A 401(k) plan is a retirement account offered by employers. It lets employees save a part of their salary. In 2023, Americans saved an average of 7.1% of their income in 401(k)s. This is more than the overall savings rate that year.

About one-third of working-age Americans have a 401(k) plan. Only one in nine have a defined benefit pension plan. This shows how crucial 401(k)s are for saving for retirement.

Experts say you should save 10% to 15% of your income for retirement. In the first quarter of 2024, the average contribution was 14.2%. A 401(k) plan lets you invest in stocks, bonds, and mutual funds. It’s a big part of retirement savings.

Table of Contents

Key Takeaways

- A 401(k) plan is an employer-sponsored retirement account that allows employees to contribute a portion of their wages to individual accounts.

- The average contribution to 401(k)s by Americans in 2023 was 7.1% of their salaries, surpassing the overall personal savings rate that year.

- Financial professionals recommend contributing 10% to 15% of income to retirement savings.

- A 401(k) plan is a type of defined-contribution plan that allows employees to contribute a portion of their wages to individual accounts.

- Employer matching contributions can significantly boost a retirement account, with some companies offering matching contributions up to 6% of employee wages.

- The 401(k) employee contribution limit for 2024 is $30,500, including catch-up contributions, for individuals aged 50 and older, and $23,000 for those under 50.

What Is a 401(k) Plan and How Does It Work

A 401(k) plan is a way to save for retirement. It lets employees put some of their salary into a retirement account. This can be done before or after taxes. The plan helps employees save for the future, with rules to keep it fair for everyone.

Most 401(k) plans are offered by employers. They might also add money to the plan for the employee. This can be a match of the employee’s contribution or a fixed amount each year.

Basic Definition and Structure

A 401(k) plan is a type of defined contribution plan. This means the employer puts in a set amount each year. The employee’s benefit is based on what they contribute and any earnings on that.

Types of 401(k) Plans

There are two main types of 401(k) plans: traditional and Roth. Traditional plans let employees contribute before taxes. Roth plans let employees contribute after taxes.

Key Components of a 401(k)

A 401(k) plan has a few key parts. These include what the employee and employer contribute, and the investment choices. It might also have features like loans, hardship withdrawals, and vesting schedules.

| Component | Description |

|---|---|

| Employee Contributions | Pre-tax or after-tax contributions made by the employee |

| Employer Contributions | Matching or fixed contributions made by the employer |

| Investment Options | Range of investment options available to employees, such as stocks, bonds, and mutual funds |

Knowing the parts of a 401(k) plan is key to smart retirement saving. By contributing to a 401(k) and using 401(k) benefits and contribution limits, you can secure your financial future. This helps you reach your retirement goals.

The Benefits of Investing in a 401(k)

Investing in a 401(k) plan offers many benefits for your retirement savings. One big plus is the chance for long-term growth. Your money can grow in various assets like stocks, bonds, and mutual funds. Plus, many employers match your contributions, which can really boost your savings.

Some key benefits of 401(k) plans include:

- Tax advantages, as contributions may reduce taxable income

- Employer matching, which can provide free money for retirement savings

- Investment options, such as mutual funds, stocks, and bonds

Recent data shows that 401(k) plans hold about $8 trillion in assets. This shows how popular these plans are for saving for retirement. By investing in a 401(k), you can take advantage of these benefits and secure your financial future.

It’s important to remember that 401(k) plans carry market risks. Always talk to financial advisors to find the best investment strategy for you. But with the right plan, a 401(k) can be a great way to build your retirement savings and reach your long-term financial goals.

Traditional vs Roth 401(k): Understanding Your Options

When it comes to saving for retirement, you have two main choices: traditional 401(k) and Roth 401(k) plans. Each has its own rules and tax implications that can affect your savings. Knowing the differences can help you choose the best plan for you.

A traditional 401(k) lets you put in pre-tax dollars, lowering your taxable income. But, you’ll pay income tax when you take money out in retirement. A Roth 401(k), on the other hand, lets you contribute after-tax dollars. This means you won’t pay income tax when you withdraw the money in retirement.

Here are some key points to consider when deciding between a traditional 401(k) and a Roth 401(k):

- Contributions: Traditional 401(k) contributions are made with pre-tax dollars, while Roth 401(k) contributions are made with after-tax dollars.

- Tax implications: Traditional 401(k) distributions are taxed as ordinary income, while Roth 401(k) distributions are tax-free if they meet certain conditions.

- Withdrawal rules: Traditional 401(k) plans have required minimum distributions (RMDs) starting at age 73, while Roth 401(k) plans do not have RMDs during the participant’s lifetime.

The choice between a traditional 401(k) and a Roth 401(k) depends on your financial situation and goals. It’s important to think about the tax implications and withdrawal rules of each plan. Talking to a financial advisor can help you decide which plan is best for you.

Employer Matching: Maximizing Your Free Money

Employer matching in 401(k) plans is a big plus. It lets employees boost their retirement savings without adding more of their own cash. Many bosses match what you put in, either a set percentage or a fixed amount. Sadly, 25% of workers miss out on this free money by not contributing enough.

To get the most out of your 401(k) benefits, you need to know how employer matching works. Some companies match part of what you put in, while others match it all, dollar for dollar. In 2024, you can put up to $23,000 in a 401(k), with an extra $7,000 if you’re 50 or older.

- Make sure you contribute enough to get the full employer match. This is like getting free money.

- Know the vesting rules for employer contributions. This affects how you can take the money if you leave the job.

- Think about whether to put money into a Roth 401(k) or a traditional 401(k). It depends on your tax situation and goals.

| Employer Match Type | Description |

|---|---|

| Partial Matching | Employer matches a percentage of the employee’s contribution, up to a certain limit. |

| Full Matching | Employer matches the employee’s contribution dollar-for-dollar, up to a certain limit. |

Contributing to Your 401(k) Plan: Strategies and Limits

Understanding how to contribute to your 401(k) plan is key. The limit for 2024 is $23,000, with an extra $7,500 for those 50 and older. It’s important to put in as much as you can, especially if your employer matches your contributions.

To get the most out of your 401(k), think about raising your contribution by 1% each year or with raises. This will grow your retirement savings. If you’re 50 or older, use the catch-up contributions to boost your retirement fund even more.

- Contribute at least enough to take full advantage of your employer’s match

- Consider increasing your contribution rate over time

- Take advantage of catch-up contributions if you’re eligible

By using these strategies and knowing the contribution limits, you can optimize your 401(k) plan. This will help secure your retirement.

Investment Options Within Your 401(k)

When looking at investment options in your 401(k), you have many choices. These options help grow your retirement savings and reach your financial goals. Target-date funds are a popular choice. They adjust their investment mix based on your retirement date.

Mutual funds offer a mix of stocks, bonds, or other securities. Asset allocation funds mix different asset classes. Some employers also offer managed account services for a fee.

It’s key to think about your financial goals and risk tolerance when picking investment options for your 401(k). Talking to a financial advisor can help find the best strategy for you. By understanding your 401(k) benefits and options, you can make smart choices for a secure retirement.

Here are some key points to consider when evaluating your investment options:

- Target-date funds: based on your expected retirement date

- Mutual funds: diversified portfolio of stocks, bonds, or other securities

- Asset allocation funds: mix of different asset classes

- Managed account services: personalized investment management for a fee

| Investment Option | Description |

|---|---|

| Target-Date Funds | Based on expected retirement date, adjusts investment mix over time |

| Mutual Funds | Diversified portfolio of stocks, bonds, or other securities |

| Asset Allocation Funds | Mix of different asset classes |

| Managed Account Services | Personalized investment management for a fee |

Understanding Vesting Schedules and Rules

Vesting schedules and 401(k) rules can be tricky but very important. They help figure out when you own the money in your 401(k) plan. If you leave your job before you’re fully vested, you might lose some employer contributions.

There are two main vesting schedules allowed by the Internal Revenue Code (IRC). The three-year cliff vesting schedule means you’re fully vested after three years. The two- to six-year graded vesting schedule increases your vested percentage by 20% each year, reaching 100% after six years.

Types of Vesting Schedules

- Three-Year Cliff Vesting Schedule: 0% vested for the first two years, 100% vested after three years

- Two- to Six-Year Graded Vesting Schedule: 0% vested for the first two years, vested percentages increase by 20% increments annually, reaching 100% after six years

Knowing about vesting schedules and 401(k) rules is key to smart retirement planning. Your own contributions to retirement plans are always yours. But, employer contributions might follow a vesting schedule.

How to Calculate Your Vested Amount

To figure out your vested amount, you need to know your vesting schedule and employer contributions. For instance, if you’re 60% vested with a $1,000 balance, you get $600. The other $400 is lost.

Managing Your 401(k) Through Career Changes

When you’re changing careers, think about how it affects your 401(k). You can roll it over to a new job or keep it with your old one. Each choice has its good and bad sides, and knowing the tax rules and penalties is key.

Understanding rollover and distribution rules is crucial. For example, rolling over to a new job might help you avoid a 20% tax. But, leaving it with your old employer could mean more control over your money and fewer fees.

Here are some important things to think about when managing your 401(k) during career changes:

- Rollover options: You can roll over your 401(k) to a new employer or to an IRA.

- Tax implications: Rollovers and distributions may be subject to taxes and penalties, so it’s essential to understand the rules and regulations.

- Investment control: You may have more control over your investments if you roll over your 401(k) to an IRA.

| Option | Benefits | Drawbacks |

|---|---|---|

| Rollover to new employer | Avoid 20% mandatory withholding, maintain control over investments | Potential fees associated with rollover, limited investment options |

| Leave with previous employer | Maintain control over investments, avoid potential fees | May be subject to 20% mandatory withholding, limited access to funds |

The best way to manage your 401(k) during career changes is to know your options well. By weighing the pros and cons of each choice and getting advice when needed, you can keep your 401(k) on track for your future.

Early Withdrawals and Loans: What You Need to Know

Understanding early withdrawals from a 401(k) plan is key. Planning for taxes in retirement helps avoid penalties. Taking money out before age 65 (or your plan’s normal retirement age) may cost you 10% extra in taxes.

Another choice is a 401(k) loan. You might borrow up to 50% of your vested balance or $50,000, whichever is less. You must repay the loan, plus interest, within 5 years. Also, remember that defaulted 401(k) loans don’t hurt your credit score.

Here are some important things to think about when considering a 401(k) loan or early withdrawal:

- Early withdrawals may incur a 10% additional income tax.

- 401(k) loans must be repaid to the borrower’s retirement account, not taxed if repayment rules are followed.

- Loans from a 401(k) can be advantageous due to the opportunity to repay oneself and replenish the plan account with interest payments.

It’s important to weigh the pros and cons of early withdrawals and 401(k) loans before deciding. Talking to a financial advisor can help you choose the best option for your situation.

Required Minimum Distributions (RMDs)

As you get closer to retirement, it’s key to know about Required Minimum Distributions (RMDs) from your 401(k) plan. RMDs are withdrawals you must take by age 73. Not taking them can lead to big penalties, so it’s vital to grasp the 401(k) rules on RMDs.

The RMD amount depends on your account balance and life expectancy. You can figure out your RMD with the Uniform Lifetime Table from the IRS. Remember, RMDs are taxed as your income tax rate, unless they’re from a Roth IRA.

Here are some important RMD facts:

- RMDs must be taken every year by December 31, starting at age 73.

- Not taking an RMD can lead to a 25% tax penalty. This can drop to 10% if you correct it within two years.

- RMDs don’t apply to Roth IRAs or Designated Roth accounts while you’re alive.

Understanding the RMD rules and 401(k) rules is crucial. It helps you avoid penalties and make the most of your retirement savings. By learning about RMDs and planning well, you can secure a financially stable future.

Common 401(k) Mistakes to Avoid

Avoiding common 401(k) mistakes is key to getting the most from your retirement savings. Investment errors can hurt your returns, and contribution mistakes can mean missing out on growth chances.

Some common mistakes to steer clear of include:

- Not spreading out your investments, which can up the risk and lead to investment errors

- Not putting enough into your 401(k), which can mean missing out on employer matches and lower savings overall

- Taking money out of your 401(k) too soon, which can cause penalties and taxes, and is a big 401(k) mistake to avoid

Knowing these common 401(k) mistakes and how to dodge them can help secure your financial future. It’s vital to learn about investment errors and other risks to get the best from your 401(k) plan.

Remember, a smart 401(k) plan can help you reach your retirement dreams and avoid costly 401(k) mistakes. By avoiding investment errors and making smart choices, you can boost your returns and look forward to a brighter financial future.

| Mistake | Consequence |

|---|---|

| Not diversifying your portfolio | Increased risk and potential investment errors |

| Not contributing enough | Missed employer matching funds and lower overall savings |

| Withdrawing too early | Penalties and taxes |

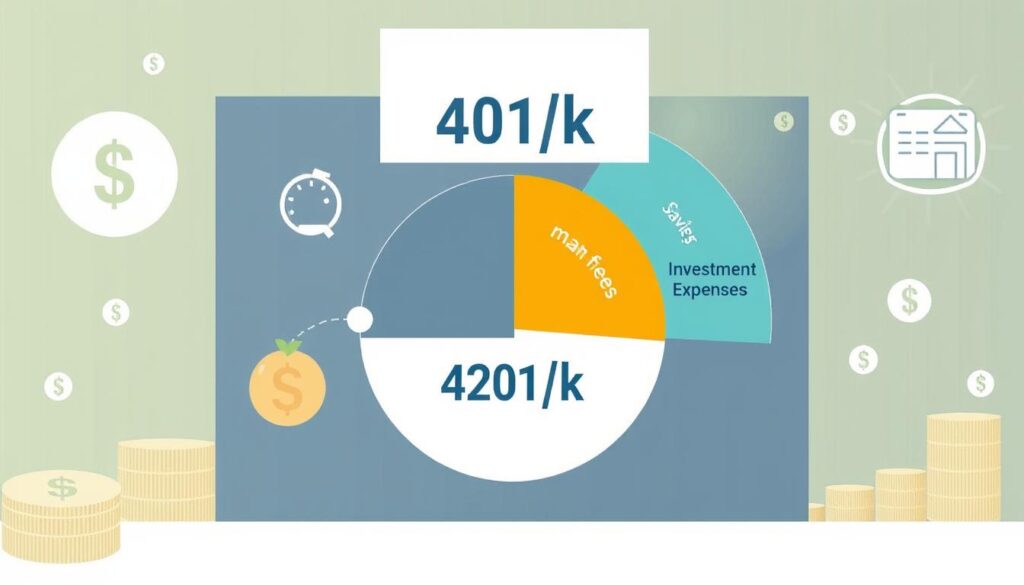

401(k) Plan Fees and Expenses

When it comes to 401(k) plans, fees and expenses can cut into your investment returns. It’s key to know the different fees in 401(k) plans. These include management fees, administrative fees, and investment fees. Recent data shows the average annual fee for 401(k) funds is 1%. Large plans usually have fees under 1%, while small plans can range from 1.5% to 2%.

A study revealed that 95% of 401(k) plan participants pay fees. Yet, 37% of workers didn’t know they paid fees in their 401(k) plans. To cut down on 401(k) fees, it’s vital to grasp the various fees. This includes:

- Rule 12b-1 fees, which cover advertising and promotion costs

- Back-end loads, which are charges when selling fund assets

- Individual service fees, for services like loans and withdrawals after employment ends

Plans with more assets might lower plan expenses by using special funds. It’s also worth noting that revenue sharing in 401(k) plans can reach 1.19% of plan assets. This can be hard to figure out because of how fees are disclosed. By understanding these fees and taking steps to reduce them, you can optimize your 401(k) plan. This helps you save more for retirement.

Tips for Optimizing Your 401(k) Performance

To boost your retirement savings, focus on optimizing your 401(k). Use asset allocation strategies to reduce risks and increase returns. Spread your investments across stocks, bonds, and mutual funds for a balanced portfolio.

Regularly rebalancing your portfolio is key. This keeps your investments in line with your retirement goals. Review and adjust your portfolio as needed. This helps you stay on track and make smart decisions about your savings.

Here are some tips for better 401(k) performance:

- Contribution limits: In 2024, you can contribute up to $23,000 to a 401(k). Those over 50 can add up to $7,500 more.

- Expense ratios: Choose low-cost options like index funds or ETFs to save on fees and boost returns.

- Employer matching: Don’t miss out on employer matching contributions. They can significantly increase your savings.

By following these strategies and staying up-to-date on 401(k) optimization and asset allocation, you can optimize your retirement savings. This will help you reach your long-term financial goals.

| Investment Option | Expense Ratio | Return |

|---|---|---|

| Index Fund | 0.05% | 8-10% |

| ETF | 0.20% | 9-11% |

| Mutual Fund | 1.00% | 6-8% |

Conclusion: Making the Most of Your Retirement Savings

A 401(k) plan is a great way to grow your retirement savings. It offers tax benefits, employer matching, and many investment choices. This can greatly increase your savings and prepare you for a comfortable retirement. It’s key to know the 401(k) benefits and rules to use this account wisely.

Starting your career or nearing retirement, it’s always a good time to start a 401(k). By regularly contributing and using features like automatic enrollment, you can secure your financial future. The main thing is to start early, contribute as much as you can, and keep your investment strategy up to date.

With the right knowledge and planning, your 401(k) can be the base for a stable and fulfilling retirement. So, take action now and maximize this powerful tool for retirement savings. Your future self will be grateful for your foresight and commitment to your financial well-being.

FAQ

What is a 401(k) plan?

A 401(k) plan lets employees save a part of their salary in their own accounts. These accounts can grow with investments in stocks, bonds, and mutual funds.

What are the different types of 401(k) plans?

There are two main types: traditional 401(k) and Roth 401(k). Traditional 401(k) lets you contribute before taxes. Roth 401(k) lets you contribute after taxes.

What are the benefits of investing in a 401(k) plan?

401(k) plans offer long-term growth, tax benefits, and employer matching. These benefits help your retirement savings grow.

How do traditional and Roth 401(k) plans differ in terms of tax implications and withdrawal rules?

Traditional 401(k) plans reduce your taxable income now but tax withdrawals later. Roth 401(k) plans tax contributions now but not withdrawals later.

How does employer matching work in 401(k) plans?

Employer matching is a big plus. It means your employer adds to your retirement savings without you adding more. Many employers offer this.

What are the annual contribution limits for 401(k) plans?

In 2022, you can contribute up to $19,500 to a 401(k) plan. If you’re 50 or older, you can add up to $6,500 more.

What investment options are available in 401(k) plans?

401(k) plans often include target-date funds, mutual funds, and stocks. The choices depend on your plan and employer.

How do vesting schedules and rules work in 401(k) plans?

Vesting rules show when you own employer contributions. If you leave before being fully vested, you might lose some employer money.

What options are available when managing a 401(k) plan through career changes?

When you change jobs, you can roll over your 401(k) to a new employer, leave it with your old one, or take a distribution.

What are the rules and regulations surrounding early withdrawals and loans from 401(k) plans?

Early withdrawals and loans from 401(k) plans can lead to big tax penalties. It’s crucial to know the rules before making a move.

What are required minimum distributions (RMDs) in 401(k) plans?

RMDs are mandatory withdrawals from 401(k) plans starting at age 72. Not taking them can lead to big penalties.

What are some common mistakes to avoid in 401(k) plans?

Common mistakes include bad investments, wrong contributions, and poor withdrawals. Knowing your options and rules is key.

What types of fees and expenses are associated with 401(k) plans?

401(k) plans have management, administrative, and investment fees. Understanding these fees is important to save money.

What strategies can be used to optimize 401(k) performance?

To improve your 401(k), use asset allocation, rebalance, and monitor your investments. These strategies help your savings grow.