Tracking your expenses is the first step to gaining control over your personal finances. By closely monitoring where your money is going, you can identify spending patterns, create a realistic budget, and make informed decisions to improve your financial well-being. From manually recording your expenses to utilizing cutting-edge budgeting apps, there are numerous approaches to keeping a close eye on your cash flow.

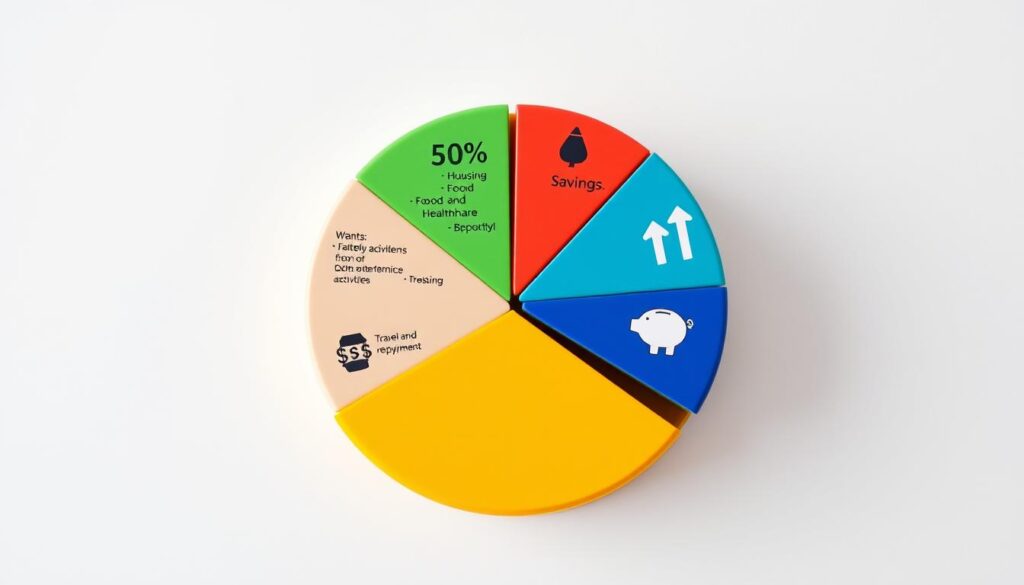

The 50/30/20 budget guideline offers a simple framework for allocating your net income: 50% for essential needs, 30% for discretionary wants, and 20% for savings and debt repayment. By understanding this formula and making adjustments as needed, you can ensure your spending aligns with your financial goals.

Table of Contents

Key Takeaways

- Expense tracking provides a clear picture of where your money is being spent.

- The 50/30/20 budget method is a popular guideline for allocating income.

- Manual recording, spreadsheets, templates, and mobile apps are effective expense tracking tools.

- Regular review and adjustment of your budget are crucial for financial health.

- Identifying fixed and variable expenses can help you better manage your spending.

Understanding the Importance of Expense Tracking

Maintaining financial awareness is crucial for individuals and businesses alike. Expense tracking plays a vital role in understanding spending habits and managing budgets effectively. While traditional budgeting methods often fall short, tracking your expenses can provide valuable insights into your financial health and help you build better money habits.

Why Traditional Budgeting Often Fails

Traditional budgeting approaches typically rely on estimates and projections, which can be inaccurate and lead to frustration. Without a clear understanding of where your money is actually going, it becomes challenging to make informed financial decisions. Expense tracking, on the other hand, offers a more detailed and comprehensive view of your spending patterns, allowing you to identify areas for improvement and make more informed budgeting choices.

The Impact of Tracking on Financial Health

Regularly tracking your expenses can have a significant impact on your financial health. By revealing your spending patterns, you can better understand where your money is being allocated and make adjustments to align your spending with your priorities. This awareness can help you identify unnecessary or excessive expenses, and take steps to reduce or eliminate them, ultimately improving your overall financial well-being.

Building Better Money Habits

Expense tracking is not about restricting your spending, but rather about making informed choices. By increasing your financial awareness, tracking can help you develop better money habits, such as mindful spending, saving consistently, and aligning your expenditures with your long-term goals. This approach empowers you to take control of your finances and make more strategic decisions, leading to a healthier financial future.

Getting Started with Financial Record-Keeping

Effective financial organization is the foundation of successful expense tracking and budgeting. Start your journey by gathering all your account statements, including checking and credit card records. This step will help you identify your spending patterns and categorize your expenses into fixed and variable costs.

Maintaining a consistent record-keeping system is crucial for accurate expense documentation. You can choose a method that works best for you, whether it’s a simple notebook, a dedicated binder, or a digital expense tracking app. Consistency is the key to ensuring your financial records remain accurate and up-to-date.

- Gather all your account statements, including checking and credit cards

- Identify your spending patterns and categorize expenses into fixed and variable costs

- Establish a record-keeping system, such as a notebook, binder, or digital app, that suits your preferences

- Maintain consistency in your record-keeping to ensure accurate and reliable expense documentation

“Knowing where your money goes is the first step towards financial freedom.” – Unknown

By establishing a solid financial organization and expense documentation system, you’ll lay the foundation for effective record-keeping methods that will empower you to take control of your finances.

Ways To Track Expenses

Keeping tabs on your expenses is crucial for achieving financial stability and reaching your savings goals. Fortunately, there are several effective expense tracking techniques at your fingertips, ranging from manual methods to digital solutions and automated banking tools.

Manual Tracking Methods

For those who prefer a hands-on approach, a simple notebook or binder can be an effective way to log your expenses. By recording each purchase, you can gain a clear understanding of where your money is going. This manual method emphasizes the physical nature of cash transactions, similar to the envelope system, and can help curb overspending by making you more conscious of your spending habits.

Digital Solutions and Apps

In the digital age, numerous budgeting apps and financial software offer convenient expense tracking solutions. Spreadsheet programs like Microsoft Excel or Google Sheets allow for customization and detailed calculations, while apps like NerdWallet can automate the categorization of your expenses for you. These digital tools often sync with your bank accounts, providing real-time updates and a comprehensive view of your financial situation.

Automated Banking Tools

Many financial institutions now offer integrated expense tracking features within their online banking platforms or mobile apps. These automated banking tools can automatically sync with your accounts, categorize your transactions, and provide detailed reports on your spending patterns. This hands-off approach can save you time and effort, allowing you to focus on adjusting your spending habits rather than manual data entry.

When choosing an expense tracking method, consider your personal preferences, the complexity of your financial situation, and the features that will best support your expense tracking techniques. By exploring the various options available, you can find a system that seamlessly fits your lifestyle and helps you gain better control of your finances.

Creating Categories for Your Expenses

Organizing your expenses into distinct categories is a crucial step in expense categorization and spending analysis. By categorizing your expenses, you can gain a deeper understanding of your spending patterns and identify opportunities for budget organization.

Common expense categories include housing (rent/mortgage, utilities, repairs), transportation (car payments, gas, insurance), food (groceries, dining out), healthcare (insurance, prescriptions), and entertainment (hobbies, travel, dining out). Personalizing your categories based on your specific financial situation and goals can provide even greater insights.

- Use the 50/30/20 rule to divide your expenses into needs (50%), wants (30%), and savings/debt repayment (20%).

- Review and adjust your categories regularly as your financial circumstances or priorities change.

- Categorize expenses with precision to identify patterns and opportunities for optimization.

| Expense Category | Percentage of Total Expenses |

|---|---|

| Housing | 34% |

| Transportation | 15% |

| Food | 12% |

| Healthcare | 8% |

| Entertainment | 6% |

| Savings/Debt Repayment | 25% |

By creating a comprehensive expense categorization system, you can gain valuable insights into your spending habits and make informed decisions to optimize your budget organization and financial health.

Understanding Fixed vs Variable Expenses

Effectively managing your finances requires a clear understanding of the different types of expenses you face each month. Fixed expenses are consistent costs that remain relatively stable, such as rent or mortgage payments, car loans, and insurance premiums. On the other hand, variable expenses fluctuate based on your spending habits and can include groceries, dining out, entertainment, and other discretionary purchases.

Managing Fixed Monthly Costs

Fixed expenses typically represent around 50% of an individual’s income, according to the popular 50/30/20 budgeting rule. These expenses are often non-negotiable in the short term, but you can take steps to minimize them over time. For example, you might consider refinancing your mortgage or negotiating lower rates on your insurance premiums to reduce your fixed monthly costs.

Controlling Variable Spending

Variable expenses, which can account for the remaining 50% of monthly expenditures, require a more hands-on approach to manage. Setting spending limits, finding cost-effective alternatives, and tracking your spending habits can help you gain better control over your variable costs. This, in turn, can increase your budget flexibility and allow you to allocate more resources towards your financial goals, such as saving and investing.

By understanding the distinction between fixed and variable expenses, you can create a more balanced and effective budget that helps you achieve long-term financial stability. Regularly reviewing and adjusting your spending in these two key areas can be a powerful strategy for improving your overall financial well-being.

The 50/30/20 Budgeting Method

The 50/30/20 budgeting method is a popular framework that can help individuals achieve financial balance and progress toward their goals. This simple yet effective approach divides your after-tax income into three distinct categories: needs, wants, and savings/debt repayment.

Under the 50/30/20 rule, you allocate 50% of your net income to essential expenses, such as housing, utilities, groceries, and transportation. Another 30% goes toward discretionary spending, including entertainment, dining out, and hobbies. The remaining 20% is dedicated to building savings and paying off debts beyond the minimum required payments.

- Needs (50%): Housing, utilities, groceries, healthcare, transportation, and minimum debt payments.

- Wants (30%): Dining out, travel, entertainment, subscriptions, and other discretionary expenses.

- Savings/Debt Repayment (20%): Emergency fund, retirement contributions, and paying off high-interest debt.

This balanced approach aims to help you manage your budget allocation, maintain financial planning, and ensure a healthy income distribution. By adhering to the 50/30/20 rule, you can prioritize your essential needs, enjoy some discretionary spending, and steadily build your savings and pay off debts.

The 50/30/20 budgeting method is designed to be flexible, allowing you to adjust the percentages based on your unique financial situation and priorities. It’s recommended to track your expenses for a month, categorize them accordingly, and then apply the rule to your budget.

Implementing the 50/30/20 rule can help you develop healthier financial habits, achieve your savings goals, and ultimately, gain a better understanding of your spending patterns and overall financial well-being.

Essential Tools for Expense Tracking

Staying on top of your finances requires a strategic approach to expense tracking. Fortunately, there are a variety of tools available to help you gain control over your spending and achieve your financial goals. From customizable spreadsheet solutions to intuitive mobile applications, the options cater to diverse budgeting preferences and needs.

Spreadsheet Solutions

Tried-and-true spreadsheet software like Microsoft Excel and Google Sheets offer a flexible platform for detailed expense tracking. These tools allow you to create personalized budget templates, categorize your spending, and generate visual reports to better understand your financial patterns. With formulas and macros, you can automate calculations and streamline the tracking process.

Mobile Applications

For on-the-go expense management, mobile applications have become increasingly popular. Apps like NerdWallet, Mint, and YNAB (You Need a Budget) provide a comprehensive suite of features, from real-time expense logging to advanced budgeting tools. Many of these financial apps also offer seamless integration with your bank accounts, making it easier to monitor your spending patterns.

Traditional Recording Methods

While digital solutions have revolutionized expense tracking, some individuals still prefer the simplicity of traditional methods. The pencil-and-paper approach or the envelope system can be effective in visually representing your cash flow and limiting overspending. For those who thrive on tactile engagement, these time-honored techniques can be a valuable complement to digital expense tracking tools.

When it comes to choosing the right expense tracking solution, consider your personal preferences, the level of detail you require, and the amount of time you’re willing to invest. Many find success in combining multiple methods, leveraging the strengths of different budgeting software and techniques to create a comprehensive financial management system.

| Expense Tracking Method | Pros | Cons |

|---|---|---|

| Pencil and Paper |

|

|

| The Envelope System |

|

|

| Computer Spreadsheets |

|

|

| Expense-Tracker Apps |

|

|

Making Sense of Your Spending Patterns

Analyzing your spending patterns is a crucial step in achieving financial well-being. By reviewing your tracked expenses regularly, you can identify areas of overspending and opportunities for savings. Look for trends in your discretionary spending and necessary expenses to gain a deeper understanding of your financial behavior.

Over-reliance on credit and debit cards for daily purchases has led to an increase in overspending and debt accumulation. Contactless technology has further facilitated spending, making it even more important to be mindful of your spending habits. By recording every expense for at least a month, you can get a clear overview of your spending patterns and spot potential areas for saving.

Many budgeting apps offer features like account linkage and bill reminders, providing a comprehensive financial tool to track your spending. Establishing a habit of tracking your spending requires consistency and integration into your daily routines. Set reminders, categorize your expenses, and celebrate your small wins to make it a sustainable practice.

“Tracking spending is integral for understanding financial health, informing decisions for setting financial goals, and achieving financial freedom.”

Beyond tracking your spending, creating a budget, setting financial goals, and investing for retirement are essential steps for long-term financial stability. A financial professional can assist you in saving for large purchases or determining the right investment amounts for your retirement.

Remember, making sense of your spending patterns is not just about numbers, but also about understanding your financial behavior. Use this insight to adjust your budget and financial goals, and make informed decisions about your future spending and saving.

Common Expense Tracking Mistakes to Avoid

Effective expense tracking is crucial for maintaining a healthy financial outlook, but even the most diligent individuals can fall prey to common pitfalls. As you embark on your expense management journey, be mindful of these common mistakes to ensure your financial records remain accurate and your budgeting efforts fruitful.

Inconsistent Recording

One of the biggest challenges in expense tracking is maintaining a consistent recording routine. Sporadic logging of expenses can lead to incomplete data, making it challenging to get a comprehensive view of your spending habits. Establish a regular cadence for logging expenses, whether it’s daily, weekly, or monthly, to ensure you capture all your financial outflows.

Category Confusion

Properly categorizing expenses is essential for meaningful financial analysis. However, it’s easy to get bogged down in category confusion, with expenses falling into gray areas or being misclassified. Take the time to define clear expense categories and stick to them consistently. This will provide you with valuable insights into your spending patterns and help you make more informed budgeting decisions.

Avoiding these common financial errors and budgeting pitfalls is key to effective expense management tips. By maintaining a disciplined approach to expense tracking, you’ll be well on your way to gaining control over your finances and making more informed decisions about your spending habits.

“The key to successful expense tracking is consistency. Establish a routine and stick to it, and you’ll be surprised by the valuable insights you can gain about your financial habits.”

Remember, small expenses can quickly add up and have a significant impact on your overall budget. Don’t neglect to track even the smallest of purchases, as they can provide crucial information about your spending patterns. Additionally, be mindful of mixing business and personal expenses, as this can create confusion during tax filing and financial analysis. Maintain separate accounts for these two categories to simplify your expense tracking process.

By addressing these common financial errors and budgeting pitfalls, you’ll be well on your way to mastering the art of effective expense management tips and gaining better control over your financial well-being.

Using Technology to Streamline Expense Tracking

In the digital age, financial technology (fintech) offers a wealth of tools to streamline expense tracking and gain better control over your finances. From automated budgeting apps to digital money management solutions, leveraging technology can revolutionize the way you monitor and manage your spending.

One of the most valuable features of modern financial apps is their ability to categorize transactions automatically. By linking your bank accounts and credit cards, these apps can sort your expenses into predefined categories, providing you with a clear, real-time view of where your money is going. This level of automation not only saves time but also helps you identify spending patterns and potential areas for cost-cutting.

Budgeting apps with features like receipt scanning and expense forecasting can further enhance your expense tracking efforts. These tools allow you to input receipts and estimates, empowering you to plan your spending and stay within your budget more effectively. Some even incorporate AI-powered financial assistants that offer personalized insights and recommendations to help you manage your money more efficiently.

For a comprehensive overview of your finances, consider using cloud-based solutions that enable you to sync multiple accounts. This allows you to access your expense data from any device, making it easier to track and manage your spending on the go. Additionally, look for apps that provide real-time alerts when you overspend in specific categories, helping you stay accountable and make more informed financial decisions.

By leveraging the power of financial technology, you can streamline your expense tracking and gain greater control over your financial well-being. With automated categorization, budgeting tools, and cloud-based solutions, you can optimize your money management and focus on building a more secure financial future.

Expense Tracking App Ratings

| App | G2 Rating |

|---|---|

| Rippling | 4.8 out of 5 |

| Expensify | 4.5 out of 5 |

| Ramp | 4.8 out of 5 |

| Navan (formerly TripActions) | 4.7 out of 5 |

| Brex | 4.7 out of 5 |

These top-rated financial technology solutions offer a range of features to streamline automated budgeting and digital money management, helping businesses and individuals better track and control their expenses.

Strategies for Reducing Daily Expenses

Are you tired of watching your hard-earned money slip away without a clear understanding of where it’s going? Fear not! We’ve got some cost-cutting, frugal living, and money-saving tips to help you gain control of your daily expenses.

One of the most effective ways to reduce costs is through meal planning. By planning your meals in advance and sticking to a grocery list, you can avoid impulse purchases and minimize food waste. This simple strategy can significantly cut your food expenses.

Another area to focus on is transportation. Opt for public transportation, carpooling, or even biking whenever possible to save on gas and car maintenance costs. If owning a car is a necessity, consider negotiating your insurance rates or exploring usage-based insurance plans.

- Negotiate bills for services like cable, internet, and streaming subscriptions. Many providers offer discounts for loyal customers or those willing to bundle services.

- Seek out free or low-cost entertainment options in your community, such as public parks, libraries, and local events. Avoiding expensive outings can add up to substantial savings.

- Utilize cashback apps and loyalty programs for your regular purchases. These can provide valuable rebates and discounts, effectively lowering your overall spending.

When it comes to utilities, energy-saving measures can make a significant difference. Invest in LED light bulbs, use a programmable thermostat, and unplug devices when not in use to reduce your electricity and heating/cooling costs.

Finally, take a close look at your subscriptions and memberships. Regularly review them and cancel any unused services to avoid unnecessary monthly expenses. A little effort in this area can lead to significant cost savings over time.

“The key to frugal living is to be intentional about your spending and find creative ways to cut costs without sacrificing your quality of life.”

By implementing these strategies, you can take control of your daily expenses and start saving more towards your financial goals. Remember, small changes can add up to big results when it comes to cost-cutting and building a more sustainable financial future.

Building Better Financial Habits Through Tracking

Developing a strong financial discipline and a positive money mindset is crucial for achieving long-term financial success. One of the most effective ways to cultivate these habits is through diligent expense tracking. By closely monitoring your spending patterns, you can gain valuable insights that empower you to make informed decisions and work towards your long-term financial planning goals.

Setting Realistic Goals

Start by setting realistic financial goals based on the data gathered through your expense tracking efforts. This could involve targeting specific areas for cost-cutting, allocating more funds towards savings, or devising a strategic plan to tackle outstanding debts. By aligning your goals with your actual spending behaviors, you can ensure that your financial aspirations are grounded in reality and achievable.

Maintaining Consistency

Consistency is key when it comes to building better financial habits. Make expense tracking a daily or weekly routine, ensuring that you record your spending accurately and promptly. This consistent approach will help you identify patterns, uncover areas for improvement, and stay accountable to your financial commitments. Celebrate small wins along the way to stay motivated and on track.

Ultimately, by leveraging the insights gained from your expense tracking, you can develop a money mindset that aligns with your long-term aspirations and values. This holistic approach to financial management will empower you to make informed decisions, cultivate sustainable spending habits, and achieve your financial discipline goals.

“The secret to achieving financial freedom is to make a habit out of tracking your expenses.” – Ramit Sethi, author of “I Will Teach You to Be Rich”

| Expense Tracking Method | Advantages | Disadvantages |

|---|---|---|

| Budgeting Apps |

|

|

| Computer Spreadsheets |

|

|

| Envelope System |

|

|

Conclusion

Effective expense tracking is the cornerstone of financial empowerment and personal finance mastery. By choosing a tracking method that aligns with your lifestyle, you can gain invaluable insights into your spending patterns and make informed decisions to achieve your financial goals.

Whether you opt for a digital budgeting app, the traditional envelope system, or a combination of methods, the key is to maintain consistency in your approach. Regularly analyze your spending data and use these insights to create a realistic budget that allocates your income towards essential expenses, savings, and personal growth.

Remember, expense tracking is not about restriction, but rather a tool for financial liberation. By mastering your money management skills, you’ll be well on your way to a more secure and fulfilling financial future. Continuously refine your tracking methods, stay adaptable, and let your spending data empower you to make choices that align with your values and aspirations.

FAQ

What is expense tracking and why is it important?

Expense tracking gives an accurate picture of where money is going. It involves checking account statements, categorizing expenses, and building a budget. Effective expense tracking is crucial for accurate budgeting and financial planning.

How does traditional budgeting often fail?

Traditional budgeting often fails due to inaccurate estimations of spending. Tracking expenses impacts financial health by revealing spending patterns and areas for improvement.

How can expense tracking build better money habits?

Tracking expenses increases awareness of financial decisions and helps build better money habits. It’s not about restricting spending but making informed choices based on priorities.

What are the key steps to get started with financial record-keeping?

Start by gathering all account statements, identifying spending patterns, and categorizing expenses into fixed and variable. Keep receipts and use a system that works for you, such as a notebook, binder, or digital app.

What are some manual and digital methods for tracking expenses?

Manual tracking methods include using a notebook or binder to log expenses. Digital solutions involve spreadsheets, mobile apps, and automated banking tools. Choose a method that fits your lifestyle and financial complexity.

How should I categorize my expenses?

Categorize expenses to identify spending patterns. Common categories include housing, transportation, food, utilities, and entertainment. Use the 50/30/20 rule to divide expenses into needs, wants, and savings/debt repayment.

What is the difference between fixed and variable expenses?

Fixed expenses are consistent monthly costs like rent or mortgage payments. Variable expenses fluctuate, such as groceries or entertainment. Balancing both types of expenses is crucial for effective budgeting and financial stability.

What is the 50/30/20 budgeting method?

The 50/30/20 budgeting method allocates 50% of net income to needs, 30% to wants, and 20% to savings and debt repayment. This method provides a balanced approach to managing expenses and achieving financial goals.

What are some essential tools for expense tracking?

Spreadsheets, mobile applications, and traditional pen-and-paper methods are common tools for expense tracking. Choose tools based on personal preference and ease of use, and combine methods for comprehensive expense management.

How can I analyze my spending patterns?

Analyze spending patterns by reviewing tracked expenses regularly. Identify areas of overspending and opportunities for savings. Use this information to adjust your budget and financial goals, considering seasonality and one-time expenses.

What are some common expense tracking mistakes to avoid?

Avoid inconsistent recording, category confusion, and neglecting small purchases. Regularly reconcile tracked expenses with bank statements to ensure accuracy and honesty about spending.

How can technology help streamline expense tracking?

Utilize banking apps that categorize transactions automatically, explore budgeting apps with features like receipt scanning and expense forecasting, and consider using AI-powered financial assistants for personalized insights.

What strategies can I use to reduce daily expenses?

Implement strategies like meal planning, public transportation, negotiating bills, and using cashback apps and loyalty programs to reduce expenses. Regularly review subscriptions and cancel unused services.

How can I build better financial habits through expense tracking?

Set realistic financial goals based on tracked spending data, maintain consistency in tracking, and use insights to develop a long-term financial plan aligned with personal values and aspirations. Celebrate small wins to stay motivated.