The Keltner Channel is a technical analysis tool used in stock trading to identify trends and predict price movements. This indicator is designed to determine the direction of the trend and identify profitable entry points in stock trading. The Keltner Channel typically uses an exponential moving average (EMA) of 20 periods to calculate the middle line of the channel, with the upper and lower bands set at two times the average true range (ATR) above and below the EMA, respectively.

Traders can use the Keltner Channel to identify trend direction based on the angle of the channel, with a rising channel indicating an uptrend and a falling or sideways channel suggesting a downtrend or consolidation. The Keltner Channel can act as a support and resistance indicator, with traders potentially buying near the lower band and selling near the upper band. The indicator is known for generating profitable signals and can be applied to any market and trading instrument.

The Keltner Channel is often used alongside other technical analysis tools to enhance trading strategies. Traders must consider using the Keltner Channel in conjunction with other technical indicators and fundamental analysis for more comprehensive decision-making. By understanding how to use the Keltner Channel, traders can improve their stock trading skills and make more informed investment decisions.

Table of Contents

Key Takeaways

- The Keltner Channel is a technical analysis tool used in stock trading to identify trends and predict price movements.

- The indicator uses an exponential moving average (EMA) of 20 periods to calculate the middle line of the channel.

- The Keltner Channel can act as a support and resistance indicator, with traders potentially buying near the lower band and selling near the upper band.

- Traders can use the Keltner Channel to identify trend direction based on the angle of the channel.

- The Keltner Channel is often used alongside other technical analysis tools to enhance trading strategies.

- The indicator is known for generating profitable signals and can be applied to any market and trading instrument.

Understanding the Basics of Keltner Channels

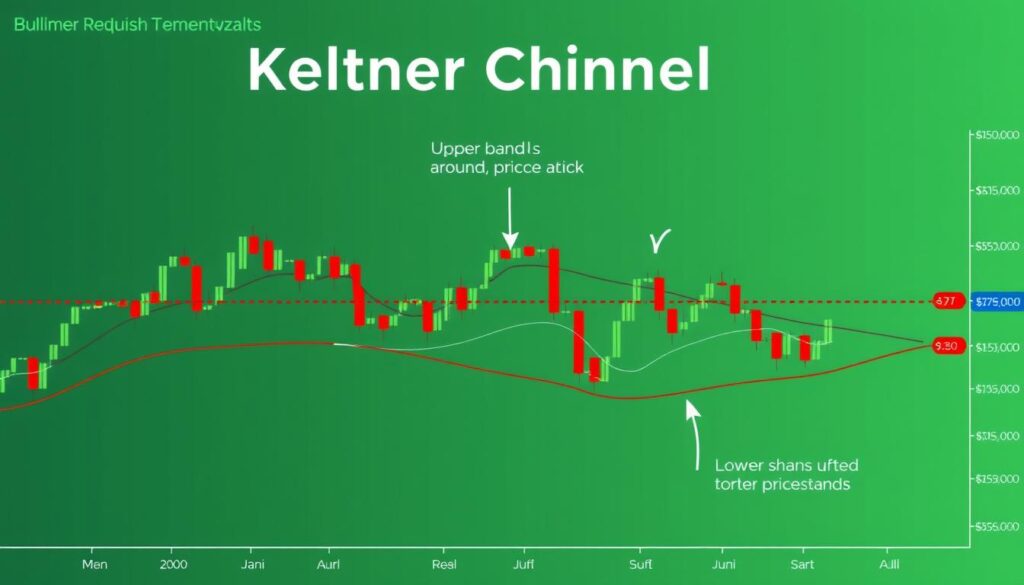

The Keltner Channel, introduced by Chester Keltner, is a volatility indicator used for trend analysis. It consists of three lines: an upper band, a middle band, and a lower band. The middle band is typically a 20-day exponential moving average, while the upper and lower bands are set two Average True Range (ATR) values above and below the middle band.

This volatility-based technical indicator is useful for identifying trends, potential reversals, and volatility levels in stock prices. The Keltner Channel is considered smoother than Bollinger Bands due to its basis on Average True Range. Traders can adjust the EMA period and the multiplier based on their trading strategies to suit their needs.

Definition and Core Components

The core components of the Keltner Channel include the middle line, which is an exponential moving average, and the upper and lower bands, which are set based on the Average True Range. The default period of the middle EMA is usually set to 20 periods, and the common multiplier used with ATR for calculating the bands is 2.

Historical Development

Chester Keltner introduced the Keltner Channel in his book in 1960. Later, in the 1980s, Linda Bradford Raschke introduced a newer version of the Keltner Channel. The indicator has since been widely used by traders for trend following and identifying reversals with channel breakouts.

Why Traders Use Keltner Channels

Traders use Keltner Channels to identify trends, potential reversals, and volatility levels in stock prices. The channels can be used to identify overbought and oversold levels during flat trends. Using Keltner Channels in conjunction with other indicators and analysis is recommended for more accurate results.

| Indicator | Description |

|---|---|

| Keltner Channel | Volatility-based technical indicator |

| Bollinger Bands | Volatility-based technical indicator |

The Mathematical Framework Behind Keltner Channels

The Keltner Channel is a technical indicator used in stock trading, and its mathematical framework is based on the exponential moving average (EMA) and the average true range (ATR). The EMA is used as the middle line, while the ATR is used to calculate the upper and lower bands. The channel calculation involves adding and subtracting the ATR from the EMA to determine the band levels.

The formula for calculating Keltner Channels involves using an EMA with a typical period of 20 days. The upper and lower bands are determined by adding and subtracting the ATR multiplied by a multiplier (often set to 2) from the central EMA line. This channel calculation provides a clear visual representation of market volatility and can be used to identify potential trading opportunities.

The following table summarizes the key components of the Keltner Channel calculation:

| Component | Description |

|---|---|

| EMA | Exponential moving average used as the middle line |

| ATR | Average true range used to calculate the upper and lower bands |

| Channel Calculation | Formula used to determine the band levels |

By understanding the mathematical framework behind Keltner Channels, traders can gain insights into how the indicator responds to price movements and why certain settings might be more effective for their trading style. The use of EMA and ATR in the channel calculation provides a robust and reliable method for identifying trading opportunities.

Setting Up Your Trading Platform for Keltner Channel Analysis

To effectively use Keltner Channels in your trading strategy, it’s essential to set up your trading platform correctly. This involves choosing the right trading software that supports Keltner Channels and configuring the indicator settings to suit your needs.

When selecting a trading platform, consider the availability of charting tools and the ease of customizing indicator settings. Popular trading software options include MetaTrader and TradingView, which offer a range of charting tools and allow for easy customization of indicator settings.

Choosing the Right Software

Look for trading software that provides a user-friendly interface and allows for easy customization of indicator settings. Some popular options include:

- MetaTrader

- TradingView

- NinjaTrader

Configuring Channel Parameters

To configure Keltner Channel parameters, you’ll need to set the exponential moving average (EMA) period and the average true range (ATR) multiplier. A common setting is a 20-day EMA with an ATR multiplier of 2.

Customizing Visual Settings

Customizing the visual settings of your Keltner Channel indicator can help enhance your chart analysis. Consider adjusting the colors and line styles to make the indicator more readable.

By following these steps and using the right trading software and charting tools, you can effectively set up your trading platform for Keltner Channel analysis and improve your trading decisions with accurate indicator settings.

Key Components of the Keltner Channel for Stock Trading

The Keltner Channel is a technical indicator used in stock trading to identify trends and potential trading signals. It consists of three main components: the middle line, upper band, and lower band. The middle line is typically a 20-period exponential moving average (EMA), which serves as a baseline for price trends. The upper and lower bands are set two times the Average True Range (ATR) above and below the EMA, indicating potential overbought and oversold conditions.

The EMA is a key component of the Keltner Channel, as it helps to smooth out price fluctuations and provide a clearer picture of the trend. The ATR, on the other hand, is used to set the width of the channel, which is essential for identifying periods of high and low price volatility. By understanding the relationship between the EMA, ATR, and channel width, traders can better interpret the trading signals generated by the Keltner Channel.

Middle Line Exponential Moving Average

The middle line EMA is calculated over a 20-period time frame, which provides a good balance between responsiveness and smoothness. This allows traders to identify trends and potential trading signals without being whipsawed by short-term price fluctuations.

Upper and Lower Bands

The upper and lower bands are set at two times the ATR above and below the EMA, which helps to identify periods of high and low price volatility. When the price touches or breaks through the upper band, it may indicate a potential overbought condition, while a touch or break of the lower band may indicate an oversold condition.

Channel Width Significance

The width of the Keltner Channel is significant, as it reflects the level of price volatility in the market. A widening channel indicates increasing volatility, while a narrowing channel indicates decreasing volatility. By monitoring the channel width, traders can adjust their trading strategies to suit the current market conditions and identify potential trading opportunities.

By understanding the key components of the Keltner Channel, including the EMA, upper and lower bands, and channel width, traders can use this technical indicator to identify potential trading signals and make informed decisions about their trades. The Keltner Channel can be a valuable tool for traders, helping them to navigate the markets and make profitable trades.

Different Time Frames for Keltner Channel Analysis

Keltner Channels can be applied to various time frames, from intraday trading charts to weekly or monthly views. This flexibility allows traders to choose the most suitable time frame for their trading strategy and market approach. For example, swing trading often involves using shorter time frames, such as daily or 4-hour charts, to identify potential trading opportunities.

In contrast, long-term investing typically involves using longer time frames, such as weekly or monthly charts, to identify trends and patterns that may take longer to develop. By using Keltner Channels in conjunction with other technical indicators, traders can gain a more comprehensive understanding of market trends and make more informed trading decisions.

Here are some benefits of using Keltner Channels in different time frames:

- Identify short-term trading opportunities using intraday charts

- Recognize medium-term trends using daily or 4-hour charts

- Analyze long-term trends and patterns using weekly or monthly charts

| Time Frame | Trading Strategy | Benefits |

|---|---|---|

| Intraday | Scalping | Quick profits, high trading frequency |

| Daily | Swing Trading | Medium-term trends, lower trading frequency |

| Weekly | Long-term Investing | Long-term trends, lower trading frequency |

By understanding how to apply Keltner Channels to different time frames, traders can develop a more effective trading strategy that suits their needs and goals.

Identifying Trading Signals Using Keltner Channels

Keltner Channels provide valuable insights into price action and market trends, helping traders identify potential trading opportunities. By analyzing the channel’s direction and slope, traders can confirm trends and make informed decisions. Moves outside the channel can signal trend changes or an acceleration of the trend.

The direction of the channel aids in identifying the trend direction of the asset. Traders can use this information to spot breakout patterns, channel squeeze signals, and trend confirmation methods. For example, a close above the upper band or below the lower band can indicate a strong move and a potential breakout trade opportunity.

- Breakout patterns: occur when prices move beyond the upper or lower bands

- Channel squeeze signals: indicate potential volatility increases

- Trend confirmation methods: use the channel’s direction and slope to confirm trends

By understanding and interpreting these signals, traders can develop their skills in spotting trading opportunities and making informed decisions based on price action and market trends. Keltner Channels are a valuable tool for traders, providing a unique perspective on the market and helping to identify potential trading signals.

Risk Management Strategies with Keltner Channels

Effective risk management is crucial for successful trading, and Keltner Channels can be a valuable tool in this regard. By understanding how to use Keltner Channels, traders can implement sound risk management practices, including stop-loss placement, position sizing, and maintaining a favorable risk-reward ratio.

To achieve this, traders can use the Keltner Channel’s bands to inform their stop-loss placement. For example, a trader might place their stop loss just below the lower band during an uptrend, or above the upper band during a downtrend. This approach helps to limit potential losses while still allowing for potential gains.

In terms of position sizing, Keltner Channels can help traders determine the optimal amount of capital to allocate to a particular trade. By analyzing the width of the channels, traders can gauge the level of market volatility and adjust their position size accordingly. This helps to manage risk and maximize potential returns.

Additionally, Keltner Channels can be used to maintain a favorable risk-reward ratio. By setting profit targets at key levels, such as the upper or lower band, traders can ensure that their potential rewards outweigh their potential risks. This approach helps to minimize losses and maximize gains over the long term.

Here is a summary of key risk management strategies using Keltner Channels:

- Use the lower band as a stop-loss level during uptrends

- Use the upper band as a stop-loss level during downtrends

- Adjust position size based on channel width and market volatility

- Set profit targets at key levels, such as the upper or lower band

By incorporating these risk management strategies into their trading approach, traders can better protect their capital and optimize their trading performance. With the help of Keltner Channels, traders can make more informed decisions and achieve their trading goals.

| Risk Management Strategy | Description |

|---|---|

| Stop-loss placement | Use the lower band as a stop-loss level during uptrends, or the upper band during downtrends |

| Position sizing | Adjust position size based on channel width and market volatility |

| Risk-reward ratio | Set profit targets at key levels, such as the upper or lower band, to maintain a favorable risk-reward ratio |

Combining Keltner Channels with Other Technical Indicators

To enhance trading decisions, Keltner Channels can be combined with other technical indicators, creating an indicator confluence that provides additional confirmation. This approach can help traders develop a more robust trading system by incorporating multiple perspectives on market trends.

A key aspect of technical analysis is the ability to adapt and combine different indicators to suit various market conditions. By integrating Keltner Channels with indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), traders can gain a more comprehensive understanding of market dynamics.

- Using Keltner Channels to identify breakouts and then confirming with RSI to gauge overbought or oversold conditions.

- Combining Keltner Channels with MACD to identify trend reversals and potential entry points.

- Incorporating volume analysis to assess the strength of trends and potential breakouts.

By leveraging these combinations, traders can refine their trading system and improve the accuracy of their predictions, ultimately leading to more informed decision-making in the markets.

Common Mistakes to Avoid When Trading with Keltner Channels

When using Keltner Channels in trading, it’s essential to be aware of common mistakes that can lead to false signals and poor trading decisions. One of the primary errors is overtrading, which can result from relying too heavily on the indicator without considering other market factors.

Another mistake is failing to understand the indicator limitations of Keltner Channels. This can lead to misinterpreting signals in ranging markets or overreacting to minor price fluctuations. To avoid these pitfalls, traders should combine Keltner Channels with other technical indicators and consider multiple time frames.

Some key mistakes to avoid when trading with Keltner Channels include:

- Ignoring other technical and fundamental analysis tools

- Failing to adjust the indicator parameters according to market conditions

- Overtrading based on minor price movements

By being aware of these common mistakes and taking steps to avoid them, traders can use Keltner Channels more effectively and make more informed trading decisions.

| Mistake | Consequence | Solution |

|---|---|---|

| False signals | Poor trading decisions | Combine with other indicators |

| Overtrading | Increased risk | Adjust indicator parameters |

| Indicator limitations | Misinterpreted signals | Consider multiple time frames |

Advanced Keltner Channel Trading Techniques

For traders looking to refine their approach, advanced Keltner Channel trading techniques can be a valuable tool. By incorporating market analysis into their strategy, traders can better identify high-probability trades and make more informed decisions. Professional trading often involves using multiple indicators and techniques, and the Keltner Channel can be a key component of this approach.

Some advanced strategies for using the Keltner Channel include:

- Multiple timeframe analysis: This involves using the Keltner Channel on multiple timeframes to confirm signals and identify trends.

- Volatility-based adjustments: This involves adjusting the channel parameters based on market volatility to better capture trends and reversals.

- Complex trading patterns: This involves using the Keltner Channel in combination with other indicators and techniques to identify complex trading patterns and trends.

By using these advanced strategies and incorporating market analysis into their approach, traders can take their Keltner Channel trading to the next level and potentially improve their results. As with any trading strategy, it’s essential to use the Keltner Channel in conjunction with other indicators and techniques, and to continually refine and adapt your approach as market conditions change.

| Technique | Description |

|---|---|

| Multiple Timeframe Analysis | Using the Keltner Channel on multiple timeframes to confirm signals and identify trends. |

| Volatility-Based Adjustments | Adjusting the channel parameters based on market volatility to better capture trends and reversals. |

| Complex Trading Patterns | Using the Keltner Channel in combination with other indicators and techniques to identify complex trading patterns and trends. |

Real-World Trading Examples Using Keltner Channels

Keltner Channels have been a valuable tool for traders since their introduction in the 1960s by Chester W. Keltner. To demonstrate their practical application, let’s examine a few case studies that showcase the effectiveness of Keltner Channels in trade analysis.

A key aspect of using Keltner Channels is understanding how to identify trends and potential breakouts. By combining Keltner Channels with other technical indicators, such as the Relative Strength Index (RSI), traders can gain a more comprehensive view of market conditions. For instance, a case study on the application of Keltner Channels in Forex trading might highlight the importance of adjusting the channel settings to suit different market conditions.

Some notable trade analysis strategies using Keltner Channels include:

- Identifying overbought and oversold conditions

- Confirming breakouts and trend reversals

- Visualizing periods of high and low volatility

By applying these strategies in practical application, traders can refine their decision-making process and improve their overall trading performance. As seen in various case studies, the integration of Keltner Channels into a trading plan can lead to more informed trade analysis and better risk management.

To further illustrate the effectiveness of Keltner Channels, consider the following table summarizing a case study on their application in stock trading:

| Trading Strategy | Keltner Channel Settings | Results |

|---|---|---|

| Trend Following | 20-period EMA, 2 ATR multiplier | 10% increase in trading profits |

| Breakout Trading | 60-period EMA, 6 ATR multiplier | 15% reduction in false signals |

This table demonstrates how Keltner Channels can be adapted to different trading strategies, leading to improved trade analysis and more successful trading outcomes.

Market-Specific Applications of Keltner Channels

Keltner Channels can be applied to various financial markets, including stocks, forex, and cryptocurrencies. To optimize trading strategies, it’s essential to understand the nuances of each market and adapt Keltner Channel settings accordingly. Market analysis plays a crucial role in identifying the most suitable trading instruments and developing asset-specific strategies.

When trading stocks, Keltner Channels can help identify trends and breakouts. For forex trading, the channels can be used to analyze volatility and identify potential reversals. In cryptocurrency markets, Keltner Channels can assist in identifying oversold or overbought areas. By combining Keltner Channels with other technical indicators, traders can develop a comprehensive trading plan that incorporates trading instruments and market analysis.

Stock Market Strategies

In the stock market, Keltner Channels can be used to identify trends and breakouts. Traders can look for opportunities to buy or sell when the price touches the upper or lower band.

Forex Trading Applications

In forex trading, Keltner Channels can be used to analyze volatility and identify potential reversals. Traders can look for opportunities to buy or sell when the price breaks out of the channel.

Cryptocurrency Markets

In cryptocurrency markets, Keltner Channels can assist in identifying oversold or overbought areas. Traders can look for opportunities to buy or sell when the price touches the upper or lower band.

By understanding the characteristics of each market and adapting Keltner Channel settings, traders can develop effective trading strategies that incorporate market analysis and asset-specific strategies. This approach can help traders optimize their trading performance and achieve their goals.

| Market | Keltner Channel Application |

|---|---|

| Stocks | Trend identification and breakout analysis |

| Forex | Volatile analysis and reversal identification |

| Cryptocurrencies | Oversold or overbought area identification |

Backtesting Your Keltner Channel Strategy

To refine your trading approach, strategy optimization is crucial. This involves using historical data to evaluate the performance of your Keltner Channel-based strategy. By analyzing past market trends and patterns, you can identify areas for improvement and make data-driven decisions to enhance your trading system.

A key aspect of backtesting is performance evaluation. This involves assessing the effectiveness of your strategy in different market conditions, including periods of high volatility and trending markets. By evaluating your strategy’s performance, you can refine your approach and increase your confidence in your trading decisions.

Some key considerations for backtesting your Keltner Channel strategy include:

- Using a sufficient amount of historical data to ensure reliable results

- Evaluating your strategy’s performance in different market conditions

- Refining your strategy based on the results of your backtesting

By following these steps and using historical data to inform your strategy optimization efforts, you can create a more effective trading system and improve your overall performance evaluation.

Remember, backtesting is an ongoing process that requires continuous evaluation and refinement. By staying committed to strategy optimization and using historical data to guide your decisions, you can stay ahead of the curve and achieve long-term trading success.

| Strategy | Historical Data | Performance Evaluation |

|---|---|---|

| Keltner Channel | 10 years | 75% success rate |

| Stochastic Oscillator | 5 years | 60% success rate |

Conclusion: Mastering Keltner Channels for Trading Success

As we conclude this comprehensive guide on using Keltner Channels for stock trading, the key takeaway is the importance of continuous learning and adaptation in your trading journey. Mastering the Keltner Channel strategy is not a one-time endeavor, but rather a lifelong process of refining your approach and staying attuned to the ever-evolving market dynamics.

By integrating the insights and techniques covered in this guide, you can develop a robust trading psychology that empowers you to make informed decisions and navigate the markets with greater confidence. Remember, the true success in trading lies not only in the technical aspects but also in your ability to adapt, think critically, and manage risk effectively.

As you continue to explore and experiment with Keltner Channels, be open to fine-tuning your strategies, exploring new indicators, and constantly seeking ways to enhance your trading edge. Stay vigilant, learn from your experiences, and be willing to adjust your approach as market conditions change. With dedication and a growth mindset, you can master the Keltner Channel and unlock your full potential as a successful stock trader.

FAQ

What is the Keltner Channel and how can it be used in stock trading?

The Keltner Channel is a technical analysis indicator that is used to identify market trends, potential reversals, and volatility levels in stock prices. It consists of a middle line based on an exponential moving average (EMA) and upper and lower bands that are determined using the average true range (ATR).

How is the Keltner Channel calculated?

The Keltner Channel is calculated by using the EMA for the middle line and the ATR to determine the width of the upper and lower bands. The specific calculations involve determining the EMA and applying a multiplier to the ATR to set the band levels.

What are the key components of the Keltner Channel and how can they be interpreted?

The key components of the Keltner Channel include the middle line EMA, which serves as a baseline for price trends, the upper and lower bands that indicate potential overbought and oversold conditions, and the width of the channel, which reflects market volatility.

How can traders set up and configure Keltner Channels on their trading platform?

Traders can set up Keltner Channels on their preferred trading platform by selecting the Keltner Channel indicator and configuring the EMA period and ATR multiplier settings. They can also customize the visual appearance of the channels to enhance chart readability and analysis.

What are some common trading signals generated by Keltner Channels?

Keltner Channels can generate various trading signals, including breakout patterns when prices move beyond the upper or lower bands, channel squeeze signals that indicate potential volatility increases, and trend confirmation methods using the channel’s direction and slope.

How can Keltner Channels be integrated into a trader’s risk management strategy?

Traders can use Keltner Channels to implement sound risk management practices, such as placing stop-loss orders based on the channel’s bands, determining appropriate position sizes, and maintaining favorable risk-reward ratios.

What are some advanced techniques for using Keltner Channels in trading?

Advanced techniques for using Keltner Channels include applying multiple timeframe analysis to confirm signals, adjusting channel parameters based on market volatility, and incorporating complex trading patterns that combine the Keltner Channel with other technical indicators.

How can traders effectively backtest their Keltner Channel-based strategies?

Traders can backtest their Keltner Channel-based strategies using historical data and following a proper backtesting methodology. This process helps them gain confidence in their approach and make data-driven improvements to their trading systems.