The MACD indicator is a powerful tool used in stock trading to identify trends and predict future price movements. It is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders use the MACD indicator to identify entry and exit points for trades, making it a popular tool among technical analysts. The MACD indicator is used in conjunction with technical analysis to provide a comprehensive view of the market.

In stock trading, the MACD indicator is used to generate trade signals based on overbought/oversold conditions. The default settings for MACD are 26/12/9 days for daily periods, and traders use the MACD histogram to identify peaks of bullish or bearish momentum. The MACD formula involves subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA, providing a clear picture of the market trend.

The MACD indicator is a valuable tool for traders, providing insights into the market trend and helping to identify potential buy and sell signals. By using the MACD indicator in conjunction with other technical analysis tools, traders can make informed decisions and maximize their profits. In the world of stock trading, the MACD indicator is a widely used and respected tool, and its effectiveness has been proven time and time again.

Table of Contents

Key Takeaways

- The MACD indicator is a trend-following momentum indicator used in stock trading.

- The default settings for MACD are 26/12/9 days for daily periods.

- Traders use the MACD histogram to identify peaks of bullish or bearish momentum.

- The MACD indicator is used in conjunction with technical analysis to provide a comprehensive view of the market.

- The MACD indicator helps traders identify entry and exit points for trades.

- The MACD indicator is a valuable tool for traders, providing insights into the market trend and helping to identify potential buy and sell signals.

Understanding the Basics of MACD Indicator in Stock Trading

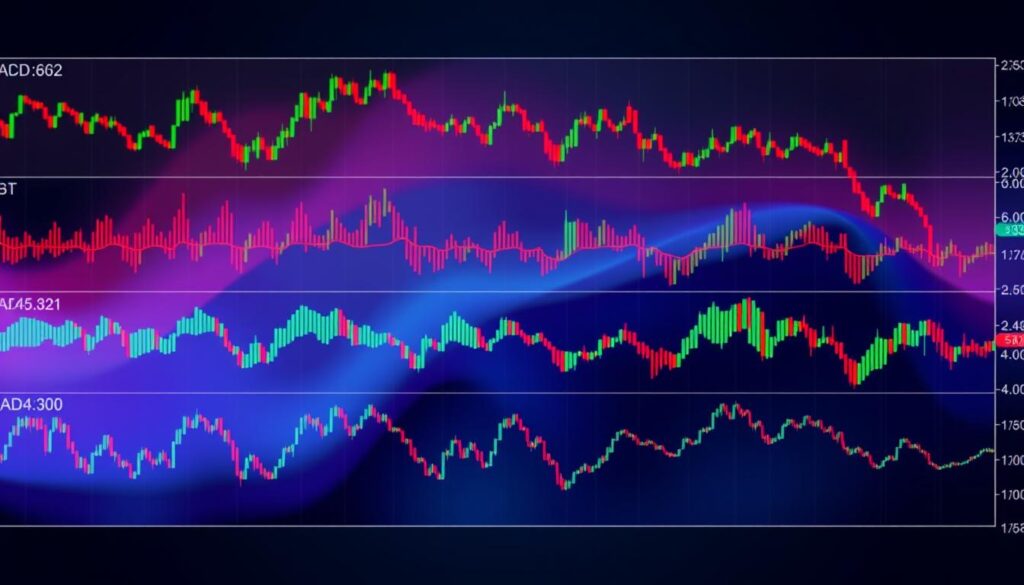

The MACD indicator is a powerful tool used in stock trading to identify trends and predict future price movements. To understand how it works, let’s break down the MACD basics. The MACD line is calculated by subtracting the 26-period exponential moving averages (EMA) from the 12-period EMA. This calculation helps in trend identification, which is a crucial aspect of stock trading.

The MACD indicator consists of multiple components, including the MACD line, signal line, and histogram. The signal line is a 9-day EMA of the MACD line, which acts as a trigger for buy or sell signals. The histogram represents the difference between the MACD and the signal line, providing a visual representation of the trend. By using exponential moving averages, traders can identify trends and make informed decisions.

Key Components of MACD

- MACD Line: calculated as the difference between the 12-day and 26-day EMAs

- Signal Line: a 9-day EMA of the MACD line

- Histogram: represents the difference between the MACD and the signal line

Traders use the MACD indicator for trend identification, as it provides a clear visual representation of the trend. By combining the MACD with other technical indicators, traders can make more accurate predictions and minimize risks. The MACD basics, including exponential moving averages, are essential for understanding how the indicator works and how to use it effectively in stock trading.

| Component | Description |

|---|---|

| MACD Line | Calculated as the difference between the 12-day and 26-day EMAs |

| Signal Line | A 9-day EMA of the MACD line |

| Histogram | Represents the difference between the MACD and the signal line |

The History and Development of MACD

The MACD indicator has a rich history, dating back to the late 1970s when it was developed by Gerald Appel. As a technical indicator evolution, the MACD was designed to reveal changes in the strength, direction, momentum, and duration of a trend in a stock’s price. The MACD origin is rooted in the concept of moving averages, and Appel’s innovation was to create an indicator that could capture the convergence and divergence of these averages.

The MACD indicator consists of three time series calculated from historical price data, including the MACD series proper, the signal series, and the divergence series. Commonly used time parameters for the MACD indicator are 12, 26, and 9 days, denoted as MACD(12,26,9). This indicator is considered a lagging indicator, less useful for stocks that are not trending or have unpredictable price action.

In trading interpretation, traders look for signals like signal-line crossovers (bullish or bearish) and zero crossovers to make buying or selling decisions. The MACD is calculated by subtracting the 26-day Exponential Moving Average (EMA) from the 12-day EMA. The MACD indicator has basic components that include the MACD line (difference between 12 and 26 day EMAs), the signal line (9 day EMA of the MACD line), and the histogram (difference between the MACD and signal line). As Gerald Appel noted, the MACD indicator is a powerful tool for traders, and its technical indicator evolution has made it a staple in the trading community.

| Indicator | Time Parameters | Description |

|---|---|---|

| MACD | 12, 26, 9 days | Reveals changes in strength, direction, momentum, and duration of a trend |

| Signal Line | 9 days | Identifies shifts in momentum |

| Histogram | MACD – Signal Line | Anticipates changes in trend |

The MACD indicator has undergone significant technical indicator evolution since its inception, with additions such as the histogram by Thomas Aspray in 1986. Today, the MACD remains a widely used and respected indicator in the trading community, thanks to its ability to provide insights into the MACD origin and behavior of stock prices. As traders continue to seek effective tools for navigating the markets, the MACD indicator remains a vital component of many trading strategies, and its Gerald Appel legacy continues to inspire innovation in the field of technical analysis.

Essential Components of MACD Analysis

The MACD indicator consists of three main components: the MACD line, the signal line, and the histogram. Understanding these components is crucial for effective MACD analysis. The MACD line is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This line is a key component of the MACD indicator and is used to identify trends and predict future price movements.

The signal line is a 9-period EMA of the MACD line and acts as a trigger for buy and sell signals. Signal line crossovers are an important aspect of MACD analysis, as they can indicate a change in trend. The histogram represents the difference between the MACD line and the signal line, providing a visual representation of the strength of momentum.

Effective histogram interpretation is critical for identifying trends and making informed trading decisions. By analyzing the MACD components, including the MACD line, signal line, and histogram, traders can gain valuable insights into market trends and make more accurate predictions. MACD components work together to provide a comprehensive view of market trends, making them a powerful tool for traders.

| Component | Description |

|---|---|

| MACD Line | Calculated by subtracting the 26-period EMA from the 12-period EMA |

| Signal Line | A 9-period EMA of the MACD line |

| Histogram | Represents the difference between the MACD line and the signal line |

Setting Up MACD on Your Trading Platform

When it comes to setting up MACD on your trading platform, it’s essential to understand that the default MACD settings may not be suitable for every trader. Many professional traders find the standard settings (12, 26, and 9) to be too slow, causing late entry and exit to and from a trade. This is where customizing MACD comes into play.

To get the most out of your trading software, you may want to experiment with different MACD settings and see how well they perform on a demo account. This will help you find the perfect balance between sensitivity and reliability. Some traders prefer to use shorter EMAs for faster markets, while others opt for longer EMAs in slower markets.

Here are some tips to keep in mind when customizing MACD:

* Use shorter EMAs for fast-moving markets

* Use longer EMAs for slow-moving markets

* Adjust the signal line to suit your trading style

* Backtest different MACD settings on historical data to find the best approach for your strategy

By taking the time to customize MACD and find the right MACD settings for your trading style, you can improve your chances of success in the markets. Remember to always use a trading software that allows you to easily adjust and customize your indicators.

Reading MACD Signals Effectively

When it comes to MACD signal interpretation, understanding the different types of signals is crucial. The MACD indicator is a powerful tool that can help traders identify emerging trends and potential buy and sell opportunities in the stock market.

Traders may buy the security when the MACD line crosses above the signal line and sell—or short—the security when the MACD line crosses below the signal line. This is known as a bullish crossover and bearish crossover, respectively.

Bullish Signals

Bullish crossovers occur when the MACD line crosses above the Signal line, indicating a potential buy signal. This can be a sign of a new uptrend, and traders may consider buying the security.

Bearish Signals

Bearish crossovers happen when the MACD line crosses below the Signal line, suggesting a potential sell signal. This can be a sign of a new downtrend, and traders may consider selling the security.

Neutral Patterns

Neutral patterns occur when the MACD line and the Signal line are moving together, without any crossovers. This can be a sign of a stable trend, and traders may consider holding their positions.

It’s also important to look out for bearish divergence, which can indicate a potential trend reversal. By understanding these different types of signals, traders can use the MACD indicator to make more informed trading decisions.

| Signal | Description |

|---|---|

| Bullish Crossover | MACD line crosses above the Signal line, indicating a potential buy signal |

| Bearish Crossover | MACD line crosses below the Signal line, indicating a potential sell signal |

| Bearish Divergence | MACD line and price are moving in opposite directions, indicating a potential trend reversal |

By mastering MACD signal interpretation, traders can gain a valuable edge in the market and make more informed trading decisions.

Common MACD Trading Strategies

MACD trading techniques are widely used by traders to identify trends and make informed decisions. One popular strategy is trend following, which involves using the MACD indicator to identify the direction of the trend and then following it. Another strategy is momentum trading, which involves using the MACD indicator to identify changes in momentum and then making trades based on those changes.

Some common MACD trading strategies include the histogram, the crossover, the zero-cross, the money flow index, and the relative vigor index. The MACD histogram is a visual representation of the difference between the MACD line and the signal line, and it can be used to identify trends and predict future price movements. The crossover strategy involves entering a trade when the MACD line crosses above or below the signal line.

Here are some key MACD trading strategies:

- Crossovers: This strategy involves entering a trade when the MACD line crosses above or below the signal line.

- Histogram reversals: This strategy involves entering a trade when the MACD histogram changes direction.

- Zero crosses: This strategy involves entering a trade when the MACD line crosses above or below the zero line.

Traders can use these strategies in conjunction with other technical indicators, such as the relative strength index (RSI), to confirm trade signals and improve their overall trading performance. By using MACD trading techniques, such as trend following and momentum trading, traders can make more informed decisions and increase their chances of success in the markets.

| Strategy | Description |

|---|---|

| Crossovers | Enter a trade when the MACD line crosses above or below the signal line. |

| Histogram reversals | Enter a trade when the MACD histogram changes direction. |

| Zero crosses | Enter a trade when the MACD line crosses above or below the zero line. |

MACD Crossover Techniques

MACD crossovers are a crucial aspect of trading signals, providing insights into potential trend reversals. A bullish signal occurs when the MACD line crosses above the signal line, suggesting upward momentum. Conversely, a bearish signal occurs when the MACD line falls below the signal line, indicating downward momentum.

There are two main types of MACD crossovers: bullish and bearish crossovers. These crossovers can be used to generate trading signals, helping traders make informed decisions. By understanding MACD crossovers, traders can identify potential trend reversals and adjust their strategies accordingly.

Signal Line Crossovers

Signal line crossovers occur when the MACD line crosses above or below the signal line. This type of crossover is often used to generate buy and sell signals. A bullish crossover can be a sign of increasing upward momentum, while a bearish crossover can indicate decreasing downward momentum.

Zero Line Crossovers

Zero line crossovers occur when the MACD line crosses above or below the zero line. This type of crossover can be used to identify potential trend reversals. When the MACD line crosses above the zero line, it can be a sign of increasing upward momentum, while a cross below the zero line can indicate decreasing downward momentum.

By understanding MACD crossovers and their relationship to trading signals and trend reversals, traders can refine their strategies and make more informed decisions. It is essential to combine MACD crossovers with other technical indicators to increase accuracy and minimize false signals.

| Type of Crossover | Signal | Momentum |

|---|---|---|

| Bullish | Buy | Upward |

| Bearish | Sell | Downward |

Combining MACD with Other Technical Indicators

Traders often use the MACD and relative strength index (RSI) indicator strategy to their advantage. This approach allows them to utilize both the RSI and the simple moving average (SMA) to make informed trading decisions. By combining MACD with other technical indicators, such as moving averages and RSI, traders can create more robust trading strategies.

One of the key benefits of using indicator combinations is that it provides a more comprehensive view of the market. For example, a trader may use MACD to identify potential trend reversals, while also using RSI to confirm overbought or oversold conditions. This approach can help traders avoid false signals and make more accurate predictions.

Some common indicator combinations used with MACD include:

- MACD and RSI: This combination allows traders to identify potential trend reversals and confirm overbought or oversold conditions.

- MACD and moving averages: This combination provides a more comprehensive view of the market, allowing traders to identify potential trend reversals and confirm support and resistance levels.

By using indicator combinations, traders can create more effective trading strategies that take into account multiple market factors. For example, a trader may use MACD to identify a potential trend reversal, while also using RSI to confirm overbought or oversold conditions. This approach can help traders make more informed decisions and avoid false signals.

In addition to using indicator combinations, traders can also use other technical indicators, such as moving averages and stochastic oscillators, to create more robust trading strategies. By combining multiple indicators, traders can gain a more comprehensive understanding of the market and make more accurate predictions.

| Indicator | Description |

|---|---|

| MACD | A trend-following indicator that shows the relationship between two moving averages. |

| RSI | A momentum indicator that measures the magnitude of recent price changes. |

| Moving Averages | A trend-following indicator that shows the average price of a security over a certain period of time. |

Managing Risk with MACD Signals

When using the MACD indicator for trading, risk management is crucial to minimize potential losses. One of the biggest risks of the MACD is that a reversal signal can be a false indicator, leading to incorrect trading decisions. To mitigate this risk, traders can use stop loss strategies to limit their losses if the trade does not go as planned.

A key aspect of risk management is setting appropriate stop losses and determining position sizes based on MACD trading signals. This involves calculating risk-reward ratios to ensure that potential gains outweigh potential losses. By using stop loss strategies and carefully managing position sizes, traders can effectively manage their risk and increase their chances of success in MACD trading.

To further enhance their risk management strategy, traders can use the following techniques:

- Set stop losses based on the MACD signal line and histogram

- Use position sizing to limit exposure to potential losses

- Calculate risk-reward ratios to ensure potential gains outweigh potential losses

By incorporating these risk management techniques into their MACD trading strategy, traders can minimize their risk and maximize their potential gains. Effective risk management is essential for successful MACD trading, and by using stop loss strategies and carefully managing position sizes, traders can achieve their trading goals.

| Risk Management Technique | Description |

|---|---|

| Stop Loss Placement | Setting stop losses based on the MACD signal line and histogram |

| Position Sizing | Using position sizing to limit exposure to potential losses |

| Risk-Reward Ratios | Calculating risk-reward ratios to ensure potential gains outweigh potential losses |

Advanced MACD Trading Patterns

Traders use the MACD’s histogram to identify peaks of bullish or bearish momentum, and to generate overbought/oversold trade signals. This is particularly useful for identifying complex MACD patterns that can inform advanced trading techniques. By analyzing the MACD histogram, traders can gain insights into the strength and direction of price momentum, which is crucial in formulating effective trading strategies.

A key aspect of advanced MACD trading patterns is the use of divergences to identify potential buying or selling opportunities. A bullish MACD divergence, for example, occurs when the MACD line does not reach a new low despite the stock price hitting a new low. This can be a powerful indicator of a potential trend reversal. On the other hand, a bearish MACD divergence occurs when the MACD line reaches a new high despite the stock price failing to reach a new high.

Some common complex MACD patterns include:

- Bullish divergences, which can indicate a potential trend reversal

- Bearish divergences, which can indicate a potential trend continuation

- Multiple timeframe analysis, which involves analyzing the MACD indicator across different timeframes to gain a more comprehensive understanding of market momentum

By incorporating these advanced trading techniques into their trading strategy, traders can gain a competitive edge in the markets. Whether using the MACD histogram to identify overbought/oversold conditions or analyzing divergences to identify potential trend reversals, traders can use the MACD indicator to inform their trading decisions and improve their overall performance.

Avoiding Common MACD Trading Mistakes

When using the MACD indicator, traders often fall into common pitfalls that can lead to trading errors. One of the primary MACD pitfalls is overreliance on the indicator, which can result in indicator limitations. It is essential to understand that the MACD is a lagging indicator and should be used in conjunction with other forms of analysis.

Some common mistakes include false signals, which can occur when the price of an asset moves sideways in a consolidation, such as in a range or triangle pattern. Timing errors can also occur when the MACD signal line is not properly aligned with the price action. To avoid these mistakes, traders should use a combination of technical and fundamental analysis to confirm trading decisions.

By being aware of these common MACD pitfalls and taking steps to avoid them, traders can improve their overall trading performance and reduce the risk of trading errors. This includes using the MACD in conjunction with other indicators, such as the RSI, and incorporating multi-timeframe analysis to get a more comprehensive view of the market.

Some key takeaways to avoid common MACD trading mistakes include:

- Avoid overreliance on the MACD indicator

- Use a combination of technical and fundamental analysis

- Incorporate multi-timeframe analysis

- Be aware of false signals and timing errors

MACD Settings for Different Trading Timeframes

When it comes to using the MACD indicator in trading, the settings can greatly impact the effectiveness of the strategy. For day trading, the most common MACD settings include Fast EMA 9, Slow EMA 12, and Signal Line 6 for scalping, and Fast EMA 12, Slow EMA 26, and Signal Line 9 for swing trading. These settings allow traders to respond quickly to price changes and make informed decisions.

Adjusting MACD settings is crucial for different trading styles. For example, scalping requires quicker responses to price changes with tighter settings, while swing trading benefits from broader views with slower settings. Fine-tuning MACD settings is essential to align with market volatility, security’s price behavior, and trader’s style, impacting the effectiveness of the indicator.

Here are some key considerations for MACD settings in different trading timeframes:

- For intraday trading, use shorter MACD timeframes, such as 5-10 minutes.

- For swing trading, use longer MACD timeframes, such as 1-4 hours.

- For long-term trading, use even longer MACD timeframes, such as daily or weekly charts.

It’s also important to note that MACD settings can be customized to suit individual trading styles and needs. By experimenting with different settings and combining MACD with other technical indicators, traders can develop a well-rounded trading strategy that suits their goals and risk tolerance.

| Trading Style | MACD Settings |

|---|---|

| Day Trading | Fast EMA 9, Slow EMA 12, Signal Line 6 |

| Swing Trading | Fast EMA 12, Slow EMA 26, Signal Line 9 |

Real-World MACD Trading Examples

MACD case studies provide valuable insights into the effectiveness of the MACD indicator in various market conditions. By analyzing these trading examples, traders can gain a deeper understanding of how to use the MACD indicator to make informed trading decisions. Market analysis is a crucial aspect of trading, and the MACD indicator is a popular tool used by traders to identify trends and predict future price movements.

A key aspect of MACD trading is the ability to identify potential reversal points. For instance, when the MACD line crosses above the signal line, it can be a bullish signal, indicating a potential buying opportunity. On the other hand, when the MACD line crosses below the signal line, it can be a bearish signal, indicating a potential selling opportunity. Trading examples, such as these, can help traders develop a trading strategy that incorporates the MACD indicator.

Some notable MACD case studies include:

- Identifying trend reversals using the MACD indicator

- Using the MACD histogram to gauge the strength of a trend

- Combining the MACD indicator with other technical indicators to form a trading strategy

By studying these MACD case studies and trading examples, traders can develop a better understanding of how to use the MACD indicator to analyze the market and make informed trading decisions. It is essential to remember that the MACD indicator is just one tool among many that traders can use to analyze the market. By combining the MACD indicator with other technical indicators and fundamental analysis, traders can develop a comprehensive trading strategy that helps them achieve their trading goals.

For more information on forex trading apps and how to use the MACD indicator in your trading strategy, please visit our website. Remember to always use proper risk management techniques when trading with the MACD indicator.

| MACD Strategy | Win Rate | Profit |

|---|---|---|

| MACD Crossover | 62% | 50% |

| MACD Divergence | 58% | 40% |

Customizing MACD for Your Trading Style

To get the most out of the MACD indicator, it’s essential to customize it according to your trading preferences. This involves indicator optimization to suit your individual needs. One way to do this is by experimenting with different MACD settings. Some alternative settings to try are: 8, 21, 5, 3, 17, 5, 10, 16.

Here are a few examples of custom MACD settings:

- 8, 17, 9 for faster trend detection in volatile markets

- 5, 13, 8 for sensitive and frequent trading opportunities

- 3, 10, 16, as used by Linda Raschke, for a faster reaction to price changes

By using a personalized MACD approach, you can optimize your trading strategy to better suit your needs. Remember to always backtest and validate any new settings before implementing them in your live trading.

Customizing your MACD settings is a crucial step in developing a successful trading strategy. By taking the time to optimize your indicator and tailor it to your trading preferences, you can improve your chances of success in the markets.

| Setting | Description |

|---|---|

| 8, 17, 9 | Faster trend detection in volatile markets |

| 5, 13, 8 | Sensitive and frequent trading opportunities |

| 3, 10, 16 | Faster reaction to price changes, as used by Linda Raschke |

Conclusion

As we conclude our journey through the intricacies of the MACD indicator, it’s clear that this technical analysis tool is a valuable asset for traders across various markets. The MACD’s ability to identify trend reversals, momentum shifts, and potential trading opportunities makes it a must-have in any trader’s toolbox.

Remember, the key to effectively utilizing the MACD lies in continuous learning, practice, and the willingness to experiment with different strategies and settings. Combining the MACD with other technical indicators, such as the Relative Strength Index (RSI) and simple moving averages (SMAs), can further enhance your trading decision-making process.

Ultimately, the MACD is a powerful tool that can help you stay ahead of the market’s ebbs and flows. By mastering its nuances and adapting it to your unique trading style, you’ll be well on your way to making more informed and profitable decisions. Keep exploring, keep learning, and let the MACD be your guide as you navigate the dynamic world of stock trading.

FAQ

What is the MACD indicator?

The MACD (Moving Average Convergence Divergence) indicator is a popular technical analysis tool used by traders to identify trends, momentum, and potential reversals in the stock market.

What are the key components of the MACD indicator?

The MACD indicator consists of three main components: the MACD line, the signal line, and the MACD histogram. These elements work together to provide traders with valuable insights about market conditions.

Why do traders use the MACD indicator?

Traders find the MACD indicator valuable because it can help them identify the strength and direction of a trend, as well as potential reversal points. The indicator is widely used to make informed trading decisions.

Who created the MACD indicator and when?

The MACD indicator was developed by Gerald Appel in the late 1970s. Appel’s work on this technical indicator has made it a staple in the trading community for decades.

How do I set up the MACD indicator on my trading platform?

Most trading platforms offer the MACD indicator as a built-in feature. You can typically find it under the “Indicators” or “Technical Analysis” section of your platform’s menu. You may also be able to customize the default settings to better suit your trading preferences.

What are the different MACD signals I should look for?

The MACD indicator can generate several types of signals, including bullish crossovers, bearish crossovers, and divergences. Identifying and interpreting these signals can help traders make more informed trading decisions.

How can I incorporate MACD into my trading strategies?

MACD can be used in a variety of trading strategies, such as trend following, momentum trading, and swing trading. Traders often combine MACD with other technical indicators to create more robust and reliable trading systems.

How do I use MACD crossover techniques to identify trading opportunities?

MACD crossovers, where the MACD line crosses the signal line, can be important signals for traders. Understanding the different types of crossovers and their implications can help you identify potential entry and exit points in the market.

What are some common mistakes traders make when using the MACD indicator?

Some common MACD trading mistakes include overreliance on the indicator, ignoring the need for confirmation, and failing to properly manage risk. Staying vigilant and avoiding these pitfalls can help traders improve their MACD-based trading strategies.

How can I customize the MACD indicator to fit my trading style?

Traders can experiment with different MACD settings, such as the time periods used for the moving averages, to find the configuration that works best for their individual trading style and market conditions.