Support and resistance levels are essential concepts in technical analysis, helping traders identify potential trade entry points and make informed decisions. These levels are determined by the interaction of supply and demand in the market, with support levels indicating where buyers are more likely to enter the market and resistance levels indicating where sellers are more likely to enter. Understanding support and resistance levels is crucial for successful trading, as they can help traders set targets and exit points for their trades, manage risk, and determine market conditions.

Price action plays a significant role in identifying support and resistance levels, as it helps traders understand the behavior of the market and make predictions about future price movements. By analyzing price action, traders can identify areas of support and resistance, which can be used to inform their trading decisions. Technical analysis, including the use of support and resistance levels, is a widely used approach in the trading industry, and mastering it can help traders improve their performance.

Table of Contents

Key Takeaways

- Support and resistance levels are critical concepts in technical analysis

- These levels are determined by the interaction of supply and demand in the market

- Price action is essential in identifying support and resistance levels

- Technical analysis, including support and resistance levels, can help traders improve their performance

- Mastering support and resistance levels is crucial for successful trading

- Support and resistance levels can help traders set targets and exit points for their trades

- Understanding support and resistance levels can aid in risk management and determining market conditions

Understanding Support and Resistance Fundamentals

Support and resistance levels are crucial in determining market psychology and supply and demand forces. These price barriers play a significant role in shaping the behavior of market participants. Market analysis often involves identifying these levels to make informed trading decisions.

Support is the level where demand halts the stock from falling further, indicating increased buying inclination. On the other hand, resistance is where supply stops the stock from increasing, showing heightened selling inclination. The interplay between these two forces creates a dynamic that influences market psychology and ultimately affects price movements.

Market participants create demand at support levels and potential demand at resistance levels based on their buying and selling decisions. This collective behavior contributes to the formation of price barriers, which can be used to predict potential price movements. Understanding these concepts is essential for traders to make informed decisions and navigate the markets effectively.

The following are key points to consider when analyzing support and resistance levels:

- Support and resistance levels are essential in trading, with resistance being a price level on a chart that signifies a high probability area where sellers are located.

- Historical price data analysis helps identify crucial support and resistance levels, utilizing past swing highs and lows, closing prices, and psychological levels like round numbers.

- Market sentiment plays a significant role in establishing support and resistance levels.

The Importance of Price Action in Market Analysis

Price action analysis is a crucial aspect of understanding market trends and making informed trading decisions. By examining the movement of prices over time, traders can identify patterns and trends that can help them anticipate future market dynamics. This approach to trading is based solely on the movement of prices, without relying on indicators, emphasizing clarity and immediacy of data.

Technical traders use price action to gather insight into the price movement of a security. This includes identifying price trends, reading chart patterns and candlestick patterns, and establishing a system for market entries and exits. The simplicity, flexibility, and adaptability of price action trading make it applicable across various markets and timeframes. Some key benefits of price action analysis include:

- Enhanced decision-making by utilizing historical price movements to inform trading decisions

- A clearer, direct view of the market at any given moment

- The ability to identify potential support and resistance levels

Incorporating price action into trading strategies can help traders better understand market trends and make more informed trading decisions. As the Securities and Exchange Commission (SEC) noted, the use of algorithms in trading is pervasive, and price action is a key component of this approach. By leveraging price action analysis, traders can gain a competitive edge in the market and improve their overall trading performance.

Types of Support and Resistance Levels

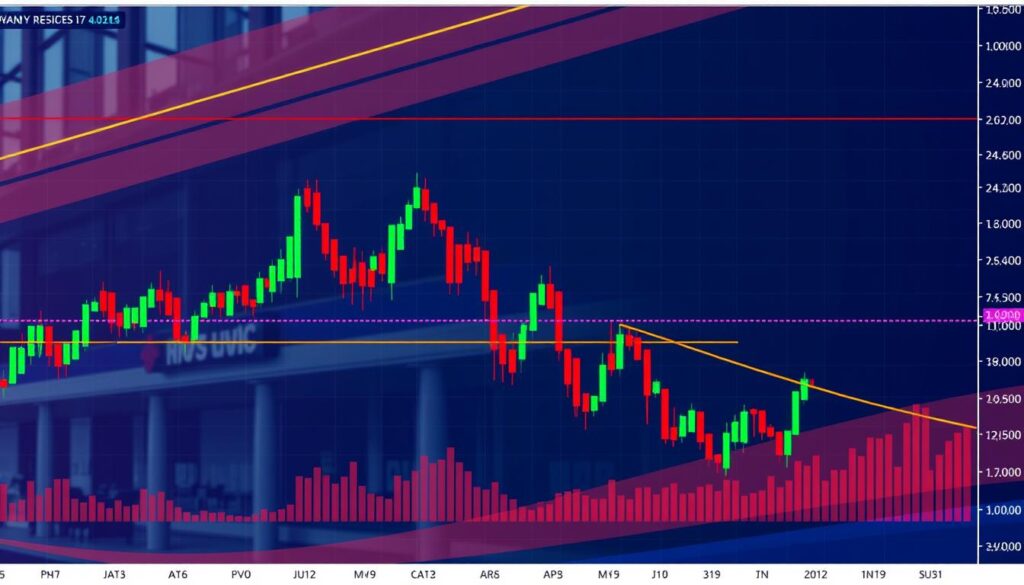

Support and resistance levels are crucial in trading, as they help identify price points where the trend may pause or reverse. There are several types of support and resistance levels, including horizontal, diagonal, and dynamic levels. Understanding these levels can help traders make informed decisions and increase their chances of success.

Horizontal Levels

Horizontal levels are areas where the price has previously reversed or consolidated, creating a level of support or resistance. These levels can be identified by drawing a horizontal line across the chart, connecting the highs or lows of previous price movements.

Diagonal Levels

Diagonal levels, also known as trendlines, are lines that connect a series of highs or lows, creating a diagonal line on the chart. These lines can help identify the overall trend and provide areas of support or resistance. Diagonal trendlines can be used to identify potential areas of support or resistance, and can be combined with other forms of analysis to increase their effectiveness.

Dynamic Levels

Dynamic levels, such as moving averages, are levels that change over time, providing a more fluid and adaptive form of support or resistance. These levels can be used to identify trends and provide areas of support or resistance, and can be combined with other forms of analysis to increase their effectiveness.

| Type of Level | Description |

|---|---|

| Horizontal | Areas where the price has previously reversed or consolidated |

| Diagonal | Lines that connect a series of highs or lows, creating a diagonal line on the chart |

| Dynamic | Levels that change over time, providing a more fluid and adaptive form of support or resistance |

By understanding the different types of support and resistance levels, including horizontal support resistance, diagonal trendlines, and dynamic levels, traders can increase their chances of success and make more informed decisions in the market.

How to Identify Support and Resistance Levels Using Historical Data

Historical price data is a crucial component in identifying support and resistance levels. By analyzing past price movements, traders can gain valuable insights into potential future price actions. Chart analysis plays a significant role in this process, as it helps traders visualize and identify key levels that have acted as support or resistance in the past.

One of the primary techniques used in historical analysis is identifying key levels that have consistently acted as support or resistance. These levels can be identified by looking for areas where the price has repeatedly bounced off or broken through. Traders can use various tools, such as trend lines, moving averages, and psychological levels, to help identify these key levels.

Some key points to consider when using historical price data to identify support and resistance levels include:

- Looking for areas of high volume and volatility, as these can indicate significant support or resistance levels

- Identifying round numbers and moving averages that can act as psychological levels of support and resistance

- Using multiple timeframes to confirm key levels and identify potential trading opportunities

By incorporating historical price data and chart analysis into their trading strategy, traders can improve their ability to identify support and resistance levels and make more informed trading decisions. Identifying key levels is a critical component of this process, as it allows traders to focus on the most significant areas of support and resistance and adjust their strategy accordingly.

Technical Indicators for Finding Support and Resistance

Technical indicators play a crucial role in identifying support and resistance levels. These indicators can be used to confirm the strength of a trend and predict potential reversals. Some of the most commonly used technical indicators for finding support and resistance include moving averages, Fibonacci retracement, and pivot points.

When using technical indicators, it’s essential to understand how they work and how to apply them to your trading strategy. Moving averages can act as dynamic support and resistance levels, while Fibonacci retracement levels can help identify areas of potential support and resistance. Pivot points can also be used to predict potential support and resistance levels.

Key Technical Indicators

- Moving Averages: used to identify trends and act as dynamic support and resistance levels

- Fibonacci Retracement: used to identify areas of potential support and resistance, including levels such as 23.6%, 38.2%, 50%, 61.8%, and 78.6%

- Pivot Points: used to predict potential support and resistance levels, including Camarilla Pivots and Murrey Math Lines

By combining these technical indicators with other forms of analysis, such as price action and market sentiment, traders can gain a more comprehensive understanding of the markets and make more informed trading decisions. Remember to always use technical indicators in conjunction with other forms of analysis to confirm the strength of a trend and predict potential reversals.

Reading Price Action at Key Levels

When it comes to making informed trading decisions, understanding price action signals is crucial. By analyzing market behavior at support and resistance levels, traders can identify potential opportunities for profit. The demand curve, for instance, is inversely related to price – as price increases, the number of units desired decreases. This fundamental principle can help traders anticipate price action signals and make more accurate trading decisions.

Some key factors to consider when reading price action at key levels include:

- Volume analysis: High-volume nodes can indicate areas of strong interest in buying or selling assets.

- Trend lines and trend channels: These visual tools can help identify dynamic key levels based on market trajectory and trend directions.

- Pivot points: Calculated from the previous day’s high, low, and close, pivot points can help determine intraday key levels for day and scalp traders.

By considering these factors and understanding market behavior, traders can develop a more comprehensive approach to reading price action signals at key levels. This, in turn, can inform more effective trading decisions and ultimately drive better outcomes in the market.

Multiple Timeframe Analysis Techniques

When it comes to trading, analyzing support and resistance across multiple timeframes is crucial for making informed decisions. This approach, known as multiple timeframe analysis, involves combining different trading timeframes to enhance decision-making and chart analyses. By using this technique, traders can identify key levels of support and resistance in the market context, increasing the probability of successful trades.

In the context of trading timeframes, traders typically use one higher timeframe and one lower timeframe for analysis. For example, a trader may use a daily chart as the higher timeframe and a 1-hour chart as the lower timeframe. This combination allows traders to identify the overall trend direction and then zoom in on specific entry and exit points. By considering multiple timeframes, traders can better understand the market context and make more accurate predictions.

Some common timeframe combinations include:

- Weekly with daily or 4-hour for swing trading

- Daily with 1-hour for shorter-term swing trading

- Daily with 30-minute or 15-minute for intra-day trading

It’s essential to choose two timeframes to use consistently for trading to improve consistency in the approach. By doing so, traders can develop a deeper understanding of the market context and make more informed decisions.

By applying multiple timeframe analysis techniques, traders can improve the quality of their signal generation and benefit from short-term momentum aligned with the higher timeframe bias. This approach can also help traders reduce holding periods and effectively time entries and exits based on higher timeframe signals. Ultimately, using multiple timeframe analysis can increase the odds of success for a trade and provide a more comprehensive understanding of the market context.

Common Patterns at Support and Resistance Zones

When analyzing support and resistance zones, traders often look for specific chart patterns that can indicate potential reversals or continuations. These patterns can be categorized into reversal patterns and continuation patterns. Reversal patterns, such as double tops and bottoms, head and shoulders, and inverse head and shoulders, can signal a change in market direction. On the other hand, continuation patterns, including flags and pennants, indicate a pause in the current trend before it resumes.

Some common chart patterns that form at support and resistance zones include:

- Double tops and bottoms: these patterns form when the price touches a support or resistance level twice, indicating a potential reversal.

- Head and shoulders: this pattern forms when the price creates a higher high, followed by a lower high, and then a higher low, indicating a potential reversal.

- Flags and pennants: these patterns form when the price consolidates after a strong move, indicating a potential continuation.

Traders should also be aware of reversal patterns and continuation patterns that can form at support and resistance zones. By recognizing these patterns, traders can make more informed decisions about their trades. It’s also important to note that these patterns don’t always result in perfect reversals or continuations, and traders should always manage their risk when trading based on these formations.

In addition to recognizing these patterns, traders should also consider the concept of “imperfect” patterns, where slight deviations from textbook examples can still provide valuable trading opportunities. By combining the analysis of chart patterns, reversal patterns, and continuation patterns, traders can gain a deeper understanding of the markets and make more effective trading decisions.

Trading Breakouts and Breakdowns

Breakout trading involves taking a position within a trend’s early stages, leading to major price moves and expansions in volatility with limited downside risk when managed properly. A breakout is not just a slight movement beyond the support or resistance levels, but a sudden and rapid movement with increased momentum, creating opportunities for profit.

To identify valid breakouts, traders look for increased volume and momentum, confirming a true breakout. However, false breakouts, also known as fakeouts, can be deceptive. Strategies for managing these include waiting for confirmation and using stop-loss orders to limit losses.

Entry and Exit Strategies

Entry points for breakouts should be established when prices close above resistance levels for bullish positions or below support levels for bearish positions. Predetermined exit strategies are essential, including setting profit targets based on recent price behavior and determining stop-loss levels based on old support/resistance levels.

Breakout trading requires patience and a well-defined trading plan to manage volatility effectively, offering the potential for significant returns while keeping risks manageable. By understanding how to trade breakouts and breakdowns, traders can improve their chances of success in the markets.

Using Volume to Confirm Support and Resistance

Volume analysis is a crucial aspect of confirming support and resistance levels in trading. By examining the trading volume at key levels, traders can gauge the significance of these levels and their potential for holding. Increased trading volume at support or resistance levels can indicate their strength, while low volume may suggest weakness and a higher likelihood of a breakout.

Traders can use volume indicators like On-Balance Volume (OBV) and Volume Profile to interpret volume bars and make informed decisions. Volume Profile helps identify areas of high and low trading activity, which can be used to determine support and resistance levels. For instance, a high volume node (HVN) within the Value Area can indicate a significant price level, while a low volume node (LVN) can signal a potential breakout or breakdown point.

Some key points to consider when using volume to confirm support and resistance include:

- High volume at support or resistance levels can indicate strength

- Low volume at these levels may suggest weakness and a higher likelihood of a breakout

- Volume indicators like OBV and Volume Profile can help interpret volume bars

- Volume Profile can identify areas of high and low trading activity, which can be used to determine support and resistance levels

By incorporating volume analysis into their trading strategy, traders can gain a better understanding of market dynamics and make more informed decisions. Price level confirmation using volume analysis can help traders distinguish between true breakouts and false moves, ultimately leading to more successful trades.

Risk Management at Key Levels

Effective risk management is crucial when trading support and resistance levels. This involves setting stop loss orders, determining position sizing, and evaluating risk-reward ratios. By placing stops and limits below support and above resistance, traders can quickly close a position if the price breaks through these levels.

Stop loss placement is a critical aspect of risk management. It’s essential to set stop-loss points that are not too close to the current price, as this can result in unnecessary executions. A common rule of thumb is to set stop-loss points at a distance of at least 1.5 times the current high-to-low range. This helps to avoid unnecessary executions and ensures that the stop loss is not triggered by minor price fluctuations.

Position Sizing Strategies

Position sizing is another vital aspect of risk management. This involves calculating the optimal position size based on the trader’s account risk and stop loss distance. The one-percent rule is a popular strategy, which suggests that traders should not put more than 1% of their capital into a single trade. This helps to manage risk and avoid significant losses.

The following table illustrates the importance of position sizing and risk-reward ratios:

| Position Size | Stop Loss Distance | Risk-Reward Ratio |

|---|---|---|

| 1% | 1.5 times high-to-low range | 1:2 |

| 2% | 2 times high-to-low range | 1:3 |

By using these strategies, traders can effectively manage their risk and increase their potential for profit. Remember, risk management is an ongoing process that requires continuous monitoring and adjustment. By staying disciplined and focused, traders can navigate the markets with confidence and achieve their goals.

Real-World Examples of Support and Resistance Trading

Support and resistance levels are crucial in market analysis, as they help traders identify potential entry and exit points. In trading examples, we can see how these levels play out in actual trading scenarios. For instance, the 200-day moving average is considered a strong support or resistance level, with prices often respecting these levels even after breaching them.

A key concept in practical application is the role reversal that occurs when an asset breaks through a support or resistance level. This can be seen in real-world examples from market charts, such as ExxonMobil, Walmart, and the Dow Jones Industrial Average. In these cases, the previous level often transforms into a new area of short-term resistance or support, affecting market trends.

Some notable examples include:

- The DJIA experienced a 5% decline after its support level turned into resistance in 2006.

- ExxonMobil’s $65 resistance level transformed into a support level, indicating potential market shifts.

- Walmart’s chart illustrates a support/resistance level changing its role, showcasing how technical traders monitor critical price levels affecting long-term stock price direction.

Understanding support and resistance levels is essential for managing risk and making informed trading decisions. By analyzing trading examples and applying market analysis techniques, traders can develop a practical application of these concepts to improve their trading strategies.

| Company | Support/Resistance Level | Outcome |

|---|---|---|

| ExxonMobil | $65 | Transformed into a support level |

| Walmart | Variable | Illustrates a support/resistance level changing its role |

| DJIA | 2006 support level | Transformed into resistance, leading to a 5% decline |

Common Mistakes to Avoid When Trading Key Levels

When trading support and resistance levels, it’s essential to be aware of common mistakes that can lead to significant losses. One of the primary trading mistakes is overtrading at these levels, which can result from the excitement of potential reversals. This can lead to excessive risk-taking, negatively impacting overall trading performance.

Another critical aspect to consider is the market context. Ignoring factors like the overall trend and market sentiment can lead to poor trading decisions. For instance, if the market is trending upwards, it might be more challenging to find support levels that hold. Understanding the market context can help traders make more informed decisions and avoid common risk management errors.

Risk management errors, such as setting stops too tight or too loose, can also significantly impact trading outcomes. Failing to adjust position sizes appropriately can lead to overexposure to potential losses. To avoid these mistakes, traders should focus on developing a solid risk management strategy that takes into account the market context and potential trading mistakes.

- Overtrading at support and resistance levels

- Ignoring the broader market context

- Poor risk management, including inadequate stop placement and position sizing

By being aware of these common mistakes and taking steps to avoid them, traders can improve their overall performance and make more informed decisions when trading key levels.

| Mistake | Impact | Strategy to Avoid |

|---|---|---|

| Overtrading | Excessive risk-taking | Set clear trading goals and stick to the plan |

| Ignoring market context | Poor trading decisions | Consider overall trend and market sentiment |

| Poor risk management | Significant losses | Develop a solid risk management strategy |

Conclusion

As we conclude this exploration of support and resistance analysis, it’s important to remember that these trading concepts are powerful tools, but just one piece of a comprehensive market strategy. Truly mastering support and resistance trading requires ongoing practice, adaptation, and a commitment to continuous learning.

The ability to accurately identify key support and resistance levels is a core skill for any successful trader. By understanding the psychology behind these price barriers and honing your market analysis skills, you can better navigate the ever-changing financial landscape and make more informed trading decisions. However, don’t rely on these techniques alone – be sure to combine them with robust risk management, effective trade execution, and a deep understanding of your chosen markets.

To further develop your support and resistance trading expertise, we encourage you to explore additional resources, such as recommended books, online courses, and practice platforms. Continuous learning and adaptation will be crucial as you apply these principles to your own trading journey. With dedication and a growth mindset, you can unlock the full potential of support and resistance analysis and take your trading performance to new heights.

FAQ

What are support and resistance levels in trading?

Support and resistance levels are price points where the market is expected to have difficulty moving lower (support) or higher (resistance). They form the basis for many trading strategies and are crucial for identifying potential market trends and opportunities.

How do support and resistance levels relate to price action?

Price action serves as a visual representation of market psychology and supply-demand dynamics. Analyzing price movements, candlestick patterns, and chart formations can help traders identify potential support and resistance levels, which in turn can be used to predict future market trends.

What are the different types of support and resistance levels?

The main types of support and resistance levels include horizontal levels, diagonal levels (trendlines), and dynamic levels (based on moving averages or other technical indicators). Each type has its own characteristics and offers different insights into market behavior.

How can historical data be used to identify support and resistance levels?

Analyzing past price movements and identifying recurring price levels that have acted as support or resistance in the past can help traders spot key levels that are likely to be significant in the future. This concept of “market memory” is crucial for predicting potential price movements.

What technical indicators can be used to identify support and resistance levels?

Common technical indicators used to identify support and resistance levels include moving averages, Fibonacci retracement levels, and pivot points. These indicators can provide dynamic levels that change over time, giving traders additional insights into potential price barriers.

How can traders interpret price action at support and resistance levels?

Specific candlestick patterns and volume analysis at support and resistance levels can signal potential reversals or continuations of trends. Traders can use this information to make more informed trading decisions and manage their risk effectively.

Why is it important to analyze support and resistance across multiple timeframes?

Aligning support and resistance levels across different timeframes, such as short-term and long-term charts, can provide a more comprehensive understanding of the market’s overall direction and help traders identify precise entry and exit points for their trades.

What are some common chart patterns that form at support and resistance zones?

Traders often look for reversal patterns like double tops/bottoms and head and shoulders, as well as continuation patterns like flags and pennants, as they can signal potential price movements at key support and resistance levels.

How can traders effectively trade breakouts and breakdowns from support and resistance levels?

Identifying valid breakouts, managing the risk of false breakouts, and using strategies like setting stop-loss orders and take-profit levels are crucial for trading breakouts and breakdowns successfully while controlling risk.

What is the role of volume in confirming support and resistance levels?

Increased trading volume at key support and resistance levels can indicate their significance and potential for holding, while low volume may suggest weakness and a higher likelihood of a breakout. Volume analysis can help traders distinguish between true breakouts and false moves.

How can traders effectively manage risk when trading support and resistance levels?

Optimal stop-loss placement, appropriate position sizing based on account risk, and maintaining a favorable risk-reward ratio are essential for managing risk when trading support and resistance levels. Avoiding common psychological pitfalls is also crucial for successful trading.