The Average Directional Index (ADX) is a technical analysis tool that measures the strength of trends, making it a valuable asset for traders. Developed by J Welles Wilder, the ADX indicator can be applied to various financial instruments, providing insights into trend analysis. The ADX line registers a trend’s strength, ranging from 0 to 100, but does not indicate the trend’s direction. This indicator is essential for trend analysis, as it helps traders identify strong trends and make informed decisions.

The ADX indicator is a numerical value that ranges from 0 to 100, indicating the strength of a trend with high values representing strong trends and low values reflecting weak or sideways trends. By using the ADX indicator for trend analysis, traders can gain a better understanding of market movements and make more accurate predictions. The ADX indicator is commonly used in combination with other technical indicators, such as the Positive Directional Indicator (+DI) and Negative Directional Indicator (-DI), to provide a comprehensive view of market trends.

Table of Contents

Key Takeaways

- The ADX indicator measures the strength of trends, ranging from 0 to 100.

- A strong trend is identified when the ADX value is above 25.

- The ADX indicator is a lagging indicator, providing signals after the trend has already occurred.

- Combining the ADX indicator with moving averages can help in catching faster break signals.

- Proper risk management and entry and exit strategies are essential when applying the ADX in trading strategies.

- The ADX indicator can be used for trend strength analysis, trend momentum assessment, range trading, and identifying exit points.

- Traders often confirm ADX signals by analyzing price action patterns and combining ADX with other technical indicators.

Understanding the Basics of ADX

To grasp the concept of ADX, it’s essential to understand its components and how it measures trend strength. The ADX, or Average Directional Index, is a non-directional indicator that quantifies trend strength by measuring the degree of directional movement in price. This is achieved through the use of three lines: the ADX line, +DI (positive directional indicator), and -DI (negative directional indicator). These lines work together to provide a comprehensive view of trend strength and direction.

The ADX basics involve understanding that the indicator is used to confirm the strength of a trend, rather than its direction. By analyzing the ADX line, traders can determine whether a trend is strong or weak, and make informed decisions based on this information. The trend strength measurement is a critical component of the ADX, as it helps traders to identify potential trading opportunities and avoid false signals.

What is the ADX Indicator?

The ADX indicator is a powerful tool used to measure trend strength and identify potential trading opportunities. It is commonly used in conjunction with other technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), to provide a comprehensive view of market trends. By understanding the ADX basics and how to use the indicator effectively, traders can improve their trading decisions and increase their chances of success.

Components of ADX

The ADX consists of three main components: the ADX line, +DI, and -DI. The ADX line measures the strength of the trend, while the +DI and -DI lines measure the direction of the trend. By analyzing these components, traders can gain a deeper understanding of market trends and make more informed trading decisions. The use of directional indicators, such as the +DI and -DI, helps to confirm the strength and direction of trends, and can be used to generate trade signals.

How ADX Measures Trend Strength

The ADX measures trend strength by analyzing the degree of directional movement in price. This is achieved through the use of a formula that calculates the difference between the +DI and -DI lines, and then divides this value by the sum of the +DI and -DI lines. The result is a value between 0 and 100, which represents the strength of the trend. By understanding how the ADX measures trend strength, traders can use the indicator to identify potential trading opportunities and avoid false signals.

The History and Development of ADX

The Average Directional Index (ADX) was developed by J Welles Wilder in 1978 as a means to measure the strength of a trend in financial markets. Wilder, a renowned technical analyst, created the ADX as part of his directional movement system, which also includes the positive directional indicator (+DI) and negative directional indicator (-DI). The ADX origin is rooted in Wilder’s work on technical indicator development, aiming to provide traders with a tool to assess the strength of trends.

The ADX was initially designed for use in commodity markets, but its application has since expanded to various financial instruments. The indicator’s ability to gauge trend strength has made it a valuable tool for traders seeking to identify strong trends and potential trading opportunities. As J Welles Wilder’s work on technical indicator development continued to evolve, the ADX became an integral part of many traders’ arsenals, helping them to navigate complex market conditions.

Today, the ADX is widely used in conjunction with other technical indicators to form comprehensive trading strategies. Its ability to provide insight into trend strength has made it a staple in many traders’ toolkits. By understanding the ADX origin and its role in technical indicator development, traders can better appreciate the value of this powerful tool in their trading endeavors.

Some key aspects of the ADX include:

- Measuring trend strength, rather than direction

- Providing a gauge of trend strength, with readings above 25 indicating a strong trend

- Being used in conjunction with other indicators to form trading strategies

The work of J Welles Wilder on the ADX has had a lasting impact on the field oftechnical indicator development, and his legacy continues to influence traders today.

Key Components of the ADX Indicator for Trend Analysis

The ADX indicator is a powerful tool used in technical analysis to measure trend strength and direction. It consists of three main components: the Positive Directional Indicator (+DI), the Negative Directional Indicator (-DI), and the ADX line. Understanding these components is crucial for effective trend analysis.

The ADX calculation involves several steps, including calculating +DM, -DM, TR, smoothed averages, and finally, the ADX value itself. This process helps to identify the strength of a trend, with values above 25 indicating a strong trend and below 20 suggesting no significant trend. The directional indicators, +DI and -DI, provide information on the direction of the trend, while the ADX line measures the strength of the trend.

Positive Directional Indicator (+DI)

The +DI measures the buying pressure and is used to identify uptrends. When the +DI line crosses above the -DI line, it signals a potential buy signal.

Negative Directional Indicator (-DI)

The -DI measures the selling pressure and is used to identify downtrends. When the -DI line crosses above the +DI line, it signals a potential sell signal.

ADX Line Calculation

The ADX line is calculated based on the smoothed averages of the difference between +DI and -DI. It measures the strength of a trend over time, with values above 40 indicating a strong trend. The ADX line is non-directional, providing information on trend strength but not the direction of the trend.

By understanding the key components of the ADX indicator, including the directional indicators and the ADX line calculation, traders can use this tool to identify trend direction and strength, making informed decisions about their trades. The ADX indicator is a valuable tool for trend analysis, and its components work together to provide a comprehensive view of market trends.

| ADX Value | Trend Strength |

|---|---|

| 0-20 | No significant trend |

| 20-25 | Weak trend |

| 25-40 | Strong trend |

| 40-100 | Very strong trend |

Setting Up ADX on Your Trading Platform

To start using the ADX indicator, you need to set it up on your trading platform. The default setting for ADX is typically a 14-period timeframe, but this can be adjusted based on your preferences. You can access the ADX settings through the trading platform configuration menu.

The ADX indicator is a powerful tool for identifying trends, and its technical indicator setup is relatively straightforward. To get the most out of the ADX, it’s essential to understand how to adjust the ADX settings to suit your trading style.

Here are some key points to consider when setting up ADX on your trading platform:

- Choose the right timeframe: The default 14-period timeframe is a good starting point, but you may need to adjust it based on the asset you’re trading and your trading strategy.

- Adjust the ADX settings: You can adjust the ADX settings to suit your trading style, including the period, the +DI and -DI lines, and the ADX line itself.

- Use the ADX with other indicators: The ADX can be used in combination with other indicators, such as the RSI, to provide a more comprehensive view of the market.

By following these steps and adjusting the ADX settings to suit your trading style, you can use the ADX indicator to identify trends and make more informed trading decisions. Remember to always use the ADX in combination with other indicators and to adjust the trading platform configuration as needed to optimize your trading strategy.

| ADX Setting | Description |

|---|---|

| Period | The number of periods used to calculate the ADX |

| +DI | The positive directional indicator line |

| -DI | The negative directional indicator line |

| ADX Line | The average directional index line |

Interpreting ADX Values

ADX interpretation is crucial for understanding trend strength signals in market trend analysis. The ADX value ranges from 0 to 100, with values below 20 indicating a weak trend or no trend, and values above 25 suggesting a strong trend.

When using the ADX indicator, key levels to watch are 20 and 40 for trend strength interpretation. An ADX value below 20 suggests a weak trend, while between 20 and 40 represents a strong trend, and above 40 signifies an extreme trend. The following table summarizes the ADX values and their corresponding trend strengths:

| ADX Value | Trend Strength |

|---|---|

| 0-20 | Weak trend or no trend |

| 20-25 | Trending for less volatile stocks |

| 25-40 | Strong trend |

| 40-60 | Very strong trend |

| 60-100 | Extremely strong trend |

By understanding ADX interpretation and trend strength signals, traders can make informed decisions in their market trend analysis.

Using ADX for Entry Points

When it comes to trend trading strategies, identifying the right entry point is crucial. The Average Directional Index (ADX) can be a valuable tool in this process. By analyzing ADX values, traders can determine the strength of a trend and make informed decisions about when to enter a trade. ADX trade entries are often based on the crossovers of the +DI and -DI lines, combined with ADX values above 25.

A key aspect of using ADX for entry point identification is understanding the different levels of trend strength. An ADX reading above 25 indicates a strong trend, while a reading below 20 suggests a weak or non-trending market. By combining ADX with other technical indicators, traders can develop a comprehensive trend trading strategy that includes effective entry and exit points.

Some tips for using ADX to identify entry points include:

* Looking for ADX crossovers above 25

* Combining ADX with other indicators, such as moving averages or RSI

* Focusing on key ADX levels, such as 20 and 25, to determine trend strength

By following these tips and using ADX as part of a broader trend trading strategy, traders can improve their chances of making successful trades and achieving their investment goals.

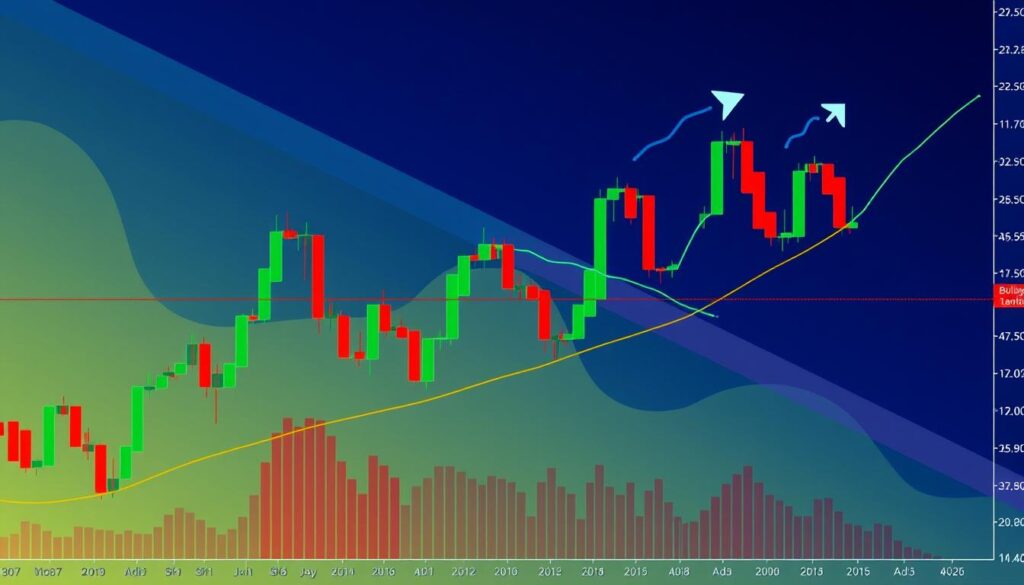

Combining ADX with Other Indicators

To create more robust trading strategies, the ADX can be effectively combined with other technical indicators like moving averages, MACD, and RSI. This multi-indicator approach helps to confirm signals and refine trading strategies, reducing risks and increasing the potential for profitable trades. By incorporating indicator combinations into technical analysis strategies, traders can gain a more comprehensive view of market conditions.

Using a combination of ADX and other indicators can help traders to identify strong trends and make more informed decisions. For example, combining ADX with moving averages can help to identify the direction of the trend, while combining ADX with MACD can help to identify the strength of the trend. The key to successful indicator combinations is to find the right balance between different technical analysis strategies.

ADX and Moving Averages

Combining ADX with moving averages can help to identify the direction of the trend. When the ADX is above 25 and the moving average is sloping upward, it can be a strong indication of an uptrend. Conversely, when the ADX is above 25 and the moving average is sloping downward, it can be a strong indication of a downtrend.

ADX and MACD

Combining ADX with MACD can help to identify the strength of the trend. When the ADX is above 25 and the MACD is above the signal line, it can be a strong indication of a strong uptrend. Conversely, when the ADX is above 25 and the MACD is below the signal line, it can be a strong indication of a strong downtrend.

By using a multi-indicator approach and incorporating different technical analysis strategies, traders can create more effective trading plans and increase their chances of success. Whether using ADX and moving averages, ADX and MACD, or other indicator combinations, the key is to find the right balance and to use the indicators in a way that complements each other.

Advanced ADX Trading Strategies

Advanced traders often utilize advanced trading techniques to refine their market analysis. One such technique involves combining the ADX indicator with other tools to form robust ADX trading systems. By doing so, traders can develop sophisticated trend following strategies that help them navigate complex market conditions.

A key aspect of advanced ADX strategies is understanding how to interpret ADX values. For instance, an ADX value between 25-50 indicates a fairly strong trend, while values above 50 represent a very strong trend. Traders can use these values to confirm breakouts, identify trend exhaustion, or as part of a broader trading system.

Some popular advanced ADX strategies include:

- The Holy Grail trading strategy, which combines ADX with a 14-period moving average

- The ADX and Parabolic SAR strategy, which uses Parabolic SAR to confirm trend direction suggested by ADX crossovers

- The ADX Price Divergence strategy, which looks for situations where ADX values and currency pair prices diverge, indicating potential trend reversals

By incorporating these advanced strategies into their trading arsenal, traders can enhance their market analysis and make more informed decisions. Remember, the key to successful trading lies in combining advanced trading techniques with a deep understanding of market dynamics and a well-thought-out trend following strategy.

| ADX Value Range | Trend Strength |

|---|---|

| 0-25 | Weak trend |

| 25-50 | Fairly strong trend |

| 50-75 | Very strong trend |

| 75-100 | Extremely strong trend |

Common Mistakes When Using ADX

When using the Average Directional Index (ADX), traders often fall into common pitfalls that can lead to trading mistakes. One of the primary ADX pitfalls is misinterpreting signals, which can result in poor timing of entries and exits. This mistake can be attributed to a lack of understanding of the indicator’s limitations.

Some common mistakes include:

- Misinterpreting ADX crossovers as buy or sell signals without considering the overall trend strength

- Ignoring divergences between the ADX and price, which can indicate potential trend reversals

- Over-relying on the ADX without considering other technical and fundamental factors

These mistakes can be avoided by understanding the indicator limitations and using the ADX in conjunction with other tools. By being aware of these common mistakes, traders can refine their ADX usage and improve their overall trading strategy.

By recognizing and avoiding these common ADX pitfalls, traders can develop a more effective trading strategy and minimize trading mistakes. It is essential to understand the ADX indicator limitations and use it in combination with other technical and fundamental analysis tools to make informed trading decisions.

| Mistake | Description |

|---|---|

| Misinterpreting signals | Poor timing of entries and exits due to a lack of understanding of the ADX |

| Ignoring divergences | Failing to recognize potential trend reversals indicated by divergences between the ADX and price |

| Over-reliance on ADX | Using the ADX without considering other technical and fundamental factors |

ADX in Different Market Conditions

The ADX indicator is a powerful tool for analyzing market trends, and its behavior can vary significantly in different market conditions, such as trending markets, ranging markets, and periods of high market volatility. Understanding how the ADX indicator performs in these conditions is crucial for traders to adapt their strategies and make informed decisions.

In trending markets, the ADX indicator can help identify the strength of the trend, with values above 25 indicating a strong trend. For example, when the ADX value exceeds 40, it signals an exceptionally powerful trend, guiding traders to adjust their strategies accordingly. On the other hand, in ranging markets, the ADX indicator can help identify potential breakouts, with values below 25 suggesting a weak or absent trend.

During periods of high market volatility, the ADX indicator can help traders navigate the uncertainty, with high ADX values indicating strong trends and low values indicating weak or absent trends. By combining the ADX indicator with other technical analysis tools, traders can develop effective strategies for trading in different market conditions. For more information on technical analysis and trading strategies, visit this resource to learn about various types of mutual funds and their applications in different market conditions.

Here are some key points to consider when using the ADX indicator in different market conditions:

- ADX values above 25 indicate a strong trend

- ADX values below 25 suggest a weak or absent trend

- High ADX values indicate strong trends, while low values indicate weak or absent trends

- The ADX indicator can help identify potential breakouts in ranging markets

By understanding how the ADX indicator behaves in different market conditions, traders can develop effective strategies for trading in trending markets, ranging markets, and periods of high market volatility. With the right combination of technical analysis tools and a deep understanding of market trends, traders can make informed decisions and achieve their trading goals.

| Market Condition | ADX Indicator Behavior |

|---|---|

| Trending Markets | ADX values above 25 indicate a strong trend |

| Ranging Markets | ADX values below 25 suggest a weak or absent trend |

| High Market Volatility | High ADX values indicate strong trends, while low values indicate weak or absent trends |

Risk Management with ADX

Proper risk management is crucial when using any technical indicator, including ADX. This involves appropriate position sizing, stop loss placement, and profit-taking strategies. By incorporating ADX into your risk management techniques, you can better navigate the markets and minimize potential losses. ADX risk control is essential in today’s volatile markets, where trends can quickly reverse.

Trading risk mitigation is a key aspect of successful trading. With ADX, you can gauge the strength of a trend and make informed decisions about your trades. For example, if the ADX line is above 50, it indicates an extremely trending market, and you may want to adjust your position sizing accordingly. On the other hand, if the ADX line is below 25, it may be a sign of a weak or non-existent trend, and you may want to hold off on opening a new position.

Position Sizing

Position sizing is a critical component of risk management. By using ADX to inform your position sizing decisions, you can minimize your exposure to potential losses. For instance, if the ADX line is rising, it may be a sign of a strengthening trend, and you may want to increase your position size. Conversely, if the ADX line is falling, it may be a sign of a weakening trend, and you may want to decrease your position size.

Stop Loss Placement

Stop loss placement is another essential aspect of risk management. By using ADX to inform your stop loss placement decisions, you can limit your potential losses. For example, if the ADX line is above 20, it may be a sign of a strong trend, and you may want to place your stop loss below the current price. On the other hand, if the ADX line is below 20, it may be a sign of a weak trend, and you may want to place your stop loss closer to the current price.

By incorporating ADX into your risk management techniques, you can develop a more comprehensive trading strategy that takes into account the strength of the trend. This can help you navigate the markets with more confidence and minimize your exposure to potential losses. Remember, risk management is an ongoing process that requires continuous monitoring and adjustment. By using ADX and other risk management techniques, you can stay ahead of the curve and achieve your trading goals.

Real-World ADX Trading Examples

ADX case studies can provide valuable insights into the practical application of the Average Directional Index in real market scenarios. By examining these examples, traders can gain a deeper understanding of how ADX signals play out in different market conditions. Practical trading examples can help traders develop their skills and make more informed decisions.

In real-world trading, ADX is often used in combination with other indicators to confirm trend strength and direction. For instance, a trader might use ADX to identify a strong trend and then use the Relative Strength Index (RSI) to determine if the market is overbought or oversold.

Some key takeaways from ADX case studies include:

- ADX values above 25 indicate a strong trend, while values below 20 indicate a weak trend.

- ADX can be used to identify trend reversals and continuations.

- ADX is suitable for use in various markets, including currency pairs, stocks, and commodities.

By studying thesereal market scenariosand applying the lessons learned, traders can improve their trading skills and increase their chances of success.

Customizing ADX Settings

When it comes to using the ADX indicator, one size does not fit all. Traders can benefit from ADX customization to suit their individual trading needs. The default ADX setting is 14 periods, but this can be adjusted to suit different trading styles and market conditions.

To optimize the ADX indicator, traders can experiment with different timeframes and parameter adjustments. This process of indicator optimization can help traders develop personalized trading settings that work best for them. By adjusting the ADX settings, traders can fine-tune the indicator to suit their specific trading strategy and risk tolerance.

Some traders may prefer a shorter timeframe for more sensitive readings, while others may prefer a longer timeframe for smoother but delayed responses. By experimenting with different ADX customization options, traders can find the perfect balance for their trading needs. With the right indicator optimization and personalized trading settings, traders can unlock the full potential of the ADX indicator and improve their trading results.

Backtesting ADX Strategies

Backtesting ADX strategies involves analyzing how they would have performed on historical data before implementing them in live trading. This process is crucial for developing robust trading strategies. By using historical data analysis, traders can evaluate the effectiveness of their trading system evaluation and make necessary adjustments.

A key aspect of strategy backtesting is to compare the performance of the strategy to benchmarks like return rates, drawdown metrics, win rate percentages, or Sharpe ratios. This helps traders understand how their strategy would have performed in different market conditions. Additionally, running the strategy across different markets, time frames, or historical datasets for out-of-sample testing can provide valuable insights.

Some important considerations for backtesting include:

- Parameter optimization: experimenting with various ADX length values and threshold levels to enhance strategy performance and risk management.

- Out-of-sample testing: running the strategy on different markets, time frames, or historical datasets to ensure its performance is not limited to a specific set of conditions.

- Comparing to benchmarks: evaluating the strategy’s performance against established benchmarks to gauge its effectiveness.

By following these steps and incorporating strategy backtesting, historical data analysis, and trading system evaluation into their workflow, traders can develop more effective trading strategies and improve their overall performance.

| Strategy | Return Rate | Drawdown |

|---|---|---|

| ADX-based strategy | 10% | 5% |

| Benchmark strategy | 8% | 10% |

Troubleshooting ADX Issues

When working with the ADX indicator, traders may encounter ADX problems such as conflicting signals, false positives, or difficulty interpreting ADX in certain market conditions. These technical analysis challenges can be frustrating, but they also present opportunities for growth and improvement in trading skills. To overcome these issues, it’s essential to understand the common indicator troubleshooting techniques and strategies.

Some common issues with ADX include:

- Conflicting signals: When the +DI and -DI lines intersect, it can be challenging to determine the direction of the trend.

- False positives: The ADX can generate false signals, especially in choppy or ranging markets.

- Difficulty interpreting ADX in certain market conditions: The ADX can be sensitive to market volatility, making it challenging to interpret in certain conditions.

To address these ADX problems, traders can use various indicator troubleshooting techniques, such as combining ADX with other indicators, adjusting the ADX settings, or using different time frames. By understanding and addressing these technical analysis challenges, traders can improve their trading skills and make more informed decisions.

By being aware of these potential issues and using the right indicator troubleshooting techniques, traders can overcome ADX problems and improve their overall trading performance. This requires a deep understanding of the ADX indicator and its limitations, as well as the ability to adapt to different market conditions and technical analysis challenges.

Adapting ADX for Different Trading Styles

When it comes to trading, one size does not fit all. Different traders have unique styles and strategies, and the ADX indicator can be adapted to suit various approaches. For day trading with ADX, traders can use the indicator to identify strong trends and potential entry points. By setting the ADX filter to a minimum value of 40, traders can focus on stocks with a strong ADX, increasing the chances of profitable trades.

For swing trading strategies, the ADX can be used to confirm trend strength and identify potential reversals. By monitoring changes in the ADX, traders can gauge trend strength and adjust their strategies accordingly. An increasing ADX indicates growing strength, while a declining ADX signals weakening trend strength.

Traders who prefer long-term trend following can also benefit from using the ADX. By analyzing the ADX on a daily chart with a 14 period smoothing factor, traders can identify strong trends and potential entry points. The ADX can enhance trading strategies by identifying strong trends for potential profitable trades and by steering clear of weak or ranging markets to reduce losses.

Here are some key considerations for adapting ADX to different trading styles:

- Values below 20 indicate a weak trend

- Values between 20 and 40 suggest a strengthening trend

- Values above 40 indicate a strong trend

By understanding how to adapt the ADX for different trading styles, traders can improve their chances of success and make more informed decisions. Whether you’re a day trader, swing trader, or long-term trend follower, the ADX can be a valuable tool in your trading arsenal.

| ADX Value | Trend Strength |

|---|---|

| Below 20 | Weak |

| 20-40 | Strengthening |

| Above 40 | Strong |

Conclusion

The ADX indicator is a powerful tool in the technical analyst’s arsenal, providing valuable insights into the strength and direction of market trends. As we’ve explored throughout this guide, the ADX can be a game-changer when used correctly and in conjunction with other technical and fundamental analysis techniques.

By understanding the nuances of the ADX, traders can better identify strong trends, recognize potential trend reversals, and make more informed trading decisions. Whether you’re a seasoned professional or a newcomer to the markets, mastering the ADX and incorporating it into your overall trading strategy can give you a significant edge.

As you continue your journey in the world of technical analysis, remember to always approach the markets with a balanced and disciplined approach. Utilize the ADX as one of the many tools in your toolkit, but never rely on it as the sole basis for your trading decisions. By combining the ADX with other indicators, risk management practices, and a deep understanding of market dynamics, you can unlock the full potential of this powerful trend analysis indicator.

FAQ

What is the ADX indicator?

The ADX (Average Directional Index) is a technical analysis indicator that measures the strength of a trend, regardless of its direction. It is a valuable tool for traders to identify and evaluate the strength of market trends.

What are the components of the ADX indicator?

The ADX indicator consists of three main components: the Positive Directional Indicator (+DI), the Negative Directional Indicator (-DI), and the ADX line itself, which represents the overall trend strength.

How does the ADX measure trend strength?

The ADX line measures the overall trend strength, with values ranging from 0 to 100. A reading above 25 generally indicates a strong trend, while a reading below 20 suggests a weak or nonexistent trend.

Who developed the ADX indicator?

The ADX indicator was developed by J. Welles Wilder, a renowned technical analyst and author of the book “New Concepts in Technical Trading Systems.” Wilder initially created the ADX for the commodity futures market, but it has since become a widely used indicator across various financial instruments.

How can I set up the ADX indicator on my trading platform?

Most trading platforms provide the ability to add the ADX indicator to your charts. You can typically find it under the “Indicators” or “Technical Studies” section of your platform’s menu. You can also customize the ADX settings, such as the default 14-period calculation, to suit your trading style and preferences.

How do I interpret ADX values?

ADX values below 20 generally indicate a weak or nonexistent trend, values between 20 and 25 suggest a moderately strong trend, and values above 25 indicate a strong trend. Traders can use these levels to identify suitable entry and exit points for their trades.

How can I use the ADX indicator for trade entries?

The ADX can be used to identify potential entry points by looking for crossovers between the +DI and -DI lines, or by waiting for the ADX line to cross above 25, indicating the start of a strong trend. Traders can then use other technical indicators or price action to confirm the entry signals.

Can I combine the ADX with other technical indicators?

Yes, the ADX can be effectively combined with other technical indicators, such as moving averages, MACD, and RSI, to create more comprehensive trading strategies. This can help traders confirm trend signals and improve their overall market analysis.

What are some common mistakes when using the ADX indicator?

Some common mistakes include misinterpreting ADX signals, timing entry and exit points incorrectly, and over-relying on the ADX as a standalone indicator. It’s important to use the ADX in conjunction with other technical analysis tools and to always consider the broader market context.

How can I adapt the ADX for different trading styles and timeframes?

The ADX can be used effectively across various trading styles and timeframes. Day traders may focus on shorter-term ADX signals, while swing traders and long-term investors can use the ADX to identify more significant trends. Adjusting the ADX parameters and combining it with other indicators can help tailor its usage to individual trading approaches.