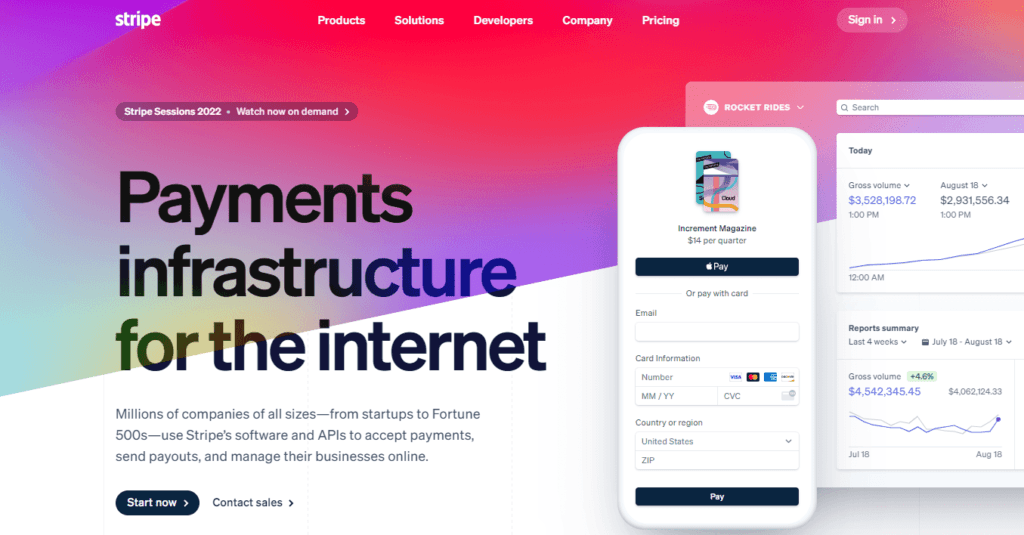

Stripe is a technology company that provides businesses with an easy and secure way to accept payments online. Founded in 2010, Stripe has quickly become one of the most popular payment processors for small and large businesses alike. Stripe’s platform allows businesses to process payments in over 135 different currencies, making it a truly global payment solution.

In this article, we will explore what Stripe is and how it works, as well as the features that make it a popular choice for businesses looking to accept payments online.

Whether you are a small business owner just starting out or an established enterprise, understanding how Stripe works can help you make informed decisions about your payment processing needs.

So, let’s dive in and explore the world of Stripe!

Table of Contents

What is Stripe?

Stripe is an online payment processing platform that was designed to make accepting credit card payments easier for businesses of all sizes.

Stripe’s customers include Dropbox, Reddit, Pinterest, and Kickstarter. One of the main benefits of using Stripe is that it offers instant setup with no hidden fees or monthly payments.

Stripe is a new type of payment gateway provider that makes it easy for merchants to accept credit card payments from their customers online. Stripe is designed for developers and was built to help any business easily accept payments over the Internet.

Different from a traditional merchant account, Stripe processes credit card payments directly with the major credit card companies instead of through a bank. This way, they can process transactions without having to deal with PCI compliance, security issues, and chargebacks.

Clients can choose from a variety of pricing plans that suit their needs. They have the freedom to operate their business the way they want to and can enjoy features such as live payment notifications, instant settlements, and world-class support.

Stripe enables businesses to securely accept credit card payments without having to deal with all the security issues that come from using traditional merchant accounts.

How Does Stripe Work?

Stripe is a credit card payment processing gateway that was designed to make it easy for businesses of all sizes to add online credit card payments to their websites.

It was developed for developers, and it can be used by any business to accept credit card payments online without having to deal with PCI compliance and security issues.

You can add Stripe to your website in minutes and it only takes a few steps:

- Enter your public-facing API key. This is your unique identifier that identifies your website to Stripe.

- Select the currency you want to use to accept payments and enter your banking information. Turn on your payment method.

- Accept customer payments securely through Stripe.

How Much Does Stripe Cost?

Stripe charges a transaction fee per transaction for the use of their service, and their plans are designed so that businesses can choose the plan that best fits their specific needs. Their founder, Patrick Collison, created Stripe with the goal of making accepting credit cards easier for everyone.

Stripe offers various pricing plans to its customers:

- Plan 1 – The card does not present a transaction fee of 2.9% + 30¢ per transaction.

- Plan 2 – The card presents a transaction fee of 3.9% + 20¢ per transaction.

“Card Present” means that the customer is physically present when making a purchase with their card. These transactions are at greater risk of fraud, so there is an additional fee for these types of transactions to cover increased merchant liability. This additional liability is not present for “Card Not Present” transactions, which are those that do not require the customer to be physically present when making a purchase.

Stripe charges no monthly fees or setup costs, but they only charge what they need to; nothing more. Their pricing is transparent and straightforward, so you know exactly what you’re paying for.

How Does Stripe Make Money?

Stripe’s revenue comes from the fees it charges for each transaction. They pass along the least amount of costs to their -is-Stricustomers, which is one of the reasons why they have been so successful thus far.

Stripe’s business model is very similar to that of PayPal, which also charges fees per transaction instead of requiring monthly fees or setup costs. This allows Stripe to deliver their services at very competitive prices and remain focused on what matters most: building the best payment gateway for developers.

What are the Benefits of Stripe?

Stripe’s biggest benefit is that it gives you all of the tools necessary to begin accepting credit card payments on your website. As a developer, you can plug into Stripe’s code and begin accepting credit card payments with just a few lines of code. Stripe is also very secure as all of your sensitive customer information is encrypted, processed through SSL, and stored in PCI Level 1 compliant servers. This ensures that every transaction made by your customer’s credit card information is safe and secure.

As a business, the biggest benefit of using Stripe is that you only pay for what you use without having to commit to any sort of monthly fee or risk paying unnecessary fees due to hidden charges and processing limits.

Stripe makes it easy to start accepting credit card payments on your website, and the simplicity of their services is what has made them so successful. Their transparent payment processing fees allow you to accept credit cards without worrying about costly monthly fees or hidden charges.

Any business can add Stripe to their website in minutes by adding a few lines of code and begin accepting payments from anyone, anywhere using any major credit card.

Stripe FAQs.

Which is Right for Your Business, Stripe or Shopify?

Stripe is an online payment service that allows you to quickly and easily accept credit card payments.

Shopify is an e-commerce platform that allows you to create your own store. It offers a variety of features, including the ability to customize your website, integrate with social media platforms, and more.

Many businesses are faced with the decision of whether they should choose Stripe or Shopify as their payment processing platform. The answer depends on several factors such as what type of business you have, how much money you make from it, how often you need to process payments, and what your budget is for the project in question.

Conclusion

Stripe is a highly popular payment processing platform that has revolutionized the way businesses handle online payments. It offers a simple and efficient way to manage transactions, with a user-friendly interface and powerful tools for customization and optimization.

By allowing businesses to accept payments from all major credit and debit cards, as well as numerous alternative payment methods, Stripe has made it easier than ever for businesses to connect with customers around the world. Additionally, Stripe’s advanced security features help to protect both businesses and their customers from fraud and other potential risks.

Overall, Stripe is a highly effective and reliable payment solution that has helped countless businesses of all sizes to streamline their payment processes and boost their revenue.