrading strategy optimizationcan help traders to achieve their goals and to minimize their risk.

Common MACD Trading Mistakes to Avoid

When using the MACD indicator in crypto trading, it’s essential to be aware of common pitfalls that can lead to false signals and significant losses. One of the primary MACD trading pitfalls is the occurrence of false signals during choppy or sideways markets. To avoid this, traders should use additional confirmation methods, such as other technical indicators or fundamental analysis, to validate the signals.

Another critical aspect of MACD trading is risk management. Traders should always prioritize risk management by setting stop-loss orders and position sizing to minimize potential losses. trading psychology in making informed decisions, rather than relying on emotions or impulsive actions.

Some common mistakes to avoid when using MACD include:

- Over-reliance on single indicators

- Failure to adjust MACD settings according to market conditions

- Ignoring the importance of timeframe selection

By being aware of these common MACD trading mistakes and taking steps to avoid them, traders can refine their strategies and improve their overall trading performance.

Advanced MACD Trading Techniques

For experienced traders, advanced MACD strategies can significantly enhance trading performance. One such technique involves customizing MACD settings based on specific market conditions or strategies. This approach allows traders to tailor the indicator to their unique needs, optimizing its effectiveness in various market scenarios.

A key aspect of professional trading techniques is the ability to adapt to changing market conditions. By adjusting MACD settings, traders can better respond to shifts in market volatility, trends, and momentum. This flexibility is particularly important in the dynamic crypto market, where conditions can change rapidly.

Some traders develop their own MACD settings, taking into account factors such as market trends, volatility, and the specific cryptocurrency being traded. This MACD optimization process involves experimenting with different settings to find the most effective combination for a given market scenario. By doing so, traders can improve the accuracy of their trading decisions and increase their overall profitability.

To illustrate the importance of advanced MACD strategies, consider the following benefits:

- Improved trading performance through customized MACD settings

- Enhanced adaptability to changing market conditions

- Increased accuracy in trading decisions through MACD optimization

By incorporating advanced MACD strategies into their trading arsenal, traders can gain a competitive edge in the crypto market. As with any trading technique, it is essential to thoroughly backtest and refine these strategies to ensure their effectiveness in various market scenarios.

| MACD Setting | Market Condition | Trading Strategy |

|---|---|---|

| Short-term EMAs | High volatility | Scalping or day trading |

| Long-term EMAs | Low volatility | Swing trading or position trading |

MACD Divergence Patterns in Crypto Markets

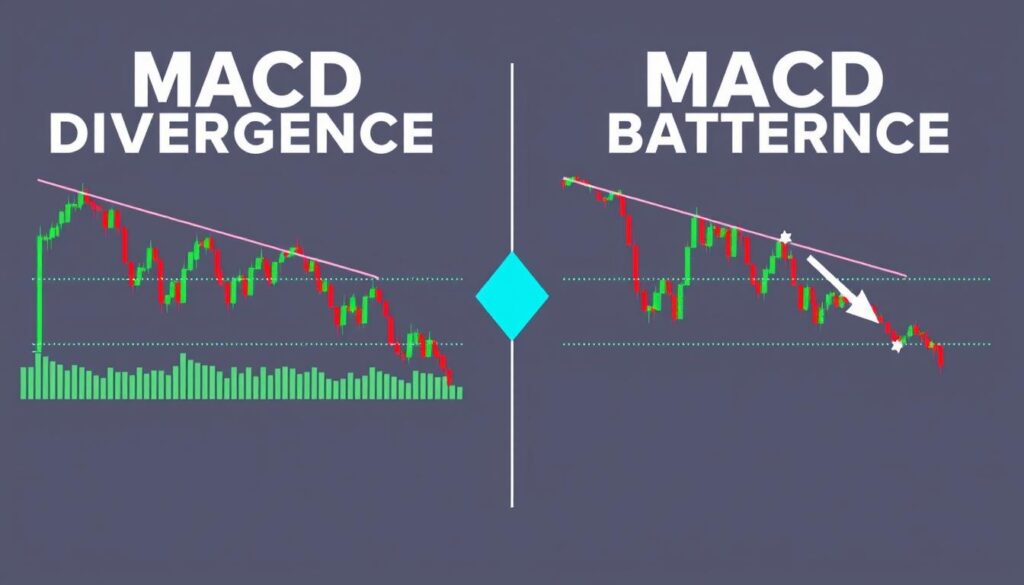

When it comes to crypto market analysis, identifying MACD divergence patterns can be a powerful tool for predicting trend reversals. MACD divergence occurs when the price of a cryptocurrency and its MACD indicator are moving in opposite directions. This can be a strong indication of a potential trend reversal, making it a crucial aspect of crypto market analysis.

A bullish divergence, for example, occurs when the price of a cryptocurrency makes lower lows, but the MACD forms higher lows. This can be a sign of a potential upward reversal, and is often used as a trend reversal signal. On the other hand, a bearish divergence occurs when the price makes higher highs, but the MACD forms lower highs, indicating a potential downward reversal.

Bullish Divergence

In a bullish divergence, the MACD line is moving upward, while the price of the cryptocurrency is moving downward. This can be a sign of a potential buying opportunity, as the MACD indicator is indicating a shift in momentum. By recognizing these MACD divergence patterns, traders can gain a better understanding of the crypto market and make more informed investment decisions.

Bearish Divergence

A bearish divergence, on the other hand, occurs when the MACD line is moving downward, while the price of the cryptocurrency is moving upward. This can be a sign of a potential selling opportunity, as the MACD indicator is indicating a shift in momentum. By combining MACD divergence analysis with other forms of crypto market analysis, traders can gain a more complete understanding of the market and make more effective trading decisions.

By recognizing and understanding MACD divergence patterns, traders can improve their crypto market analysis and make more informed investment decisions. Whether you’re a seasoned trader or just starting out, incorporating MACD divergence into your trading strategy can be a powerful way to stay ahead of the curve and achieve success in the crypto market.

Optimizing MACD Settings for Cryptocurrency

To get the most out of the MACD indicator in cryptocurrency trading, it’s essential to experiment with different MACD customization options. The default settings of 12, 26, and 9 may not be suitable for all traders, as they can be too slow, leading to late entry and exit from trades. By adjusting these parameters, traders can create crypto-specific settings that better suit their trading style and goals.

A key aspect of indicator optimization is finding the right balance between sensitivity and reliability. Traders can use a combination of shorter and longer period EMAs to generate more accurate signals. For example, using a 5-period EMA for the MACD calculation and a 3-period EMA for the signal line can help filter out noise and provide clearer trading signals. To learn more about optimizing your trading strategy, visit this resource for expert advice on investing in cryptocurrency.

Some of the best parameters for MACD customization include:

- Fast: 8-20

- Slow: 21-40

- Signal: 5-15

These ranges can help traders find the optimal settings for their specific trading needs. By experimenting with different combinations of these parameters, traders can create a customized MACD indicator that provides more accurate and reliable signals.

By optimizing their MACD settings, traders can improve their overall trading performance and increase their chances of success in the cryptocurrency market. Whether you’re a seasoned trader or just starting out, taking the time to customize your MACD indicator can make a significant difference in your trading results.

| Parameter | Range | Description |

|---|---|---|

| Fast | 8-20 | Shorter period EMA for MACD calculation |

| Slow | 21-40 | Longer period EMA for MACD calculation |

| Signal | 5-15 | Period for signal line EMA |

Real-World MACD Trading Examples

With over 420 million people worldwide now owning cryptocurrency, a growth of over 100 million in just the past year, the demand for effective trading strategies has never been higher. The Moving Average Convergence Divergence (MACD) indicator is a popular tool for identifying trend changes and momentum in cryptocurrency markets. In this section, we will explore real-world MACD case studies, examining crypto market examples and the practical application of this indicator.

The MACD indicator consists of the MACD Line, Signal Line, and Histogram, providing a comprehensive view of market trends. By analyzing historical price charts of Bitcoin and popular altcoins, we can see how MACD signals corresponded to significant market moves. For instance, a bullish crossover occurs when the MACD Line crosses above the Signal Line, indicating a potential uptrend. Conversely, a bearish crossover occurs when the MACD Line crosses below the Signal Line, indicating a potential downtrend.

Bitcoin Case Studies

Let’s examine a few Bitcoin case studies, where MACD signals played a crucial role in identifying trend reversals. In these examples, we can see how the MACD indicator helped traders capitalize on price fluctuations, making informed decisions about market entries and exits.

Altcoin Trading Scenarios

In addition to Bitcoin, the MACD indicator can be applied to altcoin trading scenarios. By analyzing the MACD signals and histogram patterns, traders can identify potential trend changes and make informed decisions about their trades. The following table illustrates a few examples of altcoin trading scenarios, where the MACD indicator was used to identify trend reversals:

| Altcoin | MACD Signal | Trend Reversal |

|---|---|---|

| Ethereum | Bullish Crossover | Uptrend |

| Litecoin | Bearish Crossover | Downtrend |

| Bitcoin Cash | Bullish Divergence | Uptrend |

By examining these MACD case studies and crypto market examples, we can see the practical application of this indicator in real-world trading scenarios. The MACD indicator is a powerful tool for identifying trend changes and momentum in cryptocurrency markets, and its effective use can help traders make informed decisions about their trades.

Risk Management When Trading with MACD

Effective crypto risk management is crucial when using the MACD indicator for trading. This involves position sizing, which helps to manage the amount of capital invested in each trade, and stop-loss strategies, which limit potential losses if the market moves against the trade.

A well-planned risk management strategy can help traders to maximize returns while minimizing losses. This includes setting realistic profit targets and stop-loss levels, as well as adjusting position sizes based on market conditions.

Some key considerations for crypto risk management include:

- Setting a stop-loss level to limit potential losses

- Adjusting position sizes based on market conditions

- Monitoring and adjusting risk management strategies as needed

By incorporating effective crypto risk management strategies, including position sizing and stop-loss strategies, traders can help to protect their capital and achieve their trading goals.

Conclusion

As you’ve discovered, the Moving Average Convergence Divergence (MACD) indicator is a powerful tool for analyzing cryptocurrency markets. By understanding its components, calculating the MACD, and interpreting the signals, you’ve equipped yourself with valuable insights to navigate the dynamic crypto landscape. However, the journey of mastering the MACD does not end here.

Continuous learning is key when it comes to trading the crypto analysis tools like the MACD. Stay up-to-date with the latest market trends, explore advanced MACD techniques, and experiment with different settings to optimize your trading strategies. Remember, the MACD is just one part of a comprehensive trading approach, and combining it with other MACD trading summary indicators can provide even deeper insights.

The crypto market is constantly evolving, and the MACD will continue to be a reliable companion as you navigate the ups and downs. Embrace the process of learning, practice diligently, and trust your own analysis. With time and dedication, you’ll develop the skills to effectively leverage the MACD and make informed continuous learning decisions in your crypto trading endeavors.

FAQ

What is the MACD indicator?

The MACD (Moving Average Convergence Divergence) indicator is a popular technical analysis tool used by crypto traders to identify trends, momentum, and potential market reversals.

What are the key components of MACD?

The MACD consists of three main components: the MACD line, the signal line, and the histogram. These elements work together to provide trading signals and insights.

Why is MACD important for crypto trading?

MACD is a valuable tool for crypto traders as it helps identify trends, momentum shifts, and potential trading opportunities in the highly volatile cryptocurrency market.

How do I set up MACD on my trading platform?

Setting up MACD on your preferred trading platform typically involves adding the MACD indicator to your chart and adjusting the default settings to better suit your trading style and the cryptocurrency market.

What are the primary MACD trading signals to look for?

The key MACD trading signals include bullish and bearish crossovers, zero-line crossovers, and divergences. These signals can indicate potential trend changes and help traders make more informed trading decisions.

How can I use MACD crossover strategies in crypto trading?

MACD crossover strategies, such as identifying bullish and bearish crossovers, as well as signal line crosses, can be effective for trading cryptocurrencies. These strategies help traders identify trend reversals and potential entry and exit points.

Can I combine MACD with other technical indicators?

Yes, MACD can be combined with other popular technical indicators like RSI, moving averages, and Bollinger Bands to create more robust trading strategies and improve decision-making in the crypto market.

What are some common mistakes to avoid when using MACD in crypto trading?

Some common MACD-related mistakes to avoid include relying too heavily on false signals, selecting inappropriate timeframes, and over-relying on a single indicator. Understanding these pitfalls can help traders use MACD more effectively.

What are some advanced MACD trading techniques?

For more experienced traders, advanced MACD techniques include using custom MACD settings, analyzing multiple timeframes, and employing MACD strategies for range-bound markets.

How can I identify MACD divergence patterns in crypto markets?

Understanding MACD divergence, including bullish, bearish, and hidden divergence patterns, can provide valuable insights into potential trend reversals in the cryptocurrency market.

How do I optimize MACD settings for crypto trading?

Experimenting with different MACD parameter combinations, such as the length of the moving averages, can help traders optimize the indicator’s performance and accuracy for the unique characteristics of the crypto market.

Can you provide real-world examples of MACD in crypto trading?

Analyzing historical price charts of Bitcoin and popular altcoins can demonstrate how MACD signals have corresponded to significant market moves, helping traders connect theoretical knowledge with practical application.

How do I incorporate risk management when using MACD for crypto trading?

Effective risk management strategies, such as proper position sizing, stop-loss placement, and profit-taking techniques, should be used in conjunction with MACD to preserve capital and achieve sustainable trading success in the cryptocurrency market.