Stripe vs Shopify Payment, which payment option is right for your business?

Payment options for your business are always important, but they’re even more vital when you’re looking to take payments online. This is especially true today as the digital age has brought the world into our living rooms. Whether you’re a small-time blogger or a big business that wants to sell your products to the world, payment options are essential.

So, if you’re looking for online payment processing providers then there are two big players that you should always keep in mind: Shopify and Stripe.

Both Shopify and Stripe are popular players with big names backing them up. However, because you’re a business owner and want to select the right payment option for your company, it’s crucial that you understand each and every facet of these providers to find the right fit.

In this article, we’ll talk about what to look for in a payment option and take a look at Stripe vs Shopify Payment to help you decide which fits your business’s needs.

Table of Contents

What to look for in payment processing providers?

Because there are literally dozens of payment processing providers out there, it can feel like shopping for a new home. However, there are some things that you should always look for in a payment processor that will help your business grow.

First, it’s important to take into consideration what kind of products you’re selling and who you’re selling them to. This is because there are different types of providers who specialize in different things. For example, if you want to sell online courses or downloadable content, then you should look for a provider that specializes in that.

Second, it’s important to find out if there are any fees involved. If you don’t want to get blindsided by hidden charges, make sure to ask about them prior to signing on for anything. Having payment processing is great, but not at the cost of losing money when you’re supposed to be making it.

Third, customer service should always be top-notch. As a business owner, you don’t have time to wait on hold every time you need help making a decision. You should find a provider that can walk you through how things work without frustration or delay.

Finally, make sure that the payment providers you’re looking at are reputable. There are plenty of scam artists out there who just want to steal your business’s money. Always do some research on any providers that seem shady or have bad reviews.

Stripe vs Shopify Payment.

Now that we know what to look for, let’s take a closer look at Shopify and Stripe.

Shopify is a provider that is great for small businesses and bloggers with its low fees and easy-to-create online storefronts. However, there are some things worth considering when using Shopify such as the fact that they charge for both credit card processing and their own payment accounts. On top of this, if you’re looking to use Shopify Payments then there are additional fees that will take away from your bottom line.

On the other hand, Stripe is great for larger businesses with little to no credit card processing fees. However, this easy-to-use service comes at a cost of not having an online storefront accessible to customers.

As you can see, both Shopify and Stripe have their strengths and weaknesses. But, keep reading to find out the one that’s right for your business!

Shopify Payments Pros And Cons

If you’re looking for a payment option that can handle all of your business needs then it has to be Shopify Payments. With this tool, your customers can pay with a credit card, Venmo, and Apple Pay.

There are some downsides to using Shopify Payments as there is a monthly fee for this service which includes no additional features besides the ability to accept electronic payments. On top of this, you’ll be charged 2.9% + $0.30 per transaction for every one of your customers’ transactions.

However, if you’re looking for a tool that works great right out of the box then Shopify Payments is the way to go. Plus, it’s not hard to integrate into other marketing tools like MailChimp and Slack.

Stripe Payments Pros And Cons

One of the biggest benefits of Stripe is that there are no monthly fees to use their payment processing. Instead, you will only pay for the transactions themselves which vary depending on whether or not it is a card-present or card-not-present transaction. Another perk of choosing Stripe is that your customers can pay with just about any device using Apple Pay, Android Pay, Apple Wallet, and more.

However, there are some cons to using Stripe such as the fact that your customers will need an internet connection in order to place an order (which can be hard for those with spotty service). Also, if you’re looking for a tool that is easy to use right out of the box then it doesn’t really get any better than Shopify Payments.

Stripe vs Shopify Payment FAQs.

What is Shopify and how does it work?

Shopify is a platform that allows you to create an online store. It provides you with a customizable platform, an easy-to-use checkout process, and a wide range of features.

Shopify works by providing you with a platform to build your online store. It includes everything you need to create a store, including a customizable platform, an easy-to-use checkout process, and a wide range of features.

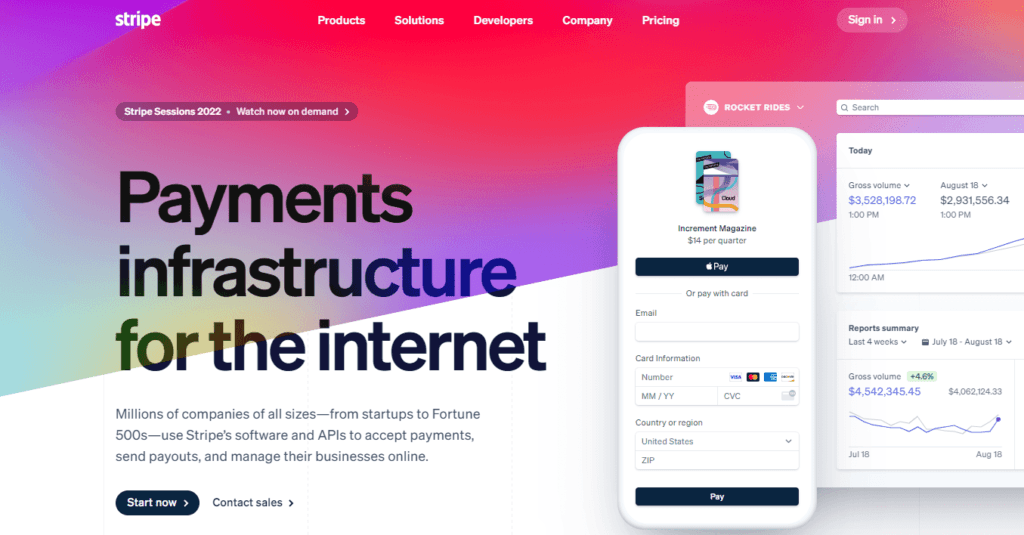

What is Stripe and how does it work?

Stripe is a payment processor that allows you to accept payments online. It works by allowing you to connect your bank account or credit card to your Stripe account, and then provides you with a way to accept payments through your Stripe account.

Do you need experience as a web designer or developer to use Shopify?

No, you don’t need any experience as a web designer or developer to use Shopify. All you need is a desire to create an online store and the willingness to learn how to use the platform. Shopify is also ideal for businesses that don’t have the budget to hire a web designer or developer to create an online store. With Shopify, you can create a beautiful and functional online store on your own.

What are the main differences between Shopify and Stripe?

The main difference between Shopify and Stripe is that Shopify is an all-in-one platform that includes everything you need to create and run an online store, while Stripe is a payment processor that you can use with any eCommerce platform.

Shopify is a good choice for businesses that want an all-in-one solution that includes everything they need to create and operate their online store, while Stripe is a good choice for businesses that are using another eCommerce platform and just need a payment processor.

What are the main similarities between Shopify and Stripe?

The main similarity between Shopify and Stripe is that they are both easy to use and have a lot of features. Shopify is an all-in-one platform that includes everything you need to create and run an online store. Stripe is a payment processor that you can use with any eCommerce platform.

The bottom line

Shopify and Stripe both provide great payment options that any business can use. So, which one should you choose? Which is better for your small business?

If you’re looking for something that is incredibly easy to use and can process payments without any hassle or frustration then go with Shopify Payments. On the other hand, if you’re looking for a payment option that has a wide array of features and benefits right from the very beginning then Stripe is the way to go.

Whichever option you choose, remember that Shopify and Stripe are both great payment options for any business out there. Just be sure to keep the pros and cons outlined above in mind so you can find out which one is right for your small business!

P.S. I have created a step-by-step guide to creating an e-commerce store, check it out here!